Good Articles to Share

Inari Rights Go Ex-ed - Bursa Dummy

Tan KW

Publish date: Tue, 20 Jan 2015, 09:28 PM

Tuesday, 20 January 2015

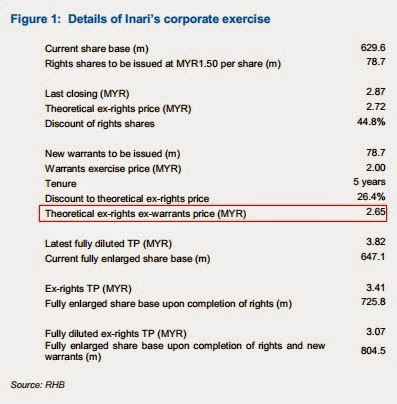

Inari's rights issue (8:1) + free warrants (1 rights share : 1 warrant) are ex-ed today. Yesterday's closing price was at RM2.87.

So Inari's share price is adjusted to RM2.64 today, which is 1sen lower than RM2.65 calculated by RHB.

How to calculate the ex-ed & adjusted share price?

As we know, we actually get nothing free from corporate exercises like free warrants, bonus issues etc, as the share price will be adjusted accordingly on the ex-date.

That means what we own before and after the corporate exercise will be the same.

For example:

Lets say if I have 8 Inari shares, I will be entitled to 1 rights share and 1 "free" warrant.

I have to pay RM1.50 for 1 rights share.

Inari's share price closed at RM2.87 before ex-date.

My cost is: (RM2.87 x 8) + (RM1.50 x 1)

After ex-date, I will have 9 Inari shares and 1 "free" warrant.

Lets say P = adjusted Inari share price after the corporate exercise. So the warrant price should be (P - RM2.00), as its exercise price is RM2.00.

As before = after, thus (RM2.87 x 8) + (RM1.50 x 1) = (9 x P) + (P - RM2.00)

P = RM2.646

Theoretically its new warrant price should be 64.6sen.

I'm actually not too sure whether my layman style calculation is correct or not, but the outcome seems to match.

According to RHB, Inari's fully enlarged share base upon completion of rights and new warrants will be 804.5mil, which is 28% more than 629.6mil currently.

So there will be a significant earning dilution once the new warrants which expires in 2020 are fully converted into Inari shares.

However, just look at RHB earning forecast for Inari until FY17 (Jun-17). Its net profit is expected to grow more than double in 3 years from FY14 to FY17!

Inari's financial results forecast by RHB

With its rather aggressive expansion plan which include a new production space in Bayan Lepas which will start to contribute soon, I am confident that Inari can continue to produce better results for the next few years.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Party of Thailand's new PM drops military-backed party from coalition govt

Created by Tan KW | Aug 27, 2024

Wall Street drops on caution ahead of Nvidia results, economic data

Created by Tan KW | Aug 27, 2024

White House condemns strike that killed Reuters safety adviser in Ukraine

Created by Tan KW | Aug 27, 2024

Border expert calls out Harris campaign for ‘stone cold lie’ about Trump

Created by Tan KW | Aug 27, 2024

We're seeing a broadening in market leadership, says BMO's Carol Schleif

Created by Tan KW | Aug 27, 2024

Discussions

Be the first to like this. Showing 1 of 1 comments

.png)

matakuda

Tq. Not owning any shares of inari but I leant the computation formula from you.

2015-01-21 07:10