Tan KW

Publish date: Tue, 09 Oct 2012, 02:43 PM

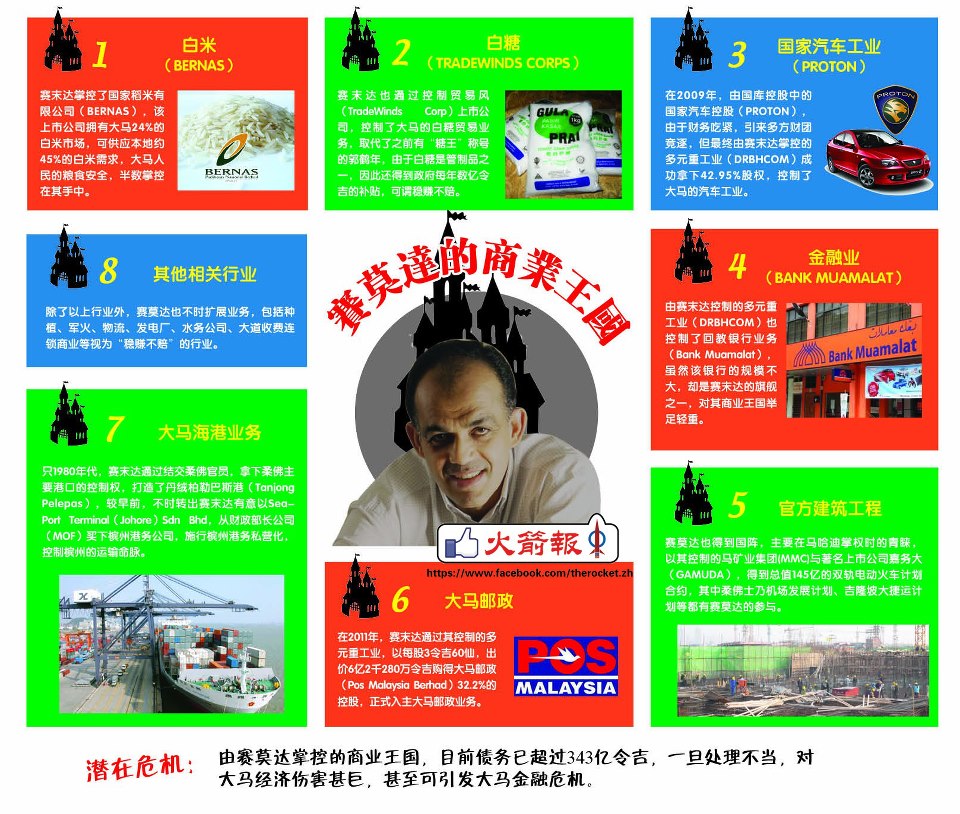

大马著名企业家丹斯里赛莫达(Syed Mokhtar Al-Bukhary)几乎控制了大马的经济脉搏,情况

这位来自吉打的土著企业家,学历只有中五程度,却善于与

八打灵再也北区国会议员潘俭伟就指出,赛莫达的商业王国

潘俭伟说,赛莫达财团债务却高达343亿令吉,在201

其中,赛莫达一人就主政了至少9家大集团:

1. 马矿业集团执行主席(Malaysia Mining Corporation Bhd)

2. 国企贸易有限公司主席(Pernas Bhd)

3. 贸易风集团执行主席(Tradewinds Bhd)

4. 马拉科有限公司主席(Malakoff Bhd)

5. 国家稻米有限公司执行主席(Bernas Bhd)

6. 多元资源工艺有限公司执行主席((DRB-Hicom Bhd)

7. 国家汽车工业有限公司执行主席(Proton Bhd)

8. 柔佛港口有限公司(Johor Port Bhd)

9. Bank Muammalat Bhd主席

google translate:-

More articles on Good Articles to Share

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Discussions

how bout debt on equity? and how about earning/debt on equity ?

if you see the whole picture, it look more worse than just plain debt.

you see, bank usually have higher DOE than other industry, because saver money is mark as company debt, but it is ok because bank give 3% interests to saver, but earn 6%-higher when they loan the money out.

check out the drb hicom debt on equity,it is 5 ringgit debt for every ringgit they own, it is way more higher than it peer such as UMW , tchong, which is 1++.

and what make it ''worser'' is , DRBhicom latest quarter profit margin is below 1%, so what their solution for rise the profit margin? of course, rise the price of their merchandise which the quality is way below par ( proton ) facepalm.

mmcorp? selangor dont want build new dam, no project = no money... kesian

2012-10-09 15:27

no nid to scare; if uxno can let him monopoly, then will bail out for him if fails. use everyone money loh

2012-10-09 22:48

The country, or more correctly to say the Government of our once resources rich country will never learn from the past mistakes and will continue to make the silly mistakes times and again.

If you may recall what happened to the country's economy after the financial crisis of 1997, the government was throwing good money after the bad one by rescuing one company after another company, and of course you know what were the companies that were being rescued.

Indeed, it was a huge amount being wasted to rescue these companies and what is the end results, companies that have lost their competitive edge with no distinctive competance to compete in an ever more competitve business environment but survived purely because of the Government's protection and heavily subsidized by the tax payers and the rakyat who are consuming locally products like proton car.

What the government should have done then was to let these companies go to the wall so that the monies used for bailing out these sick companies could have been used much more wisely by adopting more prudent fiscal and monetary policies which would have put the country in a much more solid fundamental footing for the eventual economic recovery to the like of our immediate neighour countries - Indonesia, Thailand and Philippine.

Instead, look at the miserable state of our economy over the last 1 1/2 decades whereby the country's economic growth has been stunted with average growth of 4 to 5% annually which is no better than a replacement economy, just enough to sustain the tear and wear of the economy with no real monies to spend on capital expenditure to bring about real growth for a developing country like Malaysia. If we are not careful, Malaysia may end up becomes a under developed country by 2020. The lost 1.5 decades will be difficult for the country to claw back the losses in terms of economic development and country's advancement

The country will inevitably make the same mistake again come this round of world economy slump, just wait and see unless the coming GE really see the forming of a two party system on the political spectrum to ensure enough of check and balance.

Take a look at the level of our soverign national debts, a staggering 500Billion plus and please take it with a pinch of salt as this figure excludes plenty of off balance sheet borrowing and borrowings by GLC.

God bless Malaysia!

2012-10-10 12:55

chongkonghui

Debt 34.3b, how about asset? must view the picture as a whole.

2012-10-09 15:08