Daily technical highlights – (MFLOUR, UZMA)

kiasutrader

Publish date: Tue, 25 Jan 2022, 09:15 AM

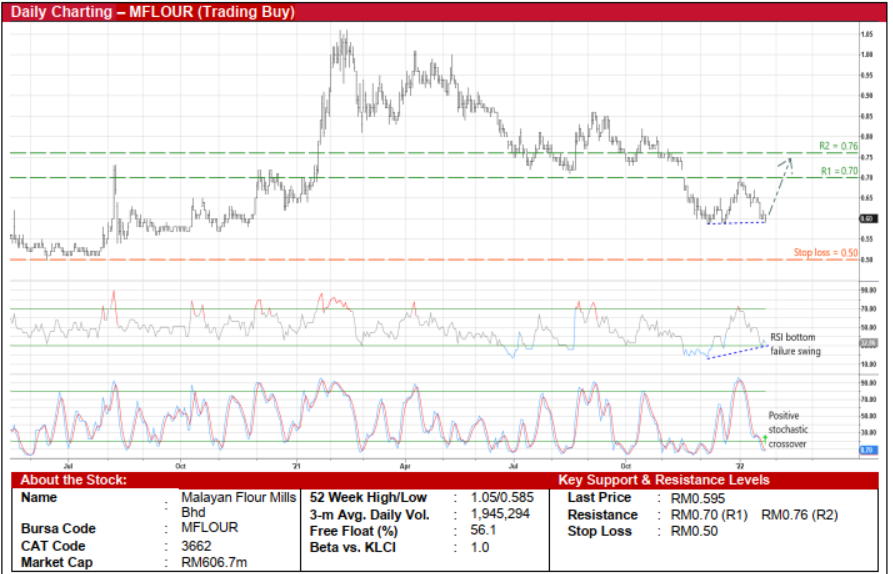

Malayan Flour Mills Bhd (Trading Buy)

• After charting lower highs since February last year, MFLOUR shares – which closed at RM0.595 yesterday or near a 14- month low – could stage a price rebound ahead.

• This follows the positive technical signals triggered by: (i) the bottom failure swing in the RSI indicator (after plotting higher lows in the oversold area as the stock treaded listlessly), and (ii) an anticipated reversal by the stochastic indicator from an oversold position.

• Riding on a strengthening momentum, the share price could climb towards our resistance thresholds of RM0.70 (R1; 18% upside potential) and RM0.76 (R2; 28% upside potential). Our stop loss price level is pegged at RM0.50 (or a 16% downside risk).

• Business-wise, MFLOUR is involved in: (i) the milling and selling of wheat flour and allied products in Malaysia, Vietnam and Indonesia, (ii) the manufacture and sale of aqua feeds and sale of related raw materials, (iii) the grains trading business (i.e. corn, soybean meal & other feed ingredients), and (iv) the integrated poultry business.

• The group reported net profit of RM149.9m in 9MFY21 (compared with net loss of RM11.9m in 9MFY20). Going forward, MFLOUR is projected to make core net profit of RM79.5m for FY Dec 2021, RM106.0m for FY Dec 2022 and RM127.0m for FY Dec 2023 based on consensus estimates. This translates to undemanding forward PERs of 5.7x this year and 4.8x next year, respectively.

• In terms of recent corporate development, in February last year, the group entered into a strategic partnership with Tyson International Holding Company (whose ultimate parent company Tyson Foods is listed in US and is ranked as one of the world’s largest food companies). Under a plan to dispose of its integrated poultry business (comprising a 49% stake for a cash consideration of up to RM420m), the joint venture outfit would leverage on MFLOUR’s standards in halal-certified food production as well as Tyson’s global distribution network and technical expertise in poultry integrated operations.

Uzma Bhd (Trading Buy)

• UZMA’s share price – which ended at RM0.44 yesterday – has probably found an intermittent bottom following its bounce-up from a low of RM0.405 about one month ago.

• With the RSI indicator climbing out from an oversold territory and the MACD indicator still on the rise (after recently cutting above the signal line), an upward shift in the price is anticipated.

• On the chart, the stock could extend its rebound towards our resistance thresholds of RM0.50 (R1; 14% upside potential) and RM0.56 (R2; 27% upside potential).

• We have placed our stop loss price level at RM0.39 (which represents an 11% downside risk).

• As an oil & gas service and equipment group, its principal activities include the provision of integrated well solutions, production solutions, subsurface solutions and other upstream services (such as the provision of geoscience and reservoir engineering, drilling, project and operations services) and other specialized services.

• After posting net profit of RM13.4m in FY June 2021 (versus FY20’s net loss of RM22.9m), the group’s bottomline came in at RM0.3m (-79% YoY) in 1QFY22.

• Consensus is forecasting UZMA to log stronger net earnings of RM21.3m in FY22 and RM29.4m in FY23, translating to undemanding forward PERs of 7.3x this year and 5.3x next year, respectively.

Source: Kenanga Research - 25 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024