Kenanga Research & Investment

Weekly Technical Highlights – FBM KLCI

kiasutrader

Publish date: Tue, 04 Jun 2024, 11:10 AM

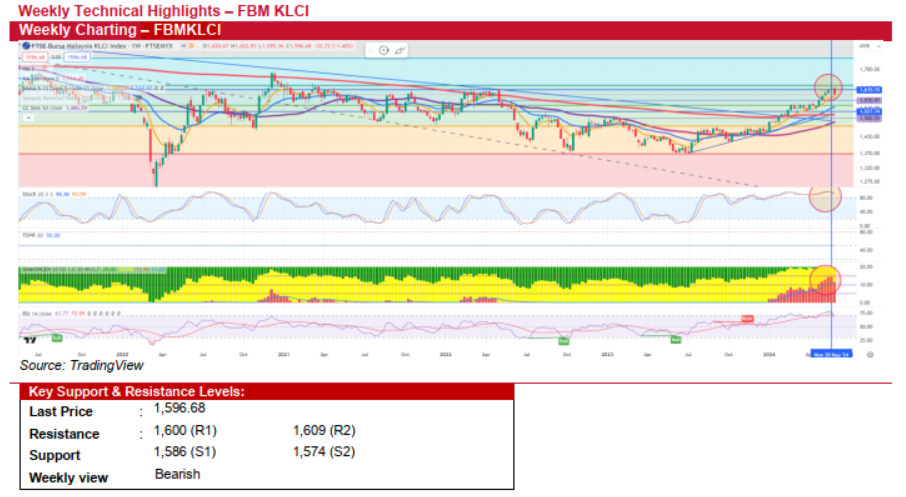

FBM KLCI (Bearish)

- As expected, the FBM KLCI ended the week on a negative note, falling below its psychological support level of 1,600. It dipped 1.4% WoW, or 22.7 points, to 1,596.68 due to continued foreign selling and profit-taking ahead of the long weekend. Sector-wise, the Plantation and Telecommunication sectors saw the biggest drops, down 3.2% compared to the previous week. However, the Construction sector bucked the trend, rising by 1.2%. Overall market turnover increased to 26b units worth RM22.2b, up from 24.2b units worth RM17.8b in the preceding week.

- Looking ahead, the local market is expected to face continued downward pressure as investors remain cautious over global interest rate directions and inflationary pressures. Key events to watch in this shortened trading week include the Taiwan Computex 2024 conference, where leading global tech giants will provide keynote speeches that could impact the local semiconductor industry. Additionally, investors will focus on Wednesday’s EPF conference and the European Central Bank (ECB) rate decision. No key data releases are scheduled from Bank Negara Malaysia (BNM) or the Department of Statistics Malaysia this week.

- Technically, the index began to retrace last week following a shooting star candlestick pattern formation two weeks ago, confirming a trend reversal. Further consolidation is likely, as the weekly stochastic, RSI, and SmartMCDX (which measures buyer activity based on volume and price movement) remain in overbought territory despite last week's weak index performance.

- In summary, we expect another week of profit-taking or negative performance, with immediate support levels at 1,586 (coinciding with the 5-week SMA) and 1,574 (50-day SMA). Conversely, breaking above the psychological resistance of 1,600 could propel the index to test the next resistance level at 1,609.

Source: Kenanga Research - 4 Jun 2024

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments