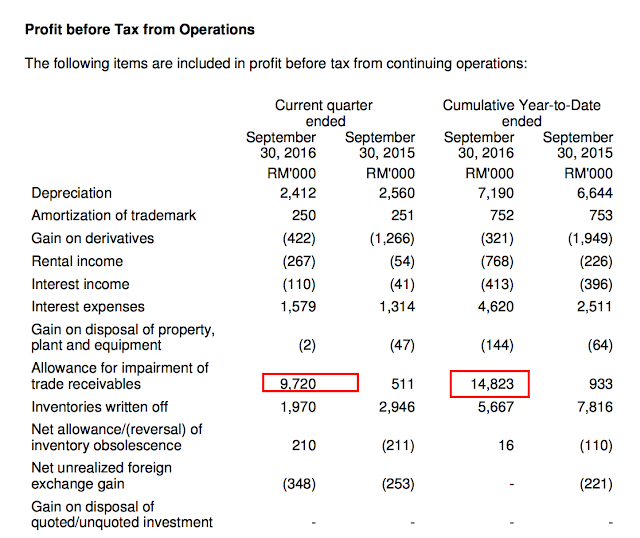

Other than that, there should not be much of a reason for its profits to be that way except that it took a much higher provision for impairment in receivables of RM9.72 million (see below). While it is not a good thing for the company, I guess it sometimes an unavoidable thing - being part of business.

|

| The company took a RM9.72 million impairment charge for 3Q16 |

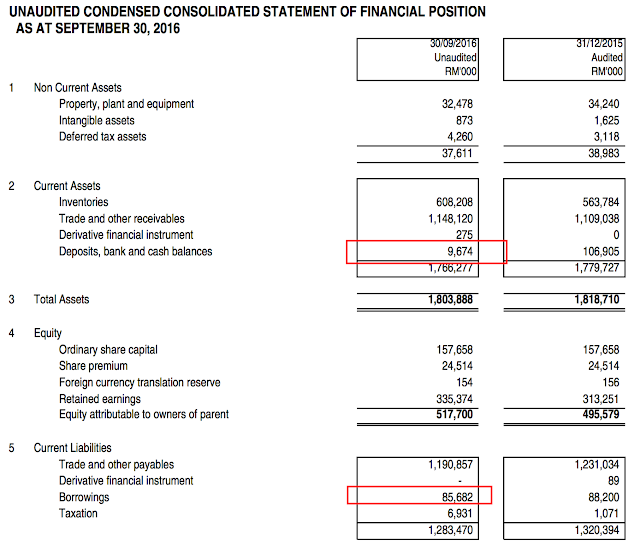

I actually have someone who asked me and being concern over its low cash in the balance sheet. Its cash as shown below was left at RM9.674 million. Again, I do not think that it is a cause for concern as DKSH certainly has short term working capital funding from banks. It may just happen that for its closing 3Q16, its cash position seemed to be on the low side.

|

| Cash at RM9.7 million |

For DKSH or many companies for that matter, we should not be too concerned over its quarter to quarter results but more of its medium to long term fundamental.

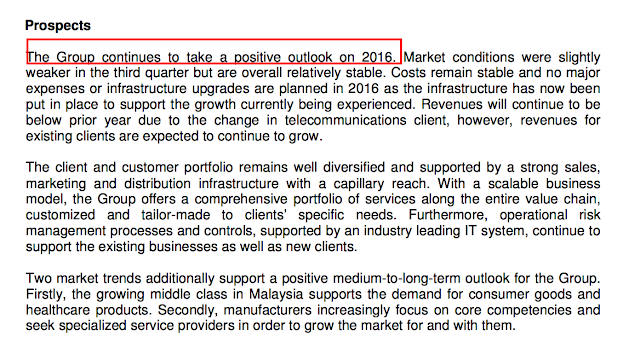

It does provide guidance and below is what it says. It does provide a decent to positive outlook of its future.

The reason I own DKSH is that it does have a certain moat as its actual competitors in terms of what it can do is not that many. It is a distributor, not a retailer. Retailers are getting challenges from e-commerce, but DKSH should be able to survive that as its business is more of a B2B rather than B2C.

Further, if one is to look at its reasoning for its growth, the second reason is a very strong reason - companies are more and more looking at doing ONLY what it does best. Which means especially the foreign importers, they will focus on using companies like DKSH to do the market expansion, distribution rather than doing it themselves. This is a global trend now and moving forward.

Henry HO

Thank you Felicity for this write-up on DKSH...

For the 3Q2016 Results...

DKSH Revenue is RM 1,256,938,000.

Profit is RM 5,414,000 only.Gross profit margin at 0.4%!!!!!!Really paper thin profit margin...If revenue goes down to RM1bil...DKSH could be at a loss...

2016-12-02 10:36