Daily technical highlights – (EFRAME, REVENUE)

kiasutrader

Publish date: Thu, 16 Feb 2023, 09:24 AM

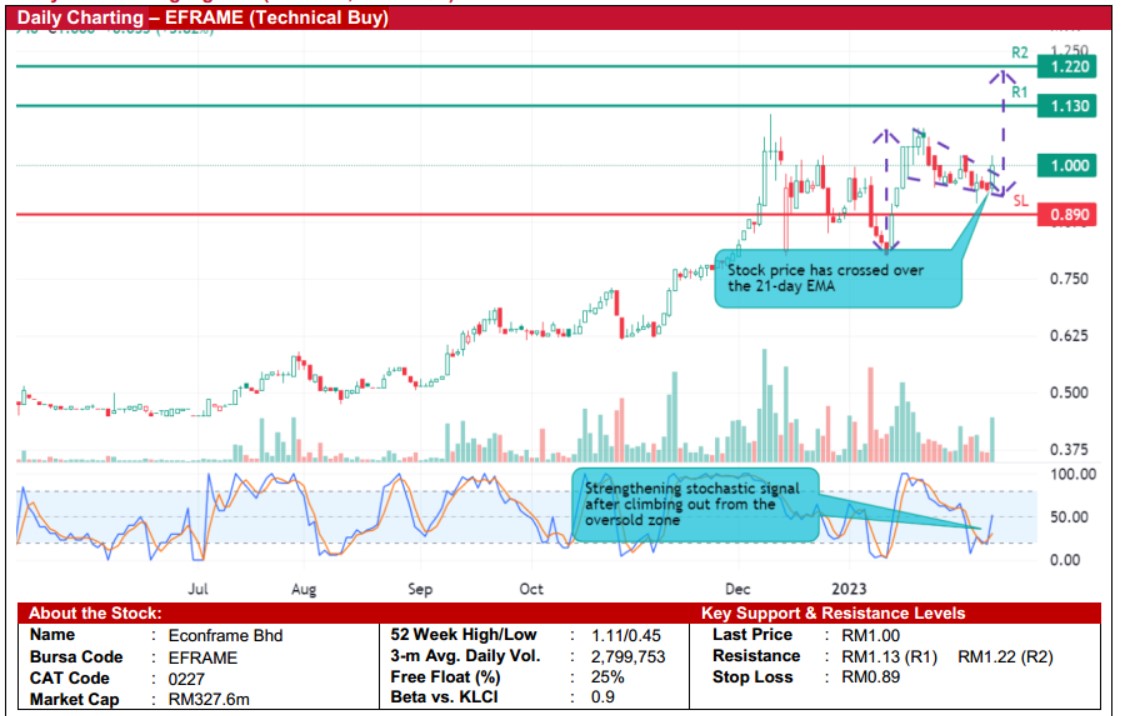

Econframe Bhd (Technical Buy)

• Following its retracement from a recent peak of RM1.08 on 25 Jan 2023 to a low of RM0.94 on 14 Feb 2023, EFRAME’sshare price has subsequently overcome the descending trendline to close at RM1.00 yesterday after breaking out from abullish pennant chart pattern.

• Riding on the surge in buying interest, the stock is set to shift higher as the share price has crossed above the 21-day EMAline while the stochastic indicator is strengthening after climbing out from the oversold zone.

• That said, the stock could be on its way to challenge our resistance targets of RM1.13 (R1; 13% upside potential) andRM1.22 (R2; 22% upside potential).

• Our stop loss price level is pegged at RM0.89 (representing a downside risk of 11% from its last traded price of RM1.00).

• A manufacturer of metal door frames and fire-rated wood doors based in Malaysia, EFRAME reported a net profit of RM2.3m(-15% YoY) in 1QFY23 after registering a full-year net earnings of RM11.2m in FY August 2022.

• Based on its book value per share of RM0.20 as of end-November 2022, the stock is presently trading at Price / Book Valuemultiple of 5x.

• In terms of recent corporate development, ECONFRAME has announced on 17 Jan 2023 its plan to acquire Lee and YongAluminium Sdn Bhd (which is primarily involved in the business of fabrication and installation of aluminium glazing & glassproducts and façade works) for RM17.2m.

