Daily technical highlights – (BONIA, KTC)

kiasutrader

Publish date: Fri, 28 Oct 2022, 09:13 AM

Bonia Corporation Bhd (Technical Buy)

• BONIA’s share price has fallen 37% since early June this year from its 52-week high of RM2.86 to close at RM1.79 yesterday. With the share price currently fluctuating near its support line at RM1.75, a level that was previously tested on 18 October, a technical rebound could be forthcoming.

• Chart-wise, we believe the share price will shift upward ahead given the following technical signals: (i) the strengthening RSI indicator, (ii) the rising Parabolic SAR trend, and (iii) the stock price has crossed above the lower Keltner Channel.

• Hence, we expect the stock to climb and test our resistance thresholds of RM1.97 (R1; 10% upside potential) and RM2.10 (R2; 17% upside potential).

• Conversely, our stop loss price has been identified at RM1.61 (representing a 10% downside risk).

• BONIA is involved in the design, manufacturing, retailing and wholesale of leatherwear, footwear, men’s apparel and accessories.

• Earnings-wise, the group reported a net profit of RM17.9m in 4QFY22, reversing from a net loss of RM0.7m in 4QFY21. This took FY June 22 bottomline to RM45m (versus RM13.9m in FY June 21).

• Based on consensus forecasts, BONIA’s net earnings are projected to come in at RM43.5m in FY June 2023 and RM45.7m in FY June 2024, which translate to forward PERs of 8.2x and 7.8x, respectively.

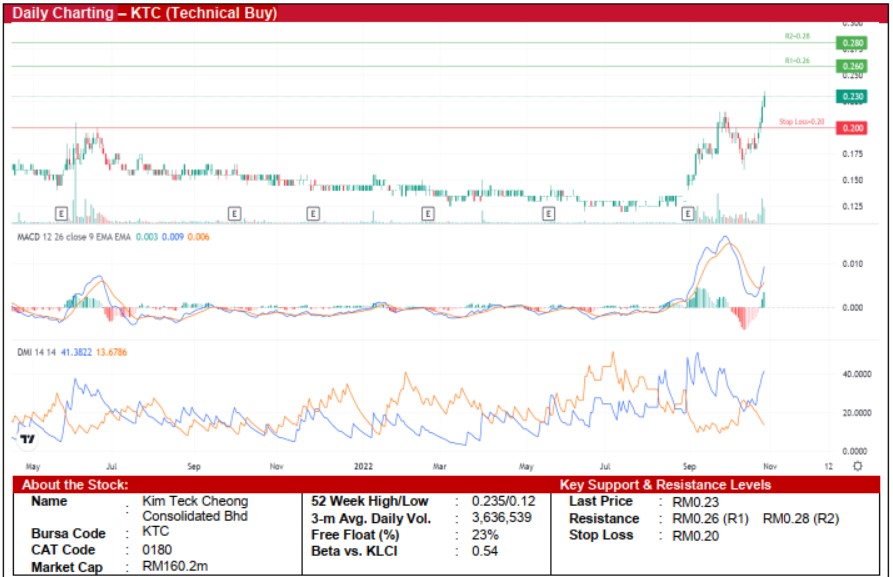

Kim Teck Cheong Consolidated Bhd (Technical Buy)

• After breaking out from the sideways pattern in late August this year, KTC’s share price has been trending upwards since then to form a sequence of higher highs before closing at RM0.23 yesterday.

• On the chart, the share price is expected to continue its upward momentum backed by: (i) the 12-day moving average still hovering above the 26-day moving average following the MACD golden cross in late October, and (ii) the DMI Plus trading above the DMI Minus.

• A continuation of the positive trajectory could then lift the stock to challenge our resistance levels of RM0.26 (R1; 13% upside potential) and RM0.28 (R2; 22% upside potential).

• Our stop loss level is pegged at RM0.20 (representing a 13% downside risk).

• Fundamentally speaking, KTC is engaged in the provision of distribution and warehousing services of third-party consumer packaged goods in East Malaysia.

• Earnings-wise, the group reported a net profit of RM7.8m in 4QFY22 compared with a net profit of RM0.8m in 4QFY21. This took FY June 22 bottomline to RM20.2m (versus net profit of RM7.5m previously).

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 1.0x (which is at its 5-year mean) based on a book value per share of RM0.24 as of end-June 2022.

Source: Kenanga Research - 28 Oct 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024