Daily technical highlights – (OPENSYS, TUNEPRO)

kiasutrader

Publish date: Wed, 19 Oct 2022, 09:08 AM

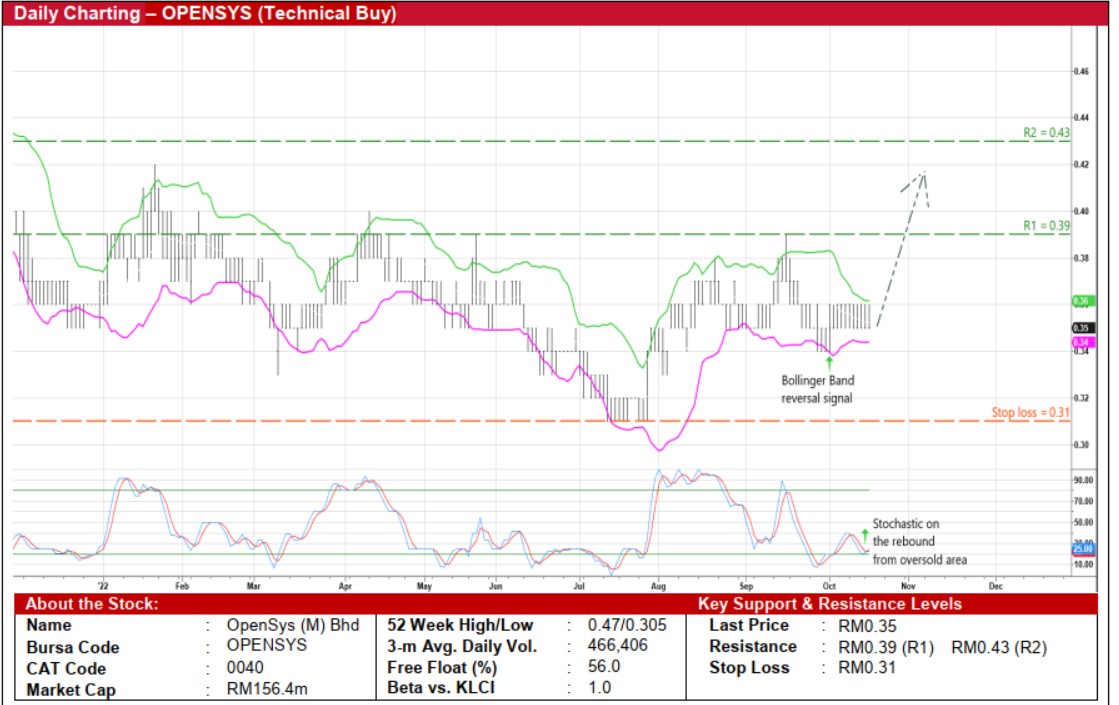

OpenSys (M) Bhd (Technical Buy)

• After a lift-off from a 28-month low of RM0.305 in late July to as high as RM0.39 in mid-September – breaking through a previous pattern of lower highs along the way – a technical rebound may ensue for OPENSYS shares.

• On account of the share price moving back above the lower Bollinger Band and the stochastic indicator reversing from the oversold zone, a continuation of the rising trajectory is anticipated.

• An upward shift could then propel the stock to challenge our resistance targets of RM0.39 (R1; 11% upside potential) and RM0.43 (R2; 23% upside potential).

• Our stop loss price level is placed at RM0.31 (representing an 11% downside risk from its last traded price of RM0.35).

• Fundamentally speaking, OPENSYS derives its income from: (i) outright sales of cash recycling machines and cheque deposit machines to financial institutions, (ii) software development services, (iii) outsourcing services via the deployment of bill payment kiosks to utility, insurance and telecommunication companies, and (iv) maintenance services of the machines. It also operates a dedicated online solar energy platform (buySolar), which is an online marketplace for renewable energy focussing on solar solutions and financing.

• After reporting net profit of RM3.0m (+7% YoY) in 2QFY22, taking 1HFY22 bottomline to RM5.4m (+17% YoY), consensus is projecting the group to post net earnings of RM12.3m for FY December 2022 and RM13.7m for FY December 2023. This represents forward PERs of 12.7x this year and 11.4x next year, respectively (with its 1-year forward rolling PER currently hovering at 1SD below its historical mean).

• An added investment merit is its sound balance sheet, which is backed by net cash holdings & short-term investments of RM45.9m (translating to 10.3 sen per share or nearly one-third of its existing share price) as of end-June 2022.

• Moreover, OPENSYS has just transferred its listing from the ACE Market to the Main Market last Wednesday. This is expected to boost its appeal to a wider group of investors going forward.

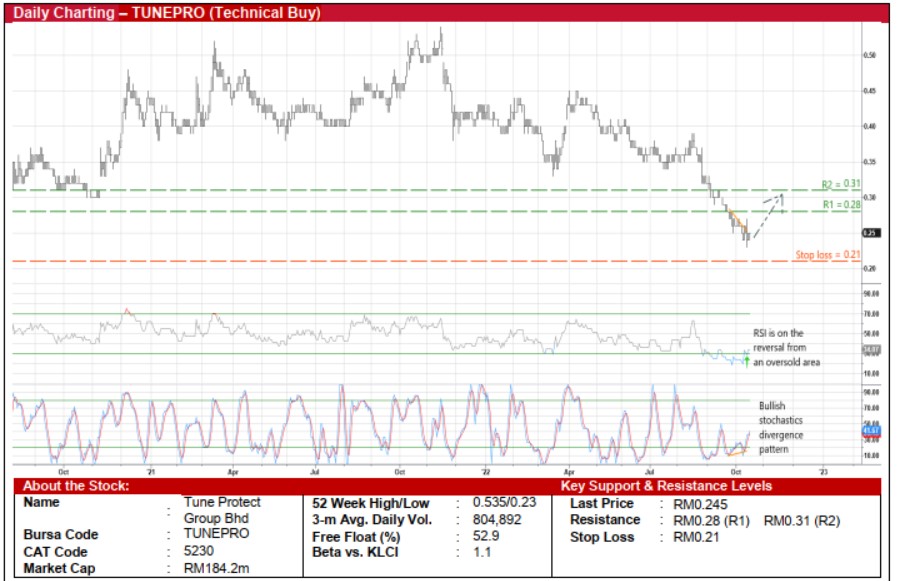

Tune Protect Group Bhd (Technical Buy)

• A plunge in the share price from a recent high of RM0.385 in mid-August to as low as RM0.23 last Friday – or back to where it was in March 2020 – may set the stage for TUNEPRO shares to reverse course ahead.

• On the chart, a technical rebound could be in the making in view of the existence of a bullish stochastic divergence pattern (which saw the plotting of rising bottoms as the price was declining) and the ongoing reversal from an oversold position by the RSI indicator.

• Thus, the stock will probably climb towards our resistance thresholds of RM0.28 (R1) and RM0.31 (R2), which translate to upside potentials of 14% and 27%, respectively.

• We have pegged our stop loss price level at RM0.21 (or a 14% downside risk).

• A financial holding company that provides underwriting and reinsurance services for non-life insurance products (such as motor personal accident protection, fire insurance, insurance plans for foreign workers, global travel protection), TUNEPRO made a net loss of RM19.8m in 2QFY22 (from a net profit of RM14.2m in 2QFY21), which led to 1HFY22’s net loss of RM22.8m (versus net loss of RM1.2m previously).

• According to consensus expectations, the group is forecasted to book a net loss of RM12.4m for FY December 2022 before turning around with a net profit of RM1.6m for FY December 2023.

• Valuation-wise, based on its book value per share of RM0.71 as of end-June 2022, the stock is presently trading at a Price/Book Value multiple of 0.35x (or at 2SD below its historical mean).

Source: Kenanga Research - 19 Oct 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024