开箱解读标叔的棋盘

metaverse

Publish date: Fri, 18 Oct 2024, 06:03 PM

标叔与李嘉诚一样,都是潮州硬汉子。坊间传言,李嘉诚有一位御用风水大师陈伯,曾建议他为了避免家族纷争,要将自己的商业帝国分割清楚,楚河汉界, 二分天下。深谙这个道理,标叔作为一位低调的商业巨子,似乎也在生前为家族遗产,未雨绸缪,居安思危,排兵布阵,像一盘精心策划的棋局。然而,这盘棋很扑朔迷离,表面上风平浪静,内里却耐人寻味。只知其一,不知其二 ,暗藏玄机。

第一个不解之谜:标叔花费毕生精力时间,日出东山,早出晚归,刻苦耐劳,靠自己一双手一点一滴一分一秒打拼回来的商业帝国,为什么竟然会没有接班人,后继无人?这个问题非常玩味,很难可以用常理来理解,只能说家家有本难念的经,一家不知一家难。清官难审家庭事。缘起缘灭缘终尽,花开花落花归尘。

昼夜交替,子承父业,三阳开泰,六六大顺,九九同心。李光耀传位李显龙,林梧桐传位林国泰。可是标叔本末倒置,一步一脚印,夕阳西照,人走灯熄,只留痕迹,不留业绩。人生兜兜转转,最后自己选择放弃自己一手千辛万苦打拼回来的江山,留给后人无限遗憾。一轮红日向西斜,只能感叹人生如梦,回头一看原来是一场空。

虽然标叔已经离世,但仔细分析不难发现,他曾经费尽心血布局操盘,为了要让大众银行稳定发展,确保没有任何人可以动摇它的根基。山管人丁,水管财。标叔好像举棋不定,未⼘先知,刻意回避传位后人的问题。宇宙万物,相生相克,要破局的终会破局。天有不测风云,人有旦夕祸福,人算不如天算。该来的,躲不掉;该去的,别纠缠!

亿万富豪吕正义,当年富甲一方的大马肯德基家乡鸡第一代掌门人,期货市场逢赌必赢的大玩家,可是晚年就是因为接班人问题而心灰意冷,最终选择放弃全马的经销权拱手转让给林玉静,并非如外界传闻是因为财务问题。成功企业家面对接班人的问题,不是外人所可以理解。长幼有序,有赢家,一定有输家。舍与得,鱼与熊掌,不能兼得。

标叔有四名子女,他们掌握着大众银行超过23%的股权(市值200亿马币),每个都是亿万富翁,富可敌国。但大众银行在标叔心目中,或许如他的“第五个孩子”,四名子女不可能可以随意收割套现。可是那些华尔街顶尖投资银行,只要你肯点头,他们一样有办法解套。标叔200亿马币的遗产,不是一般普通人可以抗拒的诱惑。是非成败转头空,青山依旧在,几度夕阳红。

七情六欲,人非草木。如果中了多多,成功集团说若干年后才可以拿钱,谁会有这个恒心耐力,永无止境的静观其变,痴心一片的默默等待?除非是老子,为无为,事无事,味无味。虎父无犬子。通过大众银行收购伦平(LPI)44.15%的股权,标叔的四名子女就能够打开缺口,合情合理,名正言顺,顺理成章地从大众银行那里及时套现17.2亿马币(也就是标叔遗产200亿马币的8.6%)。

可是话说回头,这个17.2亿马币远离市价太远,实在低的有点离谱。不看僧面也要看佛面。大众银行的老臣子这样“刻薄”对待标叔的后人,会不会有反效果,会不会太没有人情味,倚老卖老?这个17.2亿马币会不会成为一个心结,埋下伏笔,双方一拍两散,有待观察。给外人感觉很像是老臣子的下马威,要标叔的后人知难而退。所以第二个不解之谜:来日方长,为什么标叔的四名子女那么急着要套现伦平的股权?

