Investor diary

NTPM Bhd - Turnaround Completed, Massive Growth Soon?

mengteck

Publish date: Thu, 01 Oct 2020, 03:57 PM

NTPM products needs no introduction. They make tissues & diapers.

It's an essential product that benefited from the heightened awareness on hygiene.

It's an essential product that benefited from the heightened awareness on hygiene.

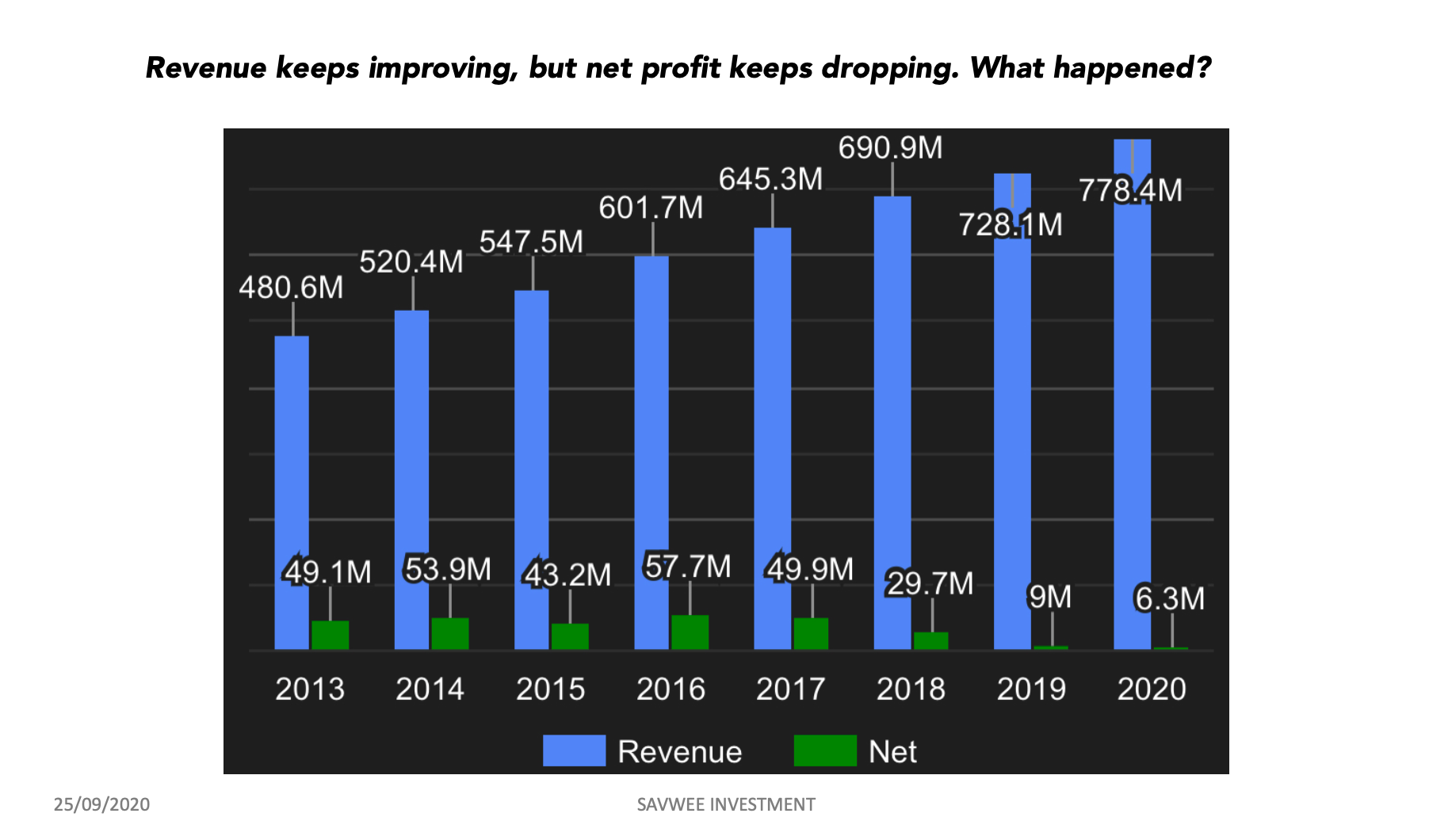

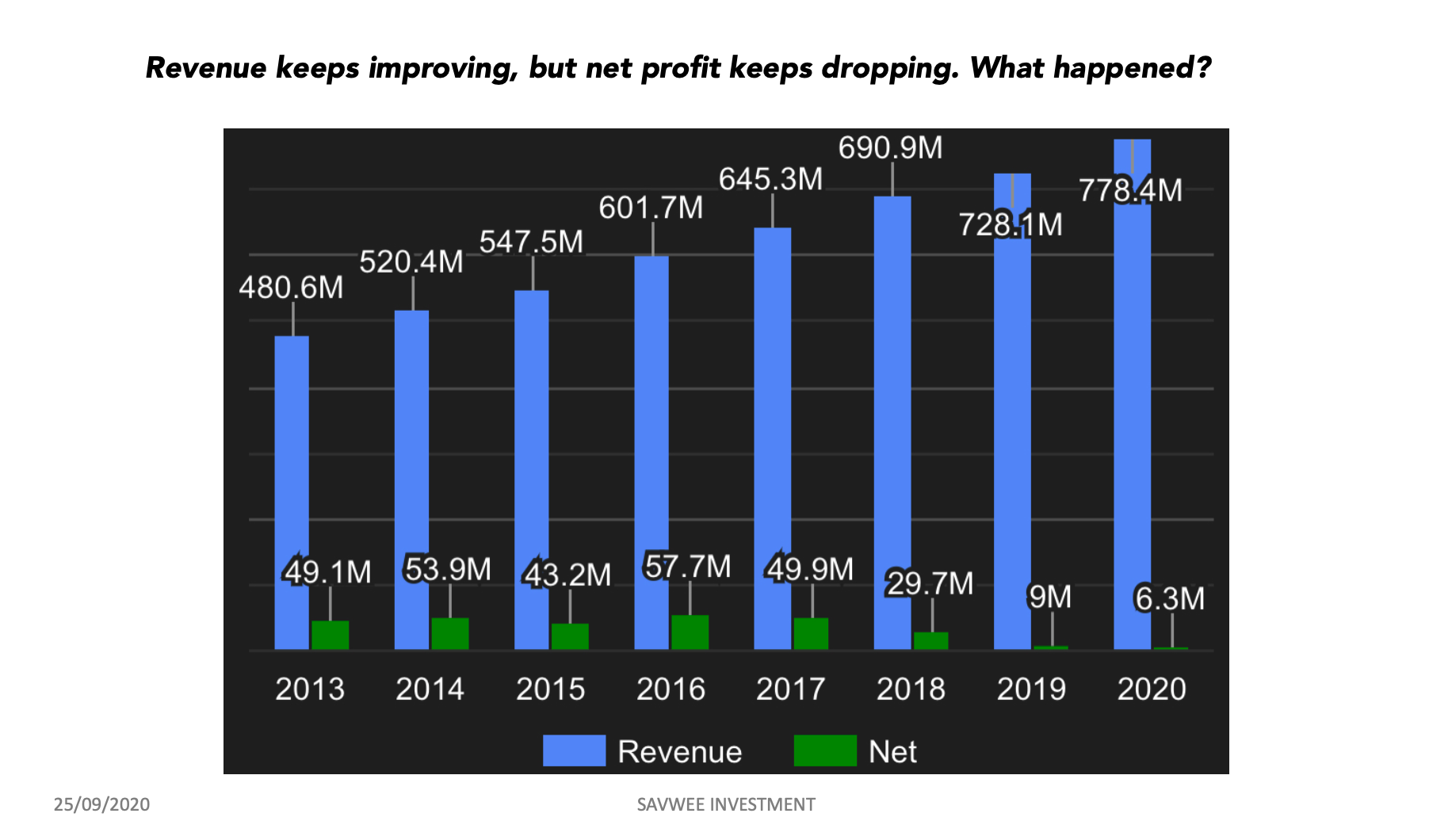

Hence, the revenue has been growing steadily.

A major part of recent revenue growth comes from Vietnam.

If you look at their revenue, it's been growing steadily.

Unfortunately, the profit has been dropping continuously over the past few years.

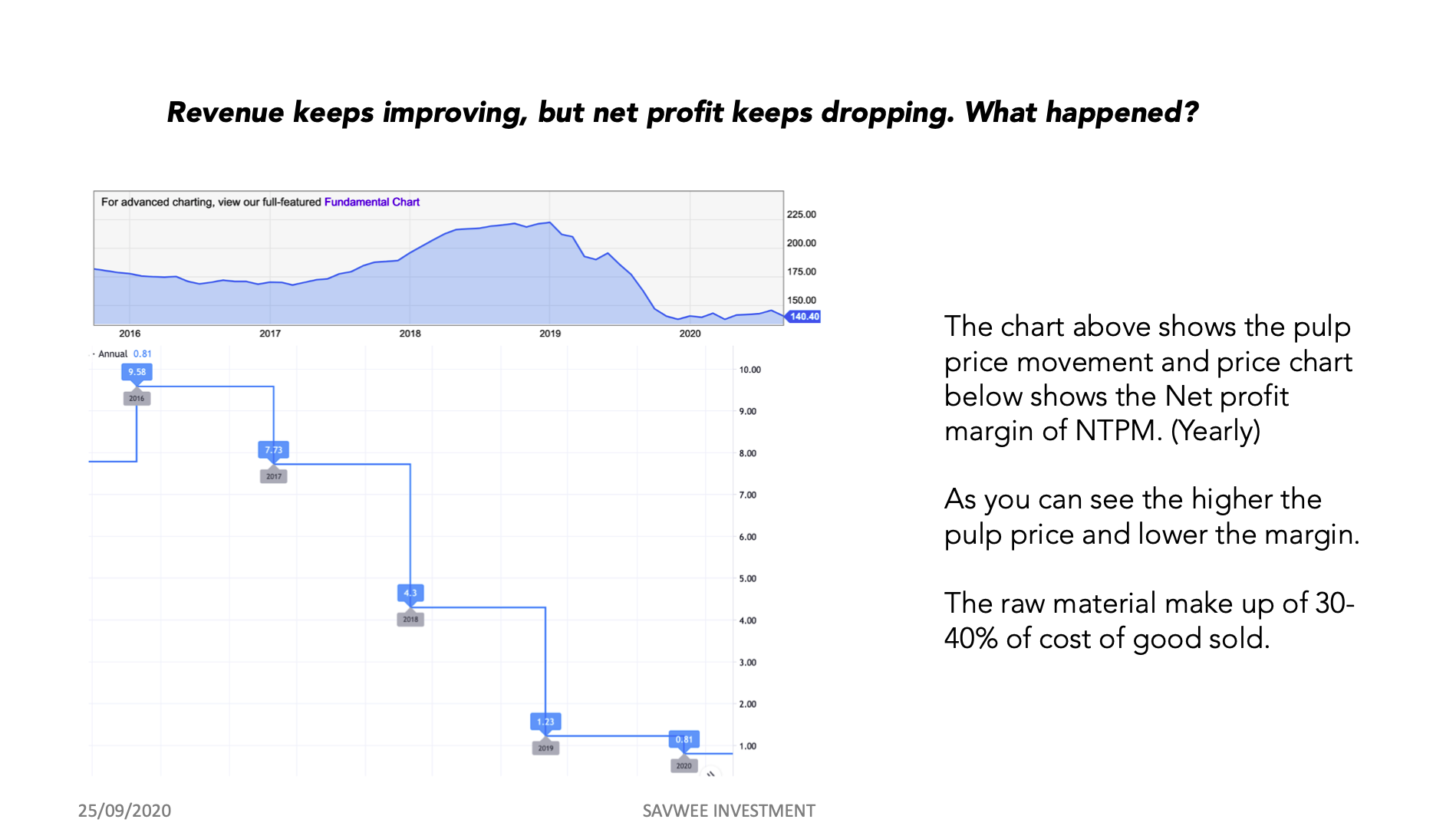

This is because their raw material price shot up and at the same time, they were ramping up their Vietnam operations that dragged down entire group's margin.

A major part of recent revenue growth comes from Vietnam.

If you look at their revenue, it's been growing steadily.

Unfortunately, the profit has been dropping continuously over the past few years.

This is because their raw material price shot up and at the same time, they were ramping up their Vietnam operations that dragged down entire group's margin.

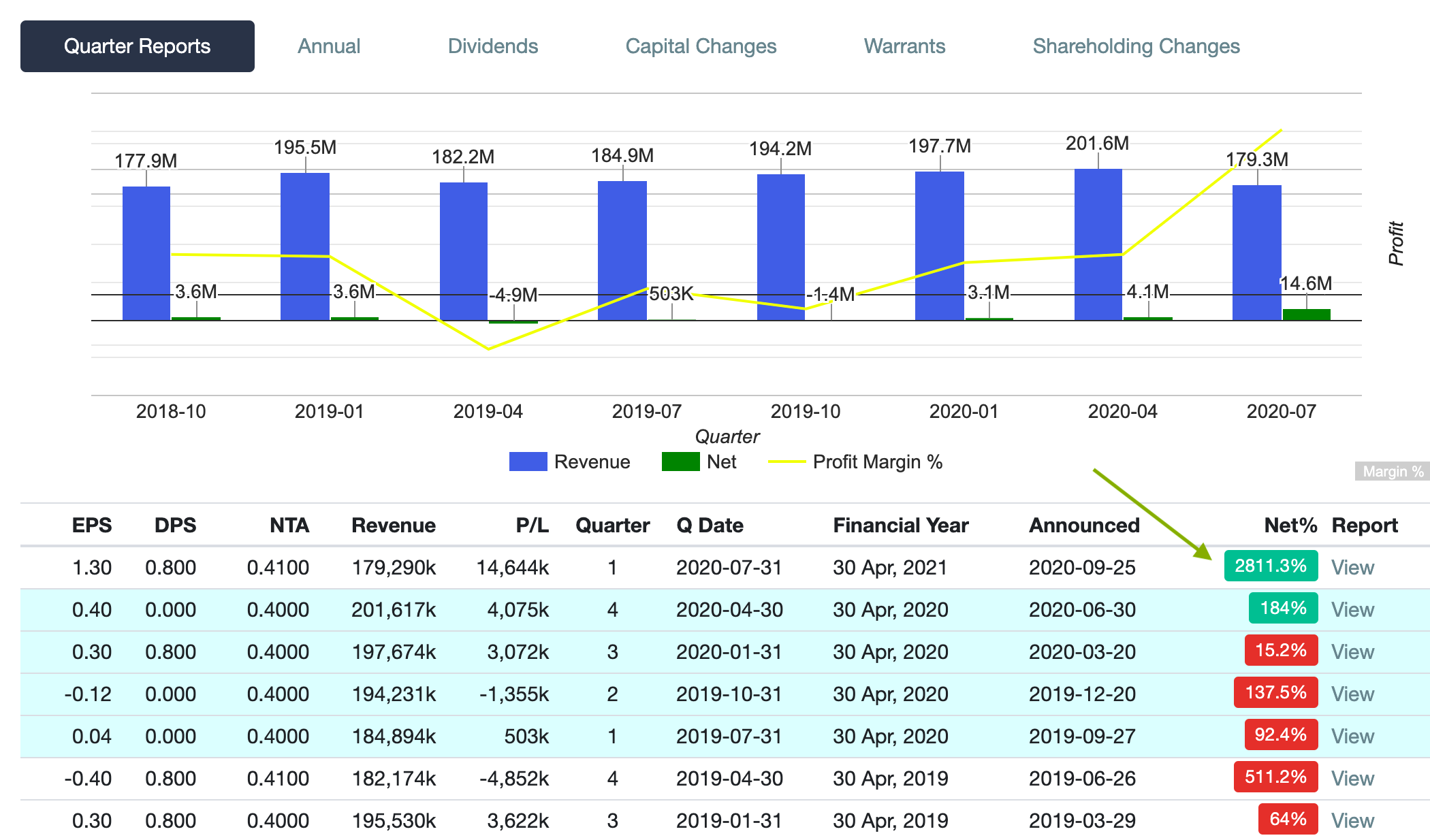

Fortunately for them, the raw material price crashed in the past few months beginning 2020.

In fact, it went to all time low.

This means, without the Vietnam losses, the company should expect to make record profit this year.

So will the Vietnam operation breakeven soon?

This is what we understand from attending NTPM Agm :

In fact, it went to all time low.

This means, without the Vietnam losses, the company should expect to make record profit this year.

So will the Vietnam operation breakeven soon?

This is what we understand from attending NTPM Agm :

NTPM made investment of RM50 mil 2 years ago to expand its capacity. A major focus is in Vietnam.

