8 things I learned from the 2022 Carlsberg Malaysia AGM By Shak Chee Hoi

Tan KW

Publish date: Fri, 27 May 2022, 10:14 AM

Established in 1969, Carlsberg Brewery Malaysia Berhad is one of two brewers that are listed on Bursa Malaysia. The company has a business presence in Malaysia and Singapore as well as Sri Lanka via a 25%-owned associate. It owns several well-known beer brands in the region including Carlsberg Danish Pilsner, 1664 Blanc, and Somersby.

The company’s operations were halted twice in the past two years. Further, on-trade outlets including restaurants and food courts that contributed to a big chunk of its revenue faced COVID-19 related restrictions. Nightclubs were among the last to reopen their doors to customers after more than two years of closure.

Here are eight things I learned from the 2022 Carlsberg Malaysia AGM.

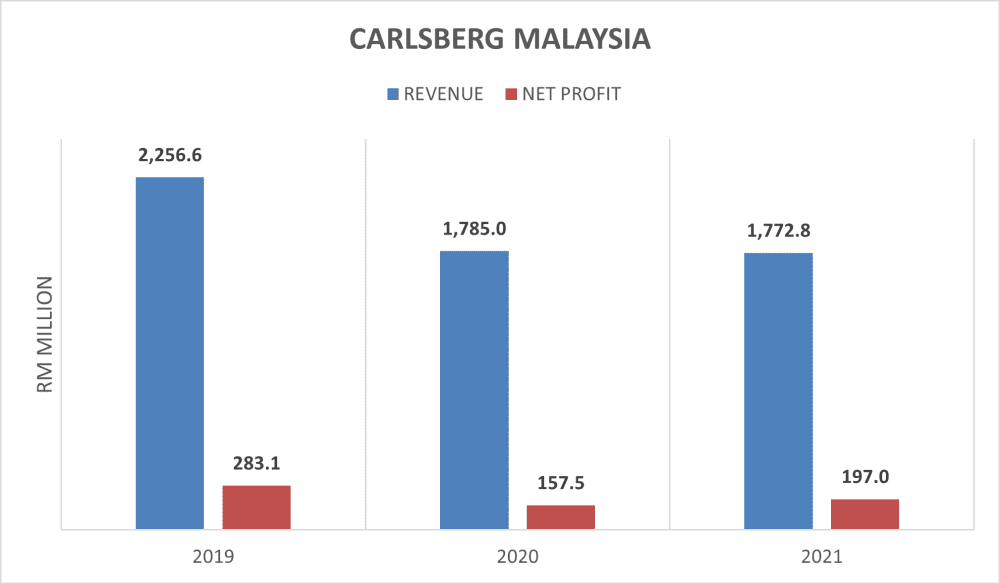

1. Revenue remained flat at RM1.8 billion in 2021 amid the challenging and difficult business environment. Carlsberg Malaysia’s brewery operations were suspended for an even longer period at 75 days in 2021, compared to 47 days in 2020 to comply with the Malaysia government’s movement control order. The company’s core beer, namely Carlsberg Danish Pilsner and Carlsberg Smooth Draught suffered a 11% drop in volume as there were intermittent dine-in restrictions and capacities.

Malaysia and Singapore made up 98.5% of the company’s revenue in 2021 and will continue to be the management’s priority. Exports to other markets like Hong Kong, Laos, Cambodia, and Thailand remained small.

2. Despite not brewing for two and a half months, net profit excluding non-operating items grew 25.0% year-on-year to RM197.0 million in 2021 because of the changes in sales mix and cost-saving initiatives. Sales of Carlsberg Malaysia’s premium brands including 1664 Blanc, Asahi Super Dry, and Somersby surged 15% year-on-year in 2021 as consumer demand for premium brands grew. According to managing director Stefano Clini, 1664 Blanc was the fastest-growing premium brand in Malaysia. The brewer further strengthened its premiumisation strategy by launching 1664 Roséand Somersby Watermelon Cider.

