Kenanga Research & Investment

Actionable Technical Highlights – (AMMB HOLDINGS BHD)

kiasutrader

Publish date: Thu, 26 Oct 2023, 09:54 AM

AMMB HOLDINGS BERHAD (Technical Buy)

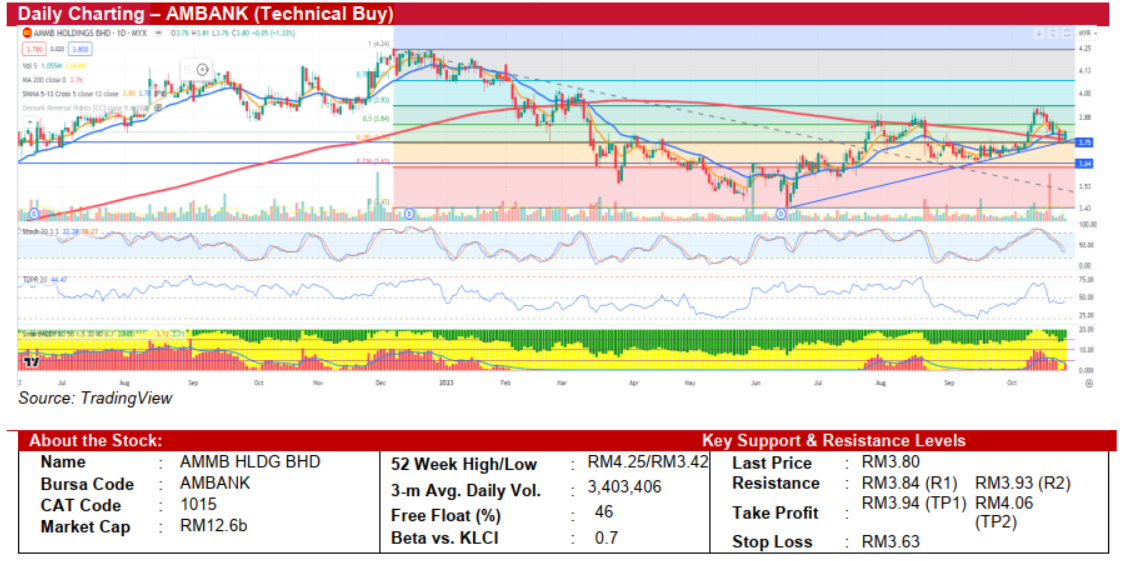

- AMBANK has retraced by 5% over the past two weeks but found solid support at RM3.75, coinciding with its previous consolidation range’s upper limit and long-term trendline. It closed 1.3% higher at RM3.80 yesterday. The short-term 5-day Simple Moving Average (SMA) is still above the longer-term 13-day SMA, indicating the continuation of the short-term upward trend.

- From a technical standpoint, although the stochastic oscillator hasn't yet shown a clear upward trend, the Tom Demark Pressure Ratio (TDRP) is on an upward trajectory, suggesting potential renewed buying interest. The presence of a “banker chip” in the MCDX further bolsters the positive technical outlook for the stock.

- A decisive breach above the key resistance level of RM3.84 could lead the stock to test the next key resistance levels at RM3.93 and RM4.07. Conversely, a significant drop below the RM3.75 key support line could trigger a sell-off down to RM3.64.

- Our recommendation is to consider entering a position in the stock in the RM3.75−RM3.80 range, with the goal of taking partial profits at RM3.94 and subsequently at RM4.06. This strategy offers an estimated upside potential of around 5.3%. To manage risk,s we advise setting a stop-loss at RM3.63, which represents a downside risk of approximately 4.5%.

Source: Kenanga Research - 26 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments