How Hong Kong Began - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 08 Sep 2019, 11:00 AM

My main purpose of writing this piece is to remind the Hong Kong protesters that their colonial masters sold opium to poison their forefathers.

I remember the British had an opium sale outlet near my house along High Street, Kuala Lumpur when I was a boy in the early 1940s. The photo below shows that the British was producing opium in India which was a British colony.

The biggest market for opium was China. When the Chinese resisted, Britain declared 2 wars and the Chinese lost in both wars.

The First Opium War 1839-1842, also known as the Opium War or the Anglo-Chinese War, was a series of military engagements fought between the United Kingdom and the Qing dynasty of China over the right to sell opium in China.

Under the Treaty of Nanking, Hong Kong was ceded to Britain.

The Second Opium War 1856-1860, also known as the Second Anglo-Chinese War, in which the Chinese also lost.

Under the treaty of Tientsin, Kowlon was ceded to Britain.

The photo below shows some of the Chinese killed by the British soldiers.

How I started investing in the HK stock market

In 1983 when China gave notice to regain the sovereignty of Hong Kong, the stock market crashed. There were so many cheap sales. I found the best share to buy was Hong Kong Realty and Trust (HKRT). It was controlled by a wealthy Jew called Willoch Marden. Just before the crash, the company sold a big office building and the shares were selling at HK$ 13.60 each. During the crash it was selling at HK$3.60 each and it had more than HK$ 10 cash per share.I used all my funds to buy HKRT.

At that time, all I needed was bravery and willing to take risk. Being a contractor, I had been taking risk all the time to under take large construction contracts. Contracting is always a risky business. That is why there are so few really profitable listed Contracting companies.

Fortunately, as soon as China offered 50 years extension to the British, the market rebounded and HKRT shot through the roof. I managed to sell all my holdings at above HK$ 14 each. I was so successful that within 3 years I managed to buy 46% of a median size stock brokering company called Kaisar Stocks & Shares Co. Ltd.

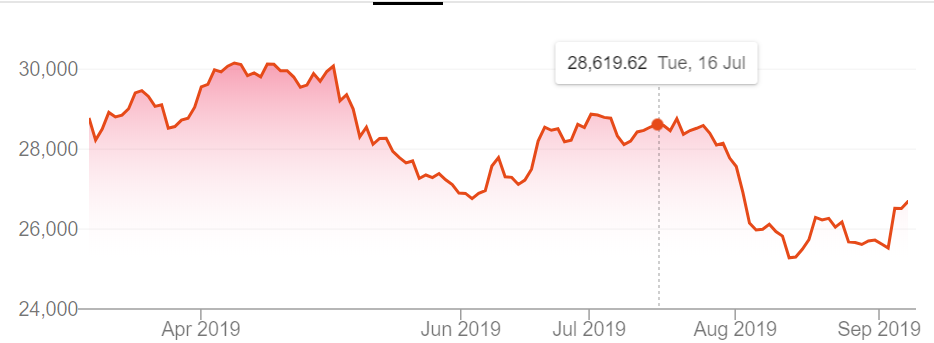

In view of the prolong protest there must be a lot of cheap sales. The Hang Seng index chart is showing the stock market is dropping and I will not take the risk to buy any stock in view of the bleak future of Hong Kong.

About half of the 50 years extension of 1 country 2 systems have passed and I do not think China will give another 50 years extension. In view of this, property price should be dropping continuously. Moreover, Hong Kong does not have manufacturing industries and China does not need to export its goods through HK because China has a few nearby ports.

The HK protesters should not forget their origin and how their colonial masters sold opium to poison their forefathers. They must realise that they are actually ruining themselves economically.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...