DELEUM–Fundamental Analysis (6 Mar 2014) - L. C. Chong

Tan KW

Publish date: Thu, 06 Mar 2014, 09:40 AM

Posted by L. C. Chong on March 6, 2014

DELEUM Analysis:-

Excel – http://lcchong.files.wordpress.com/2014/03/deleum-q4-2013.xlsx

PDF – http://lcchong.files.wordpress.com/2014/03/deleum-q4-2013.pdf

My View:-

- Fair value

– 5Y DCF: 5.21 – 5.89 (MOS: 6% – 17%)

– DELEUM is near fully valued.

- Market Timing

– EY%: Buy under 2.43, sell under 5.03

- The long term outlook looks bright for Deleum, with a RM3.5bn orderbook lasting up to 7 years and 2 major contracts commencing in FY14.

- I will wait for bigger correction. Let see how it goes.

Latest Financial – Q4 2013 Financial Report (25 Feb 2014) http://www.bursamalaysia.com/market/listed-companies/company-announcements/1547721

At the time of writing, I did not own shares of DELEUM.

http://lcchong.wordpress.com/2014/03/06/deleumfundamental-analysis-6-mar-2014/

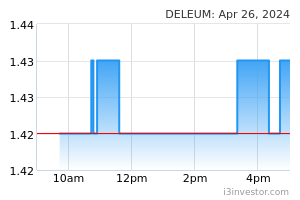

Related Stocks

Market Buzz

More articles on Good Articles to Share

Created by Tan KW | Jan 02, 2025

Created by Tan KW | Jan 02, 2025

Created by Tan KW | Jan 02, 2025

Created by Tan KW | Jan 02, 2025

Created by Tan KW | Jan 02, 2025

Created by Tan KW | Jan 02, 2025

heavyth

Can enter now...???

2014-05-02 16:11