I remember when I started investing, people (or some books) used to tell - anything that is above 8x PE is considered expensive. That practice is still within some Malaysian VCs, investors where they would even look at prospective PE of 3x - 5x. Is this archaic measurement realistic?

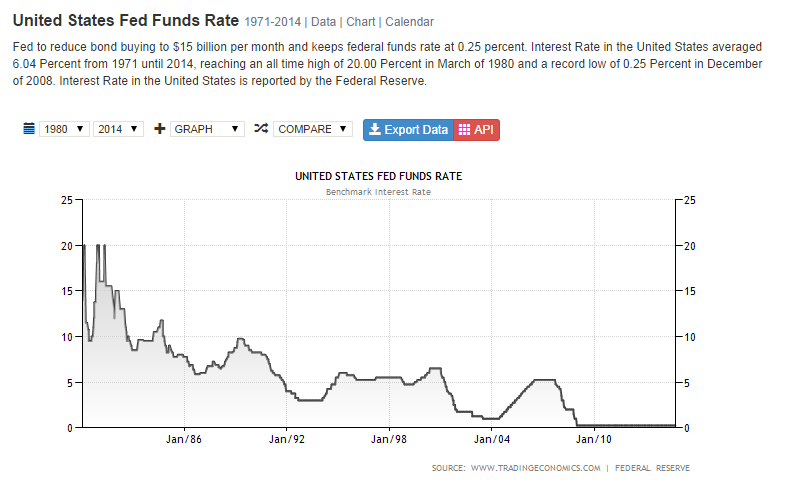

Times change, appetite changes as well. However, if one is to look at the global interest rate trend, starting with the US Fed Funds rate - where it has come down from a high of almost 20% in 1980 during the Volcker period to now post-2008 subprime crisis where the Feds are keeping rates at almost zero, should it signify something?

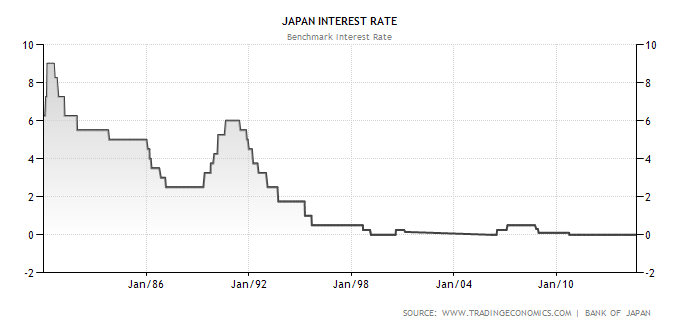

Similarly, Japan has even kept rates at zero for much longer period, basically for the entire 21st century thus far (see below).

In Malaysia, I am pulling out the time (fixed) deposit rate where it has dropped from above 8% to hovering around 3.0% to 3.5% for more than 10 years now, where does one expect to put their money? - in FD still? Would one's risk appetite be higher investing into stocks, properties, even commodities etc? Surely.

If one has a higher risk appetite, due to the low deposit rates together with low financing rates from banks - would the accepted average PE generally be higher? Again surely.

If one is to look at the general trend from US to EU to Japan as well as in a period where funds are able to move freely, would you think that these funds would look at opportunities all over the world? It is much easier for some of the funds to get financed from a low interest rate country and invests their money in any investments that would get them anything that would provide between 8% to 10%, sometimes lesser - assuming currencies exchange does not change much.

So, what's the right PE? Anything that provides me higher than the 3.4% what banks is giving me, or for some bigger funds - anything higher than high quality bonds, with a little bit of buffer.

With that wouldn't you think that any business that has a good consistent growth, a PE of somewhere between 15x to 20x, be even digestible?

Or someone has a crystal ball and can see that interest rates are moving upward fast in the near future?

sosfinance

PE has been used to compared with the past which is fine, but, one must see from the perspective of BANK INTEREST RATE as well (of course there are other factors, CURRENCY, BETA, DY. In Malaysia, household debt is 86%, because, we are in the lowest interest regime era. Many years back, interest average at 8%, now about 4% it is same as getting a RM300m loan, now is RM600m loan, and total repayment more or less same.

2014-09-25 20:32