The breakdown of revenue and net profit by segment was requested but not provided during the meeting. Dividend per share improved 40.0% year-on-year to 56 sen in 2021, but was still 44% lower than the pre-pandemic level. Overall, the company has not fully recovered from the onset of the COVID-19 outbreak.

3. The management shifted more of its marketing spend to digital channels as e-commerce volume growth doubled in 2021. More consumers purchase beer from off-trade (supermarkets, convenience stores, and sundry shops) and online channels and opt for in-home consumption amid the outbreak.

The management did not track the revenue contribution of foreign tourists. On-trade outlets that tourists usually frequented such as restaurants, pubs and clubs contributed to most of the company’s revenue and was estimated to be about two-thirds before COVID-19.

4. A number of shareholders were concerned about the increases in the prices of raw materials like barley and malt as well as packaging material like aluminium amid supply chain disruptions. The company does not source any raw materials from both Russia and Ukraine but the ongoing Russia-Ukraine war will spur the escalating commodity prices.

The company will leverage its global group’s procurement capability to negotiate for a better price for its raw and packing materials. It is able to pass on cost increases to consumers given that beer is the cheapest form of alcohol and cannot be readily replaced. The management increased the product pricing several times in the past 20 years and did so once in 2021. At the same time, consumers will stay away from contraband alcohol given its detrimental impact on health and also because of the relatively high-profile alcohol poisoning incidents in Malaysia a few years ago. Together with Heineken Malaysia, the brewery sector is essentially a duopoly in the country. The demand for beer will remain.

5. Carlsberg Malaysia set aside RM110 million to modernise its production operations and expand its bottling facilities by 2022. The investment was funded via internal cash and borrowings and will be the largest so far in the past 30 years. Operating costs including warehousing, utility, maintenance expenses are estimated to be lower in the future. The capital expenditure will also result in capital allowance in 2022 that can be used to offset against taxable income.

Inventories amounting to RM5.6 million were written down in 2021 (RM2.6 million in 2020). These inventories included bottling facilities that would be replaced as well as raw materials that were spoilt after their operations were suspended abruptly.

6. The company’s business operations via Lion Brewery (Ceylon) PLC in debt-ridden Sri Lanka have been holding up quite well. Clini remains confident about the future of this 25%-owned associate. In 2021, the associate contributed to 7.7% of the company’s net profit. Clini is not aware of and doesn’t foresee a similar age-based ban on cigarettes to be implemented on alcohol. Malaysia is mulling to introduce laws to prevent sales of cigarettes to people born after 2005.

7. In line with the growing health awareness among consumers, an alcohol-free brew will be launched in Malaysia. The alcohol-free brew duo in Singapore – Carlsberg Alcohol Free Pilsner and Wheat variants – contains no more than 0.5% alcohol by volume and remained an insignificant revenue contributor to the group. On the other hand, the company spent about RM3.6 million on its community initiatives including donating face recognition infrared thermometers to schools to combat COVID-19.

8. Clini does not expect the minimum wage policy implemented by the Malaysia government recently to significantly impact the company. Beginning May 2022, the minimum wage was raised from RM1,200 to RM1,500 for companies with five or more employees in Peninsular Malaysia. The company hires mostly locals except for some expatriates. In the past two years, it didn’t cut the salaries of its full-time employees.

The fifth perspective

While Malaysia and Singapore reopened their borders for quarantine-free travel and tourists are gradually returning, Carlsberg Malaysia’s road to recovery is bumpy but on track. The brewer’s short-term challenges ahead include potential resurgences of COVID-19 cases and new variants as well as surging raw material prices that are further aggravated by the Russia-Ukraine crisis. It will mostly be hit by the one-off 33% prosperity tax that will be imposed on taxable income above the RM100 million threshold.

https://fifthperson.com/2022-carlsberg-malaysia-agm/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Apr 27, 2024

Created by Tan KW | Apr 27, 2024

Created by Tan KW | Apr 27, 2024

Created by Tan KW | Apr 27, 2024