Daily technical highlights – (PRLEXUS, DIGI)

kiasutrader

Publish date: Tue, 22 Nov 2022, 09:01 AM

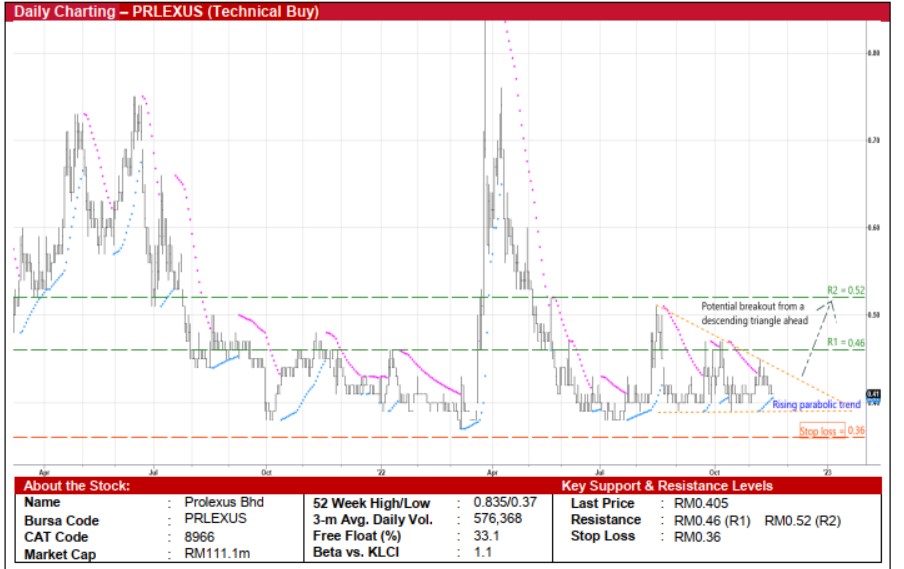

Prolexus Bhd (Technical Buy)

• Following a plunge from its peak of RM0.835 in late March this year, PRLEXUS’ share price might have hit an intermediate bottom already after bouncing off multiple times from a support line of RM0.39 since early August.

• Riding on the positive momentum of the Parabolic SAR indicator, the stock is poised to attempt a breakout from the descending triangle pattern ahead.

• An ensuing technical breakout could then lift the share price to challenge our resistance targets of RM0.46 (R1; 14% upside potential) and RM0.52 (R2; 28% upside potential).

• We have placed our stop loss price level at RM0.36 (or an 11% downside risk from yesterday’s close of RM0.405).

• A manufacturer of sportswear apparels and reusable fabric face masks, PRLEXUS has turned around from a net loss of RM6.8m previously to register a net profit of RM8.8m in 4QFY22, bringing full-year FY ended July 2022 net earnings to RM8.6m (compared with FY21’s net profit of RM16.7m).

• The group is in a financially sound position with its balance sheet backed by net cash holdings & other investments of RM36.0m (translating to 13.1 sen per share or almost one-third of its existing share price) as of end-July 2022.

Digi.com Bhd (Technical Buy)

• DIGI’s share price – which has rebounded from a recent low of RM3.19 in mid-October this year to as high as RM3.92 on 11 November before coming under pressure yesterday – remains on an upward trajectory.

• On the chart, the stock is expected to climb further inside a short-term ascending price channel after bouncing off from the 200-day SMA, thus offering a trading buy opportunity following yesterday’s price weakness.

• A resumption of the upward trend could then lift the shares to reach our resistance thresholds of RM4.16 (R1; 10% upside potential) and RM4.31 (R2; 14% upside potential).

• Our stop loss price level is pegged at RM3.43 (representing a 9% downside risk from its last traded price of RM3.78).

• Earnings-wise, DIGI – a mobile connectivity and internet services provider in Malaysia – announced net profit of RM264.5m (- 15% YoY) in 3QFY22, taking 1HFY22 bottomline to RM720.7m (-16% YoY) as its underlying performance was mainly affected by the imposition of a one-off prosperity tax by the government.

• According to consensus estimates, the group is forecasted to log net earnings of RM1.0b in FY December 2022 and RM1.2b in FY December 2023, translating to forward PERs of 29.3x this year and 24.0x next year, respectively (with its 1-year rolling forward PER currently hovering near its historical mean).

• Additionally, consensus is anticipating DIGI to make dividend payments of 12.9 sen per share for FY22 and 15.5 sen per share for FY23, implying forward dividend yields of 3.4% and 4.1%, respectively.

Source: Kenanga Research - 22 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024