Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 05 Feb 2024, 09:45 AM

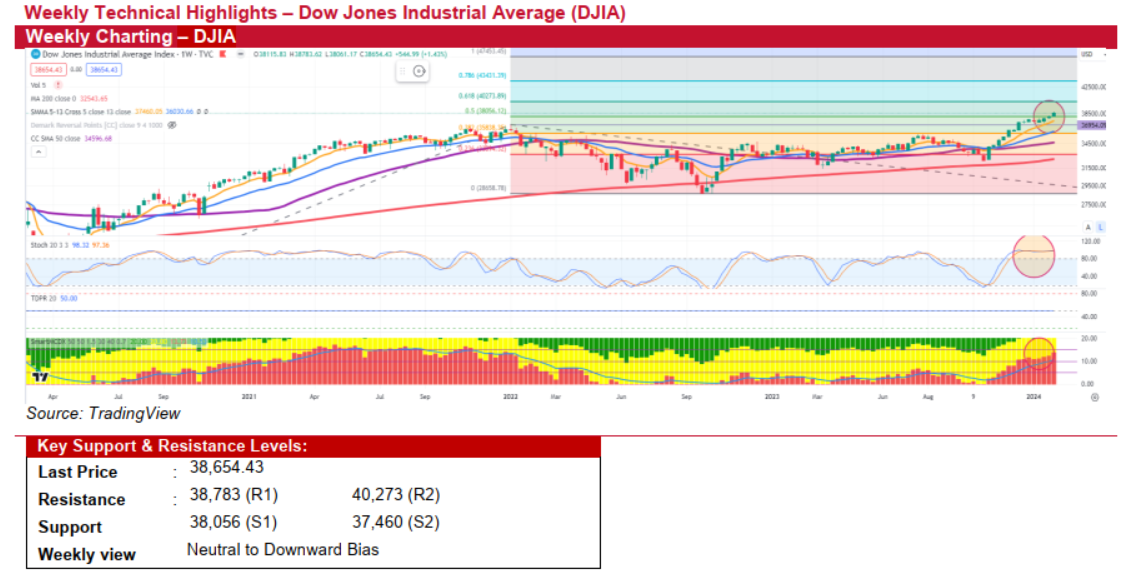

Dow Jones Industrial Average (DJIA) (Neutral to Downward Bias)

- Major stock indexes experienced a dip last Wednesday after the US Federal Reserve meeting, which tempered expectations for a rate cut in March. However, markets recovered to post gains for the week, buoyed by Federal Reserve Chair Jerome Powell's dovish remarks on economic growth and labour markets. The S&P 500, DJIA, and NASDAQ all saw over 1% weekly gains. Meanwhile, the US 10-year Treasury bond yield fluctuated, dropping to 3.82% on Thursday, then rising to 4.03% after a strong jobs report on Friday, hinting at delayed rate cuts. Oil prices also dropped over 7% due to concerns over crude demand and rate cut expectations.

- The stock market's rally seems set to continue its upward trajectory, with significant gains particularly noted in AI-related sectors. However, the limited market breadth observed last week coupled with rising treasury yield indicates that a potential slowdown might be on the horizon, especially in the absence of major economic data and extensive corporate earnings announcements this week. Noteworthy S&P 500 companies like Caterpillar, McDonald's, Ford Motor, PayPal, Philip Morris International, and PepsiCo are among the few set to release their earnings this week, which could offer some market movements.

- The DJIA's ongoing weekly uptrend remains strong, securely above its resistance-turned-support level of 38,056, which aligns with its 50% Fibonacci extension. However, a pullback might be on the horizon due to the upcoming week's scarcity of significant economic data and corporate earnings releases as well as rising bond yield. If a pullback does occur, the index is anticipated to find support at 37,460, its 5-week Simple Moving Average (SMA).

- Key resistance levels are at a recent high of 38,783 and then 40,273, with immediate support at 38,056 and additional support at 37,460, near the 5-week SMA.

Source: Kenanga Research - 5 Feb 2024

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments