US bipartisan approved US$ 1 trillion bill for infrastructure construction - Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 13 Aug 2021, 09:08 AM

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Apr 30, 2024

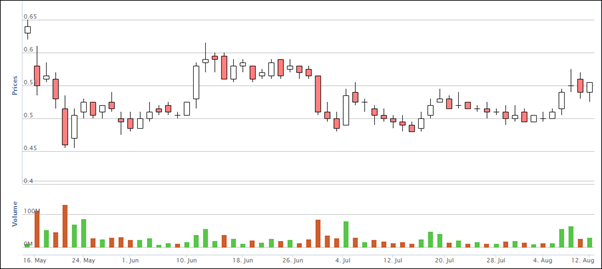

As shown on the chart below, Sendai has been dropping in the last few days. Today all shareholders must be wondering to sell, hold on or to buy some at a cheaper price.

Created by Koon Yew Yin | Apr 22, 2024

Eversendai Corporation Berhad made a remarkable comeback in FY2023, reporting strong profit growth. Here are the key highlights from their financial performance:

Created by Koon Yew Yin | Apr 22, 2024

Sendai price chart below is showing its price trend reversal. It is hitting a record high.

Created by Koon Yew Yin | Apr 18, 2024

After the stock closed yesterday, KSL announced its 4th quarter EPS which is 40.76 sen and its net tangible asset (NTA) backing of Rm 3.65. Its profit increased by 230% more than last year.

Created by Koon Yew Yin | Mar 29, 2024

Currently Sabah Government does not know that solar panel produces the cheapest electricity???

Created by Koon Yew Yin | Mar 23, 2024

During my life time I saw every Prime Minister being replaced by another politician for one reason or another. Dr Mahathir managed to stay the longest time of 22 years.

Created by Koon Yew Yin | Mar 04, 2024

All property developers have just announced their annual profit for 2023. All of them reported increased profit.

Created by Koon Yew Yin | Mar 04, 2024

Although my writing of this article sounds boastful but I feel that it is important to keep this record for posterity. Engineers play a pivotal role in shaping our modern world.

Created by Koon Yew Yin | Mar 01, 2024

What can KSL do to benefit shareholders? I hope all the shareholders will read this article so that they can attend the coming annual general meeting to vote out those directors who are seeking re...

Created by Koon Yew Yin | Feb 29, 2024

After the stock market closed, KSL announced its 4th quarter ending Dec 2023 EPS of 12.74 sen. The total is 40.76 sen for 4 quarters. Its total EPS for 4 quarter ending 2020 was only 17.8 sen.

Discussions

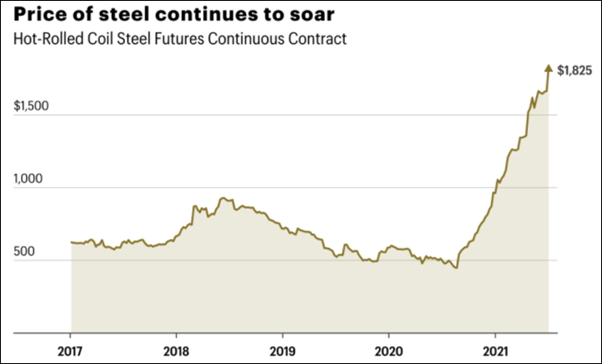

Very good news for Steel and especially long steel billets and bars by Masteel

But still need time for Congress approval

More imminent is the bull run time for Palm oil

first and foremost

2021-08-13 13:27

Rubbish mah!

If USA 1.2 trillion go ahead, the requirement of steel will be source from USA steel manufacturers mah!

All of u R dreaming that USA will source steel from Leon Fuat, Masteel, Hiap Tek...it is just all rubbish....the steel demand of USA will come to msia for sourcing loh!

2021-08-13 14:26

What rubbish !!

Who are you to condemn others.

There is not enough steel products for US to buy if 1.7 trillion USD is spend to purchase them.

Once China stops selling steel products below cost, all steel stocks listed in KLSE will make good profit.

Do not think that you are the only guy knows to invest in KLSE.

2021-08-13 15:27

Posted by ValueInvestor888 > Aug 13, 2021 3:34 PM | Report Abuse

Msian steel companies also exported steel to US currently, though quantities are small. Can become big if demand increases.

2021-08-13 15:45

Posted by ValueInvestor888 > Aug 13, 2021 3:36 PM | Report Abuse

Currently, Ann Joo, Eastern Steel, Masteel exported a lot to China due to great demand there. You check with those worked in steel companies you will know lah. Must do homework before investing

2021-08-13 15:46

msia kicimiao steel exporter...most of the time importer mah!

Export to china given mah....bcos eastern steel own by china mah....also kuantan port very near china loh!

Posted by ValueInvestor888 > Aug 13, 2021 3:34 PM | Report Abuse

Msian steel companies also exported steel to US currently, though quantities are small. Can become big if demand increases.

Posted by ValueInvestor888 > Aug 13, 2021 3:36 PM | Report Abuse

Currently, Ann Joo, Eastern Steel, Masteel exported a lot to China due to great demand there. You check with those worked in steel companies you will know lah. Must do homework before investing

2021-08-13 15:49

OTB

Post removed.Why?

2021-08-13 09:24