Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Tue, 09 Jul 2024, 10:04 AM

Dow Jones Industrial Average (DJIA)

- The DJIA gained 0.7% last week, currently 1.6% below its mid-May record. The NASDAQ and S&P 500 reached new highs with weekly returns of 3.5% and 2.0%, respectively, driven by continued optimism in the technology space. Friday's jobs report strengthened expectations for a potential Federal Reserve rate cut later this year, causing government bond yields to fall. The 10-year U.S. Treasury yield decreased to 4.28% from 4.37% a week ago. Additionally, market hopes for potential Fed rate cuts saw notable improvement on a week-over-week basis. The Bloomberg probability of a September rate cut currently sits at 81%, up from 68% a week ago.

- Looking ahead, key market-moving catalysts this week include inflation data (CPI and PPI) and the unofficial start of the 2Q earnings season on Friday, with major banks like JP Morgan, Citibank, and Wells Fargo reporting results. FactSet estimates a YoY earnings growth rate of 8.8% for the S&P 500, which would be the highest since 1QCY22.

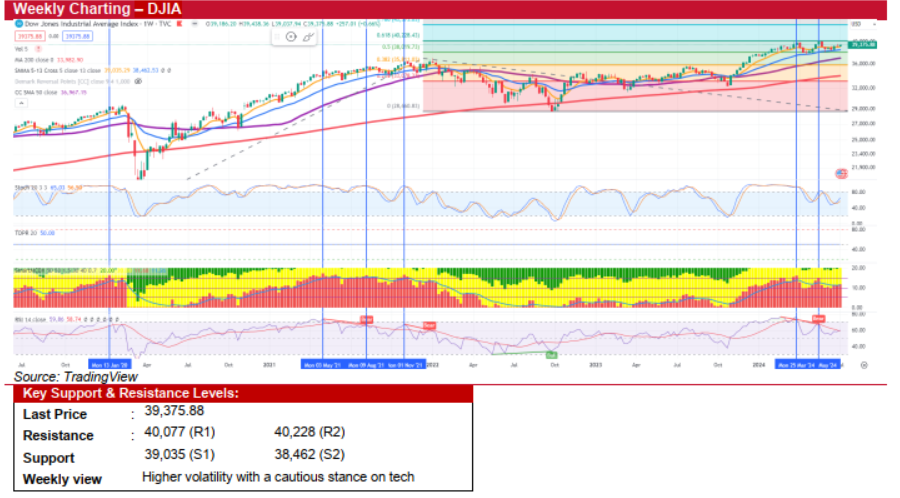

- Technically, the DJIA has formed a bullish engulfing pattern followed by a 'doji' candlestick last week, indicating potential continuation of the bullish trend. The recent close above its 5-week SMA further reinforces its near-term strength. The weekly Stochastic Oscillator and RSI are at 65.03 and 59.86, respectively, suggesting room for further upward movement. Despite these positive signs in the DJIA, it's important to note that the NASDAQ and S&P 500 indices are currently in overbought territory. This suggests that a ‘mean reversion’ pullback is likely to occur, which could impact overall market sentiment.

- In short, we expect higher volatility this week with a cautious stance on tech. The index's immediate resistances are at its alltime high of 40,077, followed by 40,228. Support levels are identified at its 5-week SMA at 39,035, followed by the crucial 13- week SMA at 38,462

Source: Kenanga Research - 9 Jul 2024

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments