Muda Holdings Bhd

LimKL1

Publish date: Tue, 11 Dec 2018, 03:52 PM

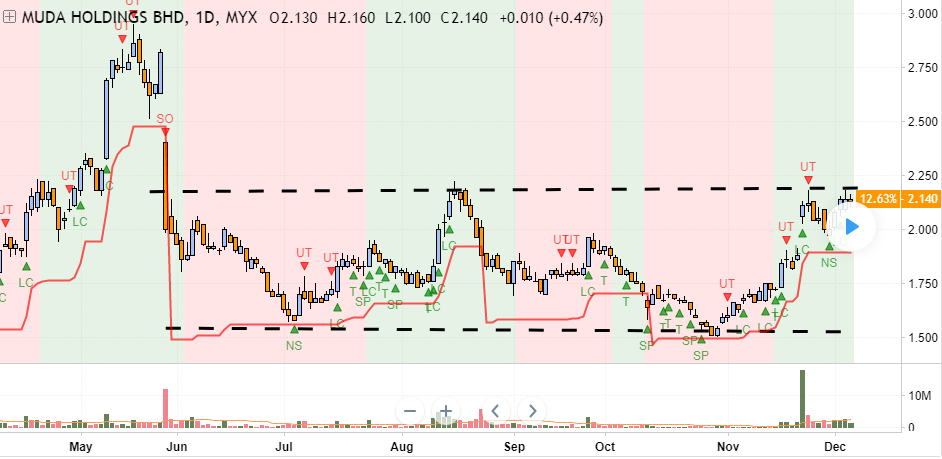

Based on the daily chart , Muda Holdings is still moving in accumulation stage. Based on Volume Spread Analysis, we spotted the Smart Money is buying slowly at the support level . Below are the signals of accumulation by Smart Money:

1. Price immediately moved sideways after the Sell-Off bar with high volume indicating the end of distribution

2. Volume getting lower on the 2nd bottom at support level (RM1.52)

3. Lots of narrow spread bar with low volume . Smart Money is buying slowly at the bottom without pushing the prices up.

4. Lots of hidden potential buying at the support level . As spotted in the chart (Spring, Test and LC )

However, based on today chart (6 December), price still failed to break above the resistance level . Notice there is a sign of weakness (UT) which indicating seller still in the market. Once Smart Money spotted sellers at the resistance, they might avoid the price level. Smart Money won’t absorb this supply at higher levels. This is why we often saw shakeouts and whipsawing in the accumulation stage because the cost is lower to buy at support level .

Price is likely to pullback to support level , traders can look for Shakeout signals for low risk trade. Example of Shakeout signal Spring.

Send us your preference stock to review based on TradeVSA chart by comment at below.

Disclaimer

This information only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

celaw0412

Hi, mind to share updated analysis?

2018-12-17 08:24