人无千日好,花无百日红,早时不算计,过后一场空。有心栽花花不开,无心插柳柳成荫。乍眼一看,老臣子的西装格调,十年如一日,简简单单,稳重踏实, 黑白分明。郑丽贤的巴黎顶级时装,走在时尚尖端,色彩缤纷,五花八门。相比之下,老臣子的品味似乎有点不对调的感觉。人生百态,八仙过海,各有千秋。长话短说,就是有点那种半梦半醒,朦朦胧胧进入四维空间,时空错乱,时间倒流的感觉。

树欲静而风不止,子欲养而亲不待。李光耀把新加坡管理得井井有条,可是管不好家人。三个儿女为了芝麻绿豆的小事翻脸,水火不容。不能说谁对谁错。仁者见仁,智者见智,各有所见,各有所得。一朝天子一朝臣。同样的道理,老古板标叔(和那班忠心耿耿的开国老臣子)认为合理的安排,他的四名子女不一定会认同。不同时间,不同对策。不能一本通书读到老。洋人称之为代沟(generation gap)。

大众银行以低于市价20%的价格收购伦平,按理来说应该是一桩好买卖,市场也应该看涨。然而,股价却反而走低。原因其实不难理解。大众银行并非一家投资公司,突然无端端动用17.2亿马币购买伦平股权,却没有话语权。这笔买卖对基金经理而言,只是账面收益(paper gain),没有实质收益,对核心业务没有帮助,多此一举。如果这笔钱用来派发股息,约有2%的回报率(以大众银行的市值875亿马币来推算)。以此类推,倒不如趁现在还有傻瓜挂单追高买进伦平,大众银行何不干脆索性将计就计,乘胜追击,在公开市场抛售伦平给那些傻瓜呢?夜长梦多,以绝后患,一举两得。要不然,结局就会像云顶收购龙马那样,脚踏俩条船,两头不到岸,一去不回头。

只要大众银行不全面掌控伦平,其股价就会一直面临卖压。最后逼使大众银行的管理层,不计成本,拿下伦平的控制权,大刀阔斧,优化人力资源管理,全面降低运营成本,然后易名伦平成为大众保险,成为大众银行旗下的独资公司。大众银行职员分工合作,九九六,出去跑业务卖保单。要不然,对大众银行的股东来说,伦平只是摆设在门口外一个美丽昂贵花瓶。未来的结局是什么,没有人知道。溪云初起日沉阁,山雨欲来风满楼。其实大众银行和标叔的四名子女都是这场交易的大输家,两败俱伤。因为以伦平净资产来计算,大众银行买贵了75%。可是以伦平市价来计算,标叔的四名子女又卖少了20%。闭月羞花,披星戴月,一头雾水。各说各有理,对错只是一念之差。

因此,当下的平静只是暴风雨前的宁静。随着标叔的去世,大众银行的股权结构变得非常复杂,太多变数,投资风险也随之上升。标叔留下的这盘棋,让人看不透,玄之又玄。以史为鉴,事与愿违。历史往往与人们的期望背道而驰。标叔越是试图要回避的事情,越有可能会发生,而且会有惊人的爆发力。因为挤压力度越大,反弹力度会越强。

三元九运,北斗七星的右弼星主管20年大运(2024到2043年)。右弼星五行属火,银行股五行属金,火克金。以玄学规律来推算,大众银行前景,夕阳西照,寒风冷夜,追星望月,秋雨绵绵,一叶知秋。

标叔在2022年12月12日与世长辞,当天大众银行收市价4.4马币。成也萧何败也萧何。标叔可能和李嘉诚一样,背后有高人指路。一命二运三风水,十个算命先生,除了陈伯,九个都会说李嘉诚其实没有大富大贵之命。

依书直说,以风水八卦来推算,大众银行不应该有这样大的成就。如同对面阿马银行一样(Arab-Malaysia Bank 创办人四眼仔枪杀事件,一马公司被罚款28亿马币,澳新银行贱价清仓出货,谈到头皮都发麻, 阴风阵阵,太巧了吧!),因为大众银行的玲珑宝塔的龙脉旺气被国油的双子塔镇压。道生一,二生三,三生万物。其实,大众银行的标识是一个八卦图,卦中有卦,天地人,三重卦。万物生于有,有生于无,周而复始, 生生不息。太极生四象,四象生八卦。如果大众银行的股价跌破这个“四四”价位,是清仓出货的信号。因为这个分水岭价位或许是标叔冥灯带路,回光返照,挥手告别,信不信由你。十年弹指一挥间,恩怨情恨皆是缘。

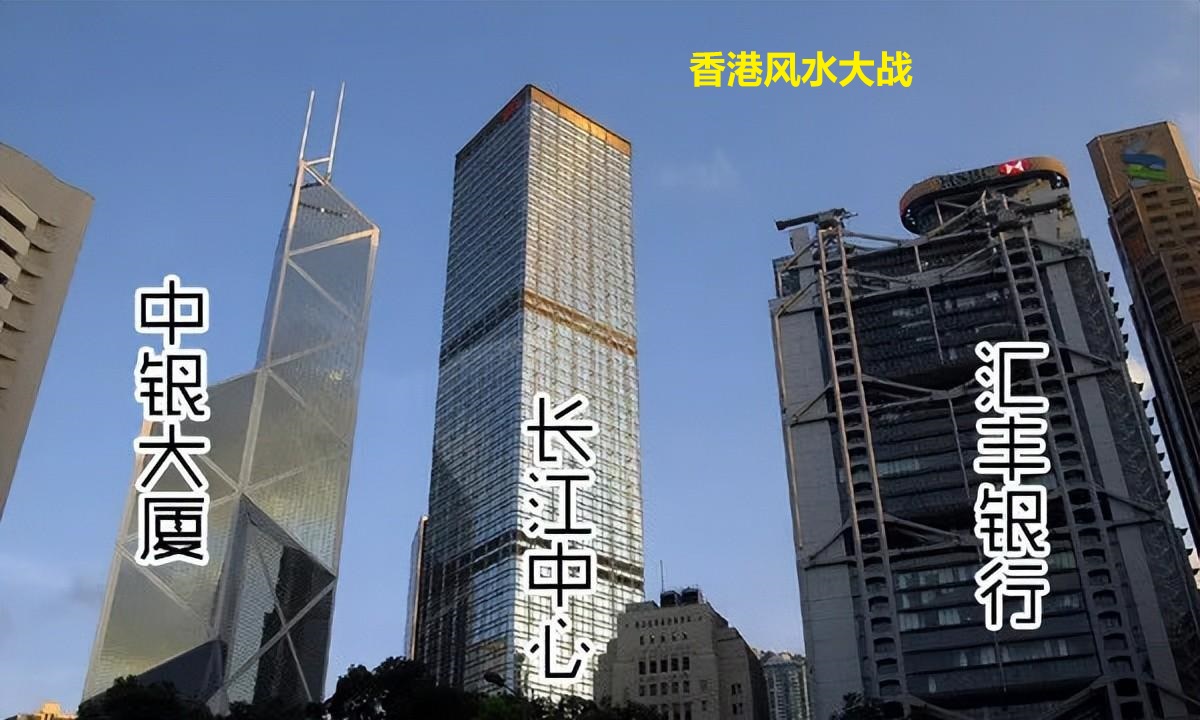

香港中银大厦是一把银蛇利剑,为了化解杀气,汇丰银行在顶楼架起双炮。可是有一年台风把大炮吹歪对准渣打银行位置,搞到渣打高层急忙发律师信请求老友鬼鬼的汇丰银行立刻把大炮移回本位。香港首富李嘉诚的长江中心,夹在中间,犹如四面铁盾,藏风聚气,巧妙地避开了这场风水大战。

原本死气沉沉的百六间(Pak Luk Kan)是一个风水死角。应该是有高人暗中布局排阵,画龙点睛,扭转乾坤,将这个鸟不生蛋的死城,变成一个充满天地灵气,日月精华,宇宙能量的风水格局,神龙摆尾,藏风纳水,如鱼得水。成功广场是神龙前脚,汇丰艾芬是神龙后脚,106塔是龙尾,隆塔是龙珠。山不在高,有仙则名。水不在深,有龙则灵。左青龙,右白虎。TRX 化身东方苍龙,百六间瞬间风生水起,顺风顺水,KLCC,凶多吉少。

时势造英雄,开国功臣潘俭伟功德无量,最后却被忘恩负义的火箭高层一脚踢进冷宫,打完斋不要和尚,岂有此理。如果没有潘俭伟,就没有今天高高在上的行动党,TRX 或许早已成为一个偷龙转凤的国际笑话。

历史一周800年,风水一运20年。和久必战,战久必衰, 衰久必亡。无风不起浪,无巧不成书。历史长河,江山如画,人生如梦。如果潘俭伟是明朝国师刘伯温,陆兆福就是朱元璋。如果袁怀绍是袁世凯,凯理是不是大马版孙中山,有待观察。两人名字太玄妙,像是背后有高人暗中布局,【袁凯双雄】,扭转乾坤,改变历史,巫统和土团党离久必合,大势所趋。

如果老马是西楚霸王项羽,阿吉哥就是汉王刘邦,都是历史大咖。反观伯拉, 慕爸爸,海龟叔叔,华哥,阿克马都不是历史巨人,只是过客,过眼烟云,对国运影响不大,不值一提。明末清初,满洲人是少数民族,可是掌握政权,搞到汉人水深火热,民不聊生。当前局势,似曾相识,很像当年清廷废除科举考试,国库空虚,财政危机,平民老百姓度日如年,苦不堪言。依此类推,民主制度,一人一票,【袁凯双雄】可能是历史关键英雄人物。

历史原来不是巧合,风水原来不是空谈。说到一身冷汗,鬼影幢幢,时间人物背景,完全吻合,对号入座。长话短说,其实风水最高境界就是要人类懂的在正确时间站在正确位置,吃饭时间吃饭,睡觉时间睡觉,人生本来就是那么简单。

More articles on 博傻理论

Created by metaverse | Dec 02, 2024

According to probability theory, a random variable with any natural occurrences, like coin tossing, will, if played long enough, produce a normal distribution (Bell Curve) with 50% heads and 50% tails

Created by metaverse | Nov 29, 2024

According to academic studies, consistently beating the index is challenging.

Created by metaverse | Nov 12, 2024

According to SC, no person (including 官有缘,陈剑老师,冷眼,夜月投资) can give unlicensed advice without a license from SC, so you are reading this article at your own discretion...

Discussions

The proposed takeover of EONCap by HLBB has all the makings of a replay of the hostile takeover of Southern Bank Bhd (SBB) by the CIMB Group back in 2005.

industry observers say there have been indications that HLBB isn’t willing to pay anything above 1.3-1.5 times price-to-book value (PBV) for EONCap, based on its rather low return on equity (ROE) of 4.2% and return on assets of 0.3% in FY2008.

Thus, based on its 2008 book value (BV) of RM4.62, this works out to between RM6.15 and RM7.10 a share. EONCap’s projected BV for 2009 is RM5.05 — which means that the price that Quek may be willing to pay is anything between RM6.76 and RM7.50 a share.

https://theedgemalaysia.com/article/cover-story-quek-prowl

2 months ago

metaverse

Malaysia’s Southern Bank rejects hostile offer

The robust defence from the country’s second-smallest bank sets the scene for a highly charged takeover battle, the largest in Malaysia’s financial sector to date and one that could result in one of the biggest deals in south-east Asia this year.

Southern Bank’s blunt statement to the stock exchange did not identify its potential alternative partner. But it said it had asked the central bank for permission to enter into negotiations, a local requirement.

“The board believes an alternative takeover partner will be available that will maximise value to our shareholders,” Southern said, describing the would-be partner as a “major local financial institution”.

Hong Leong Bank and Public Bank have been widely touted as possible partners for Southern, which said last week it was looking for a “white knight” suitor after months of talks with BCH failed to yield a friendly deal.

https://www.ft.com/content/f0b07fc0-9d4a-11da-b1c6-0000779e2340

2 months ago