They commissioned 3 new paper making machines, when fully utilised, targeted to bring 300 million in revenue.

2 out of 3 new paper making machines, are in Vietnam, these will be mainly producing products with Virgin pulp.

The last one is in Penang.

Vietnam plant operating at 40% now and may scale to 90% in 2 years (by April 2022)

Vietnam plant lost 30 mil last year, target to breakeven this year.

They were loss making in Vietnam due to aggressive expansion.

In fact, they have the biggest distribution in South Vietnam now.

In short, the worse is probably over and from now on, given similar raw material cost, NTPM is geared for massive profit growth.

They commissioned 3 new paper making machines, when fully utilised, targeted to bring 300 million in revenue.

2 out of 3 new paper making machines, are in Vietnam, these will be mainly producing products with Virgin pulp.

The last one is in Penang.

Vietnam plant operating at 40% now and may scale to 90% in 2 years (by April 2022)

Vietnam plant lost 30 mil last year, target to breakeven this year.

They were loss making in Vietnam due to aggressive expansion.

In fact, they have the biggest distribution in South Vietnam now.

In short, the worse is probably over and from now on, given similar raw material cost, NTPM is geared for massive profit growth.

Management has said that there will be no more heavy capex in the coming years, now focus on selling and increase sales to fully utilise new capacities.

One shareholder was frustrated that profit for past few years have been down, management said it’s mainly due to heavy investments & high raw material cost, now that the investments are completed and starting to generate return and also raw material cost have bottomed, management is optimistic old glory time & high dividend like those in the past should return. Pulp prices came down a lot and have reached “rock bottom”, Q3 & Q4 finished using old inventory, new inventory are low cost.

Hence, the Q1 profit became so good.

One shareholder was frustrated that profit for past few years have been down, management said it’s mainly due to heavy investments & high raw material cost, now that the investments are completed and starting to generate return and also raw material cost have bottomed, management is optimistic old glory time & high dividend like those in the past should return. Pulp prices came down a lot and have reached “rock bottom”, Q3 & Q4 finished using old inventory, new inventory are low cost.

Hence, the Q1 profit became so good.

Expected low material cost trend to continue, due to lower newspaper usage & stationery usage.

The company made ~50mil in net profit in 2016 when the pulp price was as low as now, back then, the revenue was only 600 mil. Currently, the revenue grew by 20+%, if the company can make similar net profit margin, that would mean a profit of 60 million. Which is logic if we project the current quarter for the whole year. Currently the PE ratio of the company based on 60 mil net profit is only ~11.

The average PE of this company is 16.

This means the stock could go up to ~RM1 in a bull case if the profit can return to that of the past.

This is without factoring any new profits from Vietnam.

If they can indeed fully utilise new capacity and generate another RM300 mil in revenue, that would bring the revenue up from 700 mil to 1B. Management is targeting this by end of FY22 which is April 2022. (Not a guarantee, many things can happen)

Do you think NTPM can go back to RM1 again?

This is without factoring any new profits from Vietnam.

If they can indeed fully utilise new capacity and generate another RM300 mil in revenue, that would bring the revenue up from 700 mil to 1B. Management is targeting this by end of FY22 which is April 2022. (Not a guarantee, many things can happen)

Do you think NTPM can go back to RM1 again?

If you enjoy this article, go ahead and follow our FB page for updates on market outlook and weekly live sharing :

https://www.facebook.com/savwee.my

If you want a more detailed version of this report and also full coverage of what we learnt from the company AGM, you can request the pdf version for free if you help share this article on Facebook, or comment "Thank you for the sharing!". Once you've done that, just take a screenshot and send it to my assistant Yi Kai at 016-420 0884 (Whatsapp) and he will send you the report.

Disclaimer & Disclosure : I must share with you that I've bought some shares of this company last week. This is also not a recommendation to buy/hold or sell this share. I may sell this share anytime without notice. I've tried to provide the most accurate information but sometimes human error exists. If you notice any error with the article, please notify me at admin@savwee.com

Disclaimer & Disclosure : I must share with you that I've bought some shares of this company last week. This is also not a recommendation to buy/hold or sell this share. I may sell this share anytime without notice. I've tried to provide the most accurate information but sometimes human error exists. If you notice any error with the article, please notify me at admin@savwee.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|