Scope Industries (0028) – Smashing finish to FY21, setting up for an even Smashi-er FY22…RM1.80 by 2024 (500% from here!)

Axcapital

Publish date: Wed, 25 Aug 2021, 08:56 PM

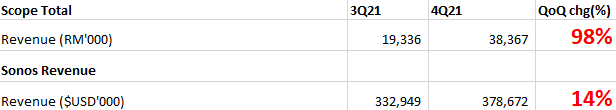

Scope reported 4QFY21 net profit of RM2.3m, bringing FY21 profits to RM6.8m, a massive 400% turnaround from FY20 net loss of RM29m! But the standout statistic to Axcapital was a 100% QoQ increase in revenue from Sonos from RM19m last quarter to RM38m this quarter!!! Although profits did not increase in a similar manner, Axcapital believes this was due to 1) MCO shutdown that escalated costs and 2) Start-up cost from the upcoming new capacity, which our channel checks suggest will start in Oct 2020.

Axcapital, in our previous article, has always pointed out that Sonos drives Scope. Sonos latest results showed a 14% QoQ increase in revenue, yet this translated to a 100% QoQ increase in revenue for Scope, which is a 7x revenue multiplier!! And all this is happening before Sonos has even fully transferred its manufacturing orders to Malaysia due to our Covid situation, which is improving day-by-day.

So, what might Scope look like 3-years out, you might ask? Well, Sonos has provided all the guidance. They are forecasting revenue of US$2.25bn in 2024, vs forecast of US$1.65bn in FY21, which is conservative given that they are having to revise guidance all the time every quarter, due to overachievement. That’s a 35% increase for Sonos, which means a whopping almost 7-fold increase for Scope to RM1bn revenue!

Using a conservative operating margin for Scope of 10% (vs. 14% now) and deducting income tax, we arrive at a potential net profit for Scope of RM80m in FY24. At a conservative sector P/E of 25x, this gives a conservative valuation of RM1.80 in 3 years time (500% upside to where we are now). So in-a-nutshell, Axcapital was pleased with this quarter’s results, the best is yet to come.

Perhaps Axcapital should make Sonos our top pick for the next 3 years instead of just 2022.....

Disclaimer: The views presented herin does not constitute a recommendation or solicitation to buy or sell the securities mentioned herein. All information and opinions expressed are subject to change without notice. The publisher may from time to time have a position in the securities mentioned. This publication is based on pulicly available information and any information from sources are believed to be reliable but we do not make any presentations as to its accuracy or completeness.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Axcapital's investment blog

Created by Axcapital | Oct 17, 2021

Created by Axcapital | Sep 25, 2021

Discussions

Thanks hello_world for your question. In my 25 years of experience covering manufacturing, prospectus only lists end-date full completion. Manufacturing capacity comes on gradually, and our channel checks suggests that the first phase should come on by late this year.

2021-08-25 21:36

Ax Capital, I'm already in Scope since 24 sen . Agree with you on the above points. Which other potential multi baggers do you like the look of other than Scope?

2021-08-25 23:26

Hi Powerplay666, I have not found one at the moment as multi bagger candidates don’t come easy. But we are always searching for them among the small cap universe in Malaysia.

2021-08-26 07:25

Hi, Just wondering how you calculate the FY24 net profit margin is 80mil? I look at EMS margin are generally 6% to 10%. Given on high side 10%, it need to hv annual revenue of RM800mil. Meaning Scope needs to increase revenue 8x or more.

2021-08-26 07:34

Hi KingKong_Doll, yes Scope might achieve revenue of RM800m or more, which was explained in the paragraph before that. For additional dollar of revenue that Sonos earns, Scope's revenue has increased 7x. So Scope is already on track to hit RM160m in annual revenue next year, based on the current quarter of about RM40m (x4 quarters). A 7x increase from RM160m, will be over RM1bn in the in 2024, if Sonos hits its sales target.

2021-08-26 17:18

Hi @thesteward, Sonos is indeed a darling stock among the top analysts in the bulge bracket firms in USA like Morgan Stanley etc. I am personally an "Old school" hi-fi enthusiast and Sonos has indeed disrupted the industry in a big way. Axcapital believes that Scope is an excellent candidate to ride on the coattails of Sonos' current and future success.

2021-08-26 21:42

Why not FPI? Same industry, with stronger shareholders and already making $$$

2021-09-03 14:49

hello_world

Where u get the information that new capacity is ready on Oct 2021? The new plant is expected to be completed on Dec 2023

2021-08-25 21:12