- Leading integrated Electronics Manaufacturing Services (EMS) provider

- World's top 50 EMS from 2007 to 2014 (source: Annual Report 2015)

- Director Salary, RM20 million annually (50% of operating expenses)

- Dividend policy minimum 40%

- Outstand shares 1,155 million shares

- Warrants 290.8 million shares (EPS will be diluted 25% once warrants convert to mother share)

- Major customers, like customer Keurig and Dyson are expected to remain strong, with sale percentage 38% and 25% respectively.

- Customer Keurig to grow CAGR 29% from FY15-18 to 4.6 million units

- Customer Dyson sales for FY16 are expected to grow 50% yoy to RM639 million.

- Dividend policy minimum 40%

- Management is confidence on future growth.

- Major revenue depends on two (2) customers (63% of total revenue)

- Director's salary too high (50% of operating expenses)

- Minimum wage implementation on July 2016 from RM900 to RM1000 (11% increase), which shall be minimum impact on profit.

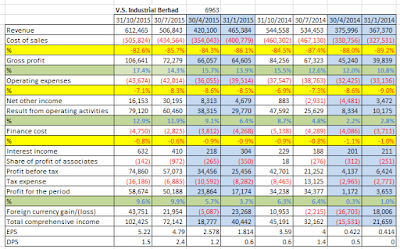

- 2QFY (January) and 3QFY (April) performances are typically its weakest quarters due to seasonal demand.

- Earning sensitivity 1.5% to 2.0% reduction for every 1% ringgit fall.

- Since there next two quarters are traditionally weakest quarters, hence there is no hurry to buy in.

- Next quarter result is expected to be weaker, compare to current quarter.

- Consistence future growth is a question mark. Risk management is too low.

- Profit Margin increase almost 100% from last year, which is unlikely to maintain. If profit margin go back to normal rate, there will be 50% drop on profit, hence as well as share price.

- Management is not taking care shareholder's interest, as taking too high salary and implement ESOS too frequent.

- Price is at high side based on diluted shares. It might be higher due to ESOS on every year.

Koon Bee

Cant imagine how low will it go if Kyy throw his 100 million share in hand...but i suspect Kyy has silently dispose this 100 mil past 3 months at around 50%

2016-03-14 21:51