Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 27 May 2024, 09:50 AM

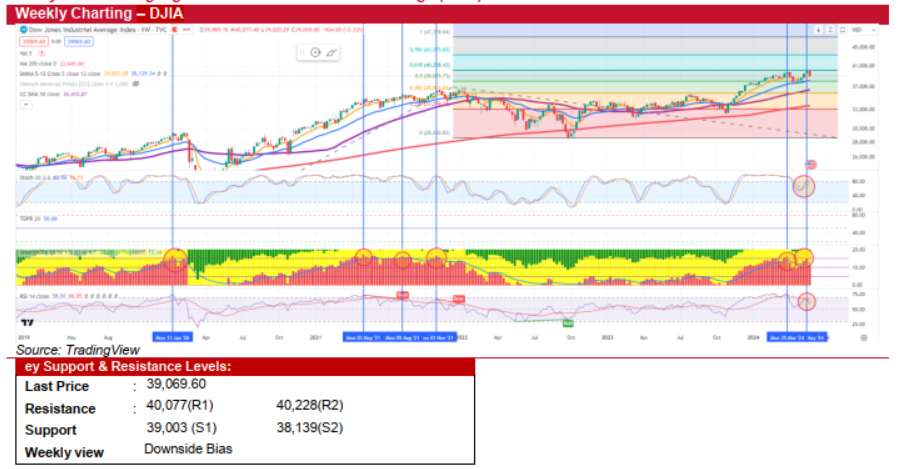

Dow Jones Industrial Average (DJIA) (Downside Bias)

- It was a week of contrasting performances for major US stock indexes last week with the DJIA fell over 2%, the NASDAQ rose more than 1%, and the S&P 500 posted a slight gain. The DJIA ended a five-week positive streak, dropping over 900 points below its recent high of 40,000. The NASDAQ, on the other hand, outperformed driven by another strong week for information technology stocks. With 96% of 1Q earnings results in by Friday, S&P 500 companies were showing an average earnings increase of 6.0% YoY, according to FactSet. If this holds, it would be the strongest growth rate since 1QCY22.

- The US market will be closed on Monday for Memorial Day. In the holiday-shortened week ahead, Thursday's updated U.S. GDP estimate will be the most closely watched economic report. The initial estimate from late April showed 1QCY24 GDP growth at 1.6%, down from 3.4% in 4QCY23. Additionally, Friday's release of the core Personal Consumption Expenditures (PCE) Price Index will provide another key inflation data point, with potential to move markets.

- Technically, the DJIA has begun to reverse, as we predicted last week, closing near the immediate 5-week SMA support line. Despite a 2% drop, there is still room for further correction this week given the high weekly stochastic and RSI indicators. However, the short-term uptrend remains intact as long as the index holds above the 13-week SMA level, around 38,139.

- In short, we expect the market to remain biased to the downside this week. Any disappointments from key economic data releases could lead to the index testing its 5-week SMA at 39,003 and the more pivotal 13-week SMA support level. Conversely, surpassing the all-time high of 40,077 would drive the index to test the next resistance level at 40,228.

Source: Kenanga Research - 27 May 2024

More articles on Kenanga Research & Investment

Malaysia Money & Credit - Slower M3 and loan growth in November signals cautious optimism ahead

Created by kiasutrader | Jan 02, 2025

Renewable Energy - Record-Breaking Order Books with More to Come (OVERWEIGHT)

Created by kiasutrader | Dec 30, 2024

Bond Market Weekly Outlook - MGS/GII yields set for modest rise amid global uncertainty

Created by kiasutrader | Dec 27, 2024

- Ringgit Weekly Outlook Eyes stability amid USD resilience and domestic optimism

Created by kiasutrader | Dec 27, 2024

Actionable Technical Highlights - RANHILL UTILITIES BHD (RANHILL)

Created by kiasutrader | Dec 23, 2024

Actionable Technical Highlights - HUP SENG INDUSTRIES BHD (HUPSENG)

Created by kiasutrader | Dec 23, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments