Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Tue, 04 Jun 2024, 11:10 AM

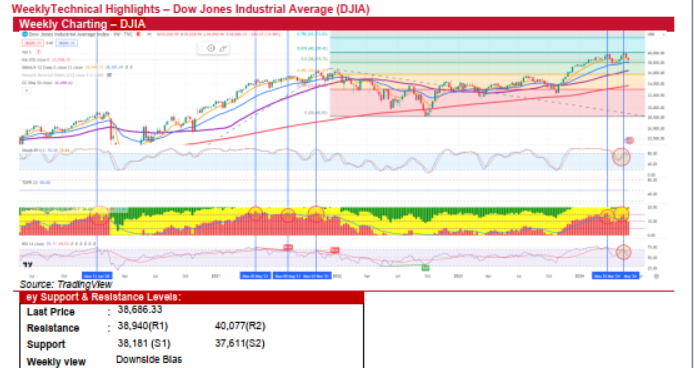

Dow Jones Industrial Average (DJIA) (Downside Bias)

- The stock market fell last week, breaking several support levels. Despite inflation readings meeting expectations, disappointing corporate earnings in some technology names weighed on performance. The Nasdaq Composite dropped the most, down 1.1% WoW, mainly due to Salesforce's disappointing 1Q earnings while the DJIA and S&P 500 fell 1.0% and 0.5%, respectively. Despite this, the DJIA, S&P 500, and Nasdaq gained 2.4%, 4.8%, and 6.9%, respectively for the month of May.

- Looking ahead, AI-related news is expected to dominate the market this week. Keynote speeches from the chief executives of Nvidia, AMD, Intel, and Qualcomm at Computex 2024 in Taiwan will be a focal point. Additionally, Nvidia's 10-for-1 stock split, which takes place after market close on Friday, may prompt last-minute purchases in anticipation of share price appreciation. Key economic releases this week include the May nonfarm payrolls report and PMI data.

- Technically, while the DJIA has rebounded after touching the 13-week SMA level, the emerging weakness in the weekly stochastic and Smart MCDX index suggests potential for further consolidation. If the index falls below the 13-week SMA level at 38,181, it could form a double top candlestick pattern and retrace to the 50-week SMA level at 36,500.

- In short, we expect the market to remain biased to the downside this week. Disappointments from key economic data or valuation resets, particularly in the AI sector following recent software-cloud earnings weakness, could lead to the index testing its pivotal 13-week SMA support level again. Conversely, surpassing the immediate 5-week SMA resistance level at 38,940 could drive the index to test its all-time high of 40,077.

Source: Kenanga Research - 4 Jun 2024

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments