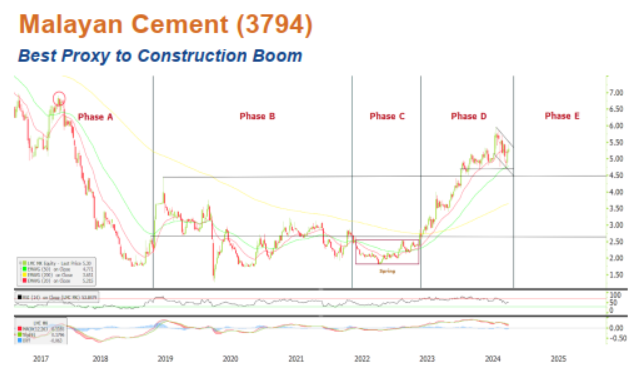

Malayan Cement (3794) - Best Proxy to Construction Boom

MercurySec

Publish date: Thu, 26 Sep 2024, 11:01 AM

Stock Highlights

Vibrant construction activities. MRT Corp’s recent public display for the MRT 3 Circle Line signals a potential revival of the RM45bn mega project, adding to other existing large-scale infrastructure projects like the Penang LRT, Penang Airport expansion, and the speculated KL-Singapore High-Speed Rail. These developments are expected to further boost the construction sector, which has also seen strong job flows related to data centres and semiconductor industry from the private sector.

Cement players to benefit. MCement likely to benefit the most as it is the largest cement producer in Peninsular Malaysia, holding a 60% market share. The current situation is quite reminiscent of the 2011-2013 period when large-scale infrastructure projects (such as KLIA2, LRT extension, and MRT1) drove significant re-ratings of cement players. Although the sector subsequently underperformed due to price wars resulting from massive capacity expansion, we argue that current industry dynamics are more favourable now following the merger between Malayan Cement and YTL Cement since 2019. The recent strengthening of the Ringgit would also help a lot to lower USD-denominated key input costs for cement production, such as coal.

Still has leg to run. Based on consensus forecast (which we think has room for upward revisions), MCement is currently trading at 18.4x fully-diluted CY25 P/E (dilution from ICPS). We believe this has yet to fully reflect the sector’s upturn and premium for being Malaysia’s largest cement producer. Historically, MCement’s valuation has traded up to 20-22x forward P/E (+1 SD) during previous upcycles. With positive newsflows from the construction sector and strong earnings delivery, we believe it is just a matter of time before the stock re-rates further.

Classic Wyckoff accumulation pattern. The stock is in the final stages of Phase D, with resistance breached and increased volume, indicating a potential move to Phase E for a stronger uptrend. The current support level is RM4.71, a critical zone where the stock has bounced back multiple times. Additionally, a bull flag has formed, suggesting further bullish momentum. The first resistance at RM5.47 coincides with the bull flag’s resistance, and a breakout here could lead to a sharp rally. On the downside, a break below RM4.54 could trigger a correction to RM3.67, where high volume has previously locked in in this zone.

Source: Mercury Research - 26 Sept 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Mercury Securities Research

Created by MercurySec | Jan 22, 2025