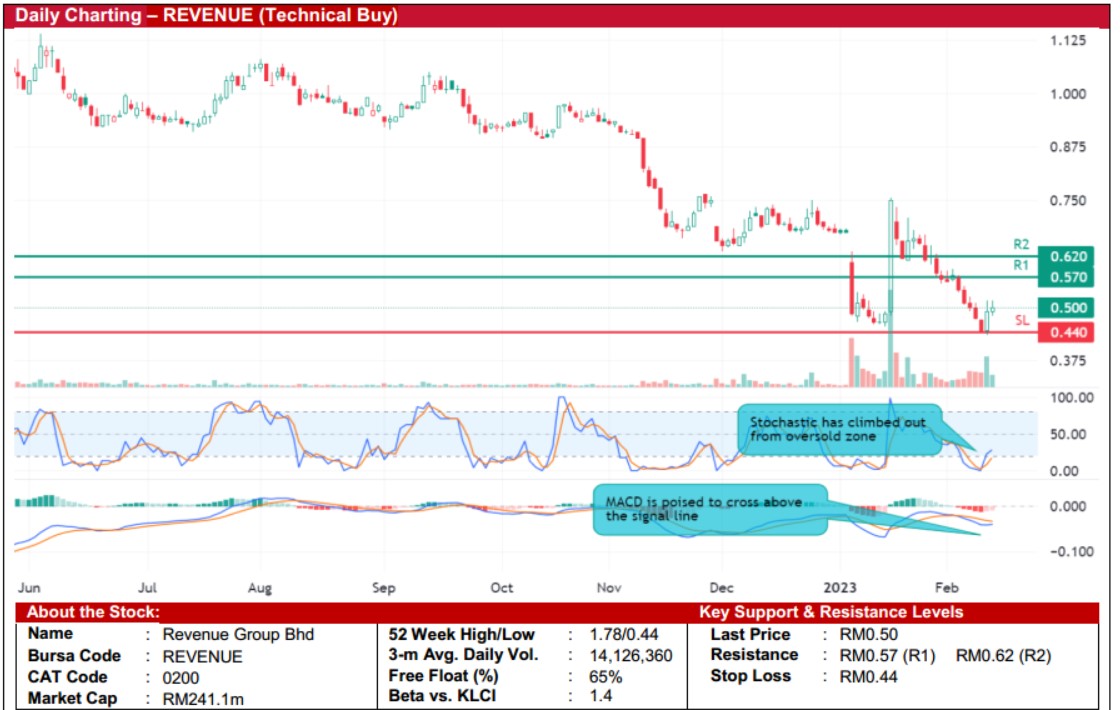

Revenue Group Bhd (Technical Buy)

• Since our Technical Buy call made on 13 January 2023, REVENUE’s share price has soared 62% to a high of RM0.755 inmid-Jan 2023 before retracing to as low as RM0.44 on 13 Feb 2023 (or marginally below the previous trough on 12 Jan 2023that was followed by a subsequent bounce-up). The stock has risen thereafter to close at RM0.50 yesterday.

• An extended technical rebound could be on the horizon backed by positive signals arising from the stochastic indicator’sreversal from the oversold zone and an anticipated crossover by the MACD above the signal line.

• Ergo, the stock could advance towards our resistance targets of RM0.57 (R1; 14% upside potential) and RM.62 (R2; 24%upside potential).

• Our stop loss price level is set at RM0.44 (translating to a downside risk of 12%).

• Business-wise, REVENUE is a provider of complete and customisable cashless payment solutions via its fully integratedplatforms, including the deployment of Electronic Data Capture (EDC) terminals and offering of electronic transactionprocessing services.

• The group reported a net loss of RM3.3m in 1QFY23 compared with a net profit of RM3.5m in 1QFY22 mainly due to lowergross profit margins and higher administrative expenses.

• Based on consensus forecasts, the group is projected to log a net profit of RM9.3m in FY June 2023 and RM12.8m in FYJune 2024, which translate to forward PERs of 26x and 19x, respectively.

Source: Kenanga Research - 16 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024