Kenanga Research & Investment

Actionable Technical Highlights - HTPADU

kiasutrader

Publish date: Thu, 20 Jun 2024, 10:57 AM

HTPADU BERHAD (Technical Buy)

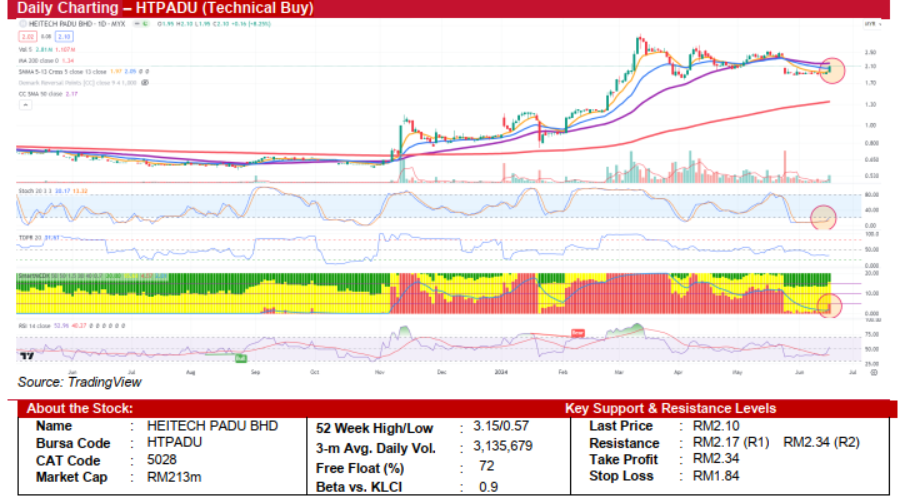

- Heitech Padu Bhd (HTPADU) broke out from its 3-week consolidation zone yesterday, closing at RM2.10 (+8.2%). The firm break-out, coupled with rising trading volume, suggests a potential renewed uptrend. The weekly chart also indicates bullish signals after forming a ‘morning star’ candlestick pattern.

- From a technical perspective, the daily stochastic, now still in the oversold zone, shows early signs of an upward trend. This, combined with a rising SmartMCDX, reinforces the likelihood of a bullish turnaround.

- A sustained position above the resistance-turned-support level at RM2.05 could signal a continued bullish trend, with the stock testing higher resistance levels at RM2.17 and RM2.34. Conversely, a sharp decline below the immediate support level at RM2.05 may lead to the next major support at RM1.97 or RM1.85.

- We recommend considering an entry position around RM2.05 (or near the 5D-SMA level). Setting a take-profit target at RM2.34 provides an estimated upside potential of approximately 14.1%. For risk management, placing a stop-loss at RM1.84 limits potential downside to around 10.2%. This strategy offers a balanced risk-to-reward ratio, making it a viable trade setup for investors.

Source: Kenanga Research - 20 Jun 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Jan 20, 2025

Renewable Energy - Big News, Another 2GW LSS Incoming (OVERWEIGHT)

Created by kiasutrader | Jan 20, 2025

Bond Market Weekly Outlook - Domestic yields set to rise ahead of Trump’s inauguration

Created by kiasutrader | Jan 17, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments