Daily technical highlights – (JTIASA, THPLANT)

kiasutrader

Publish date: Wed, 02 Mar 2022, 09:34 AM

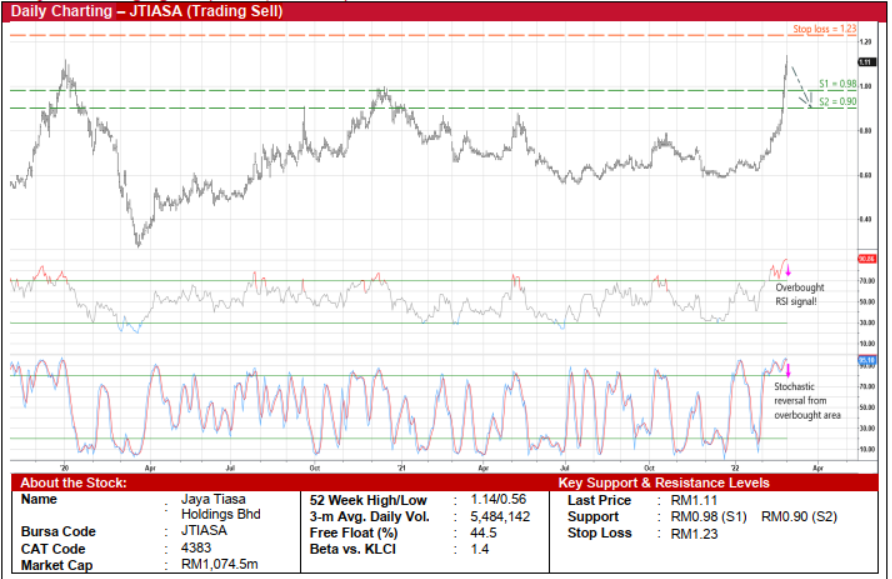

Jaya Tiasa Holdings Bhd (Trading Sell)

• JTIASA’s rapid share price run-up, which reached a high of RM1.14 yesterday before settling at RM1.11 (its highest closing since January 2018), has prompted us to recommend Trading Sell / Take Profit on the stock.

• The shares have now jumped 60% to surpass both our technical target prices of RM0.78 (R1) and RM0.83 (R2) since we made our previous Trading Buy recommendation on 10 February this year.

• On the chart, a price correction could be on the horizon as both the RSI and stochastic indicators are poised to unwind from their overbought positions.

• With that, JTIASA shares will probably retrace towards our support thresholds of RM0.98 (S1) and RM0.90 (S2), representing downside potentials of 12% and 19%, respectively.

• Our stop loss price level is set at RM1.23 (translating to an upside risk of 11%).

• In terms of fundamental outlook, while JTIASA – which is principally involved in the oil palm and timber businesses – stands to benefit from the prevailing record high CPO price (at RM7,435 per MT), the group may see weaker earnings prospects beyond the current financial year as the sustainability of the CPO price uptrend remains doubtful in the medium term.

• Based on consensus net profit forecasts of RM132.0m in FY June 2022 and RM113.0m in FY June 2023, the shares are currently trading at forward PERs of 8.1x this year and 9.5x next year, respectively.

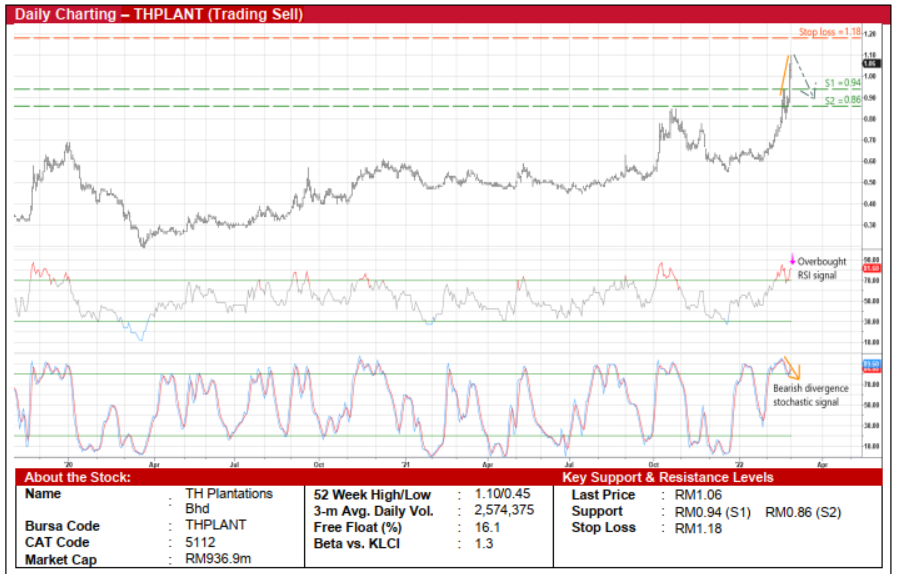

TH Plantations Bhd (Trading Sell)

• We are recommending a Trading Sell / Take Profit on THPLANT following its recent steep share price rally, which has touched a high of RM1.10 yesterday before finishing at RM1.06 (or back to where it was in end-December 2017).

• This follows our recent Trading Buy call that was issued on 4 February as the existing share price has already soared 67% since our report date to exceed both our technical target prices of RM0.70 (R1) and RM0.78 (R2).

• From a charting perspective, after overshooting on the upside, the stock is expected to pull back judging by the occurrence of a bearish divergence signal in the stochastic indicator (which has formed two declining peaks in the overbought area as the price continued to move higher) while the RSI indicator is on the verge of reversing from an overbought territory.

• On the way down, THPLANT shares could test our support lines of RM0.94 (S1; 11% downside potential) and RM0.86 (S2; 19% downside potential).

• Our stop loss price level is set at RM1.18 (or an upside risk of 11%).

• Profit-wise, THPLANT – the plantation arm of Lembaga Tabung Haji that is engaged in the business of oil palm and rubber plantations in Malaysia – may see an earnings cliff due to weaker CPO price assumptions beyond the current financial year.

• Based on consensus net profit estimates of RM86.7m in FY December 2022 and RM40.0m in FY December 2023, the stock is currently trading at forward PERs of 10.8x this year and 23.4x next year, respectively.

Source: Kenanga Research - 2 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024

calvintaneng

Post removed.Why?

2022-03-03 08:34