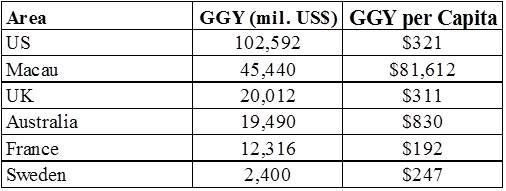

Gambling Revenues (GGYs) for Selected Countries and Macau, 2013

Source: GBGC and Morss Analysis

US gambling revenues are twice as large as any other country, while its per capita level is about average. Macau is a gambling "destination" site for many Asians, as is the west coast of Australia. Per capital gambling revenues in Sweden and particularly France are low.

The preferred gambling activity differs significantly among our countries/region (Table 2). In Macau, most of the gambling is done in casinos, while in France and Sweden, the lotteries dominate. In Australia and the US, slots/machines outside of casinos are very important. In casinos, there is a striking difference: in the US, slots dominate with revenues almost 3 times greater than card games. In Macao, Macau, card games, especially Baccarat, are the primary gambling activities.

Table 2. - Gambling Shares by Vehicle, 2013

(click to enlarge)

Source: GBGC and Morss Analysis

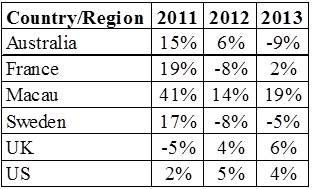

Gambling Growth

In most of our countries/regions, legal gambling is a growth industry. As Table 3 indicates, Macau's growth is torrid, with healthy growth in 4 of our other countries. The US is a special situation to be examined later in detail.

Table 3. - Gambling Methods by Country:

Compound Average Growth Rates, 2001-13

(click to enlarge)

GGY Growth (US$)

Source: GBGC and Morss Analysis

To highlight the differences, consider gambling in Macau and the US.

Macau is a destination site for Asian gamblers. The government limits its gambling growth by how many visas it issues to Chinese citizens. The Macau "package" includes smoking, drinking, gambling and sex.

Things are quite different in the US: there are indications that the demand for gambling per se has leveled out. The casino mainstay is individuals who want an opportunity to smoke and drink indoors. So the vast majority of casino space is given over to slots and other gaming machines where smoking is permitted. But most Americans are concerned about second-hand smoke. The casino operators are aware of this, so they are trying to convert gambling sites into Disney-type locales that will appeal to families. Indoor malls are primary recreation sites for families, and casinos want to copy them. So Foxwoods is putting in 75 discount outlets. It is interesting that when MGM announced plans for its new casino in Springfield MA, it focused on plans for a new 5-star hotel and a number of high-end restaurants.

Investment Implications

"Governments are now seeing the taxation of gambling without any backlash from voters so there is a drift upwards throughout the world except Nevada and Macau. Gambling companies are therefore easy targets. So taking that into account those that supply the industry

have more insulation and are best placed. Playtech on the London Stock Exchange (PTEC.L) (

OTCPK:PYTCY) and Net Entertain (NET-B

.ST) provide software for

e-gaming companies. Otherwise, you have to look to Macau: Galaxy Entertainment ((27:

HK)) (

OTCPK:GXYEY), Wynn (

WYNN) (

OTCPK:WYNMY) and Las Vegas Sands (

LVS). For a pure Macau play, buy Galaxy.

What are the risks?

China's economy. I doubt the Chinese government will issue so many visas to Macau if economic growth suffers. It would not be politically correct. Also, the medium to small business owners may have less money to spend in Macau, but over the next 10 years it is a no-brainer. The Zhuhai Bridge will be complete in 2015 making it much easier to get to Macau. Huge developments are taking place by Galaxy and these will add to earnings (phases 2, 3 and 4 on Cotai)."

Huang

Unfortunately, Malaysia and Genting were not mentioned in the article.

Both GenM and Genting have very great global biz expansion plan since many years ago and the expansion train is still well moving worldwide. However the shares prices of both are significantly lagging behind the broader market. It is contradicting with its status of the renowned blue chips of Bursa.

WHY ???

2014-04-19 10:22