To Mr Koon Yew Yin: Why You Should NOT Miss MTAG?

groverr

Publish date: Thu, 17 Oct 2019, 08:36 PM

I've come across that the prominent investor Mr Koon Yew Yin is actively looking for investment ideas. In this article, I will not only share with you on how it has fulfilled ALL your stock selection criteria, but also some facts for you to digest. I will be writting down some facts but not opinion - to avoid any bias opinion in this write up.

Who is MTAG Group Berhad?

Answer: Label Printing and Material Converting Expert

Basic Info of MTAG:-

Current Price as of 17 October 2019 of MTAG: RM0.485 (below IPO Price of RM0.53)

P/E Ratio: 7X

ROE: 36%

To know more about what the Company is doing, please visit its website at https://mtaggroup.com/

Investment Criteria by Mr Koon:-

1. The company must report increasing profit for 2 consecutive quarters and its projected PE must be less than 10.

MTAG's financials:

Profit After Tax in FY2016: RM15.9 million

Profit After Tax in FY2017: RM22.6 million (+42% yoy)

Profit After Tax in FY2018: RM47.5 million (+110% yoy)

As MTAG is a newly listed company in KLSE, therefore, there was only one quarterly result which is available in Bursa. By looking at the financials above, it has shown an exponential growth of profit.

PE Ratio: Market Cap / PAT FY2019 = RM331 / RM47.5 = PER 7X now which is below your PE 10. However, the projected 1-year PER would be even lower should it continues to grow its profits.

Prospect of MTAG

First, we need to find out who are the main customers of MTAG. Four out of its five major customers are listed entities, namely, SKPRES, VS and ATAIMS and Venture Corp (listed in SGX). In order for MTAG to do well, its customers must do well. Let's see how's the share price performances of MTAG's customers:-

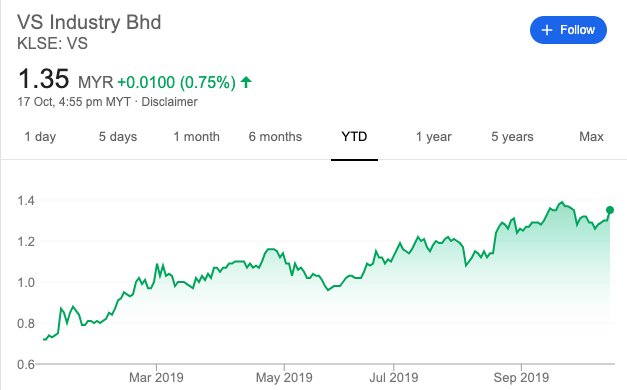

VS's Share Price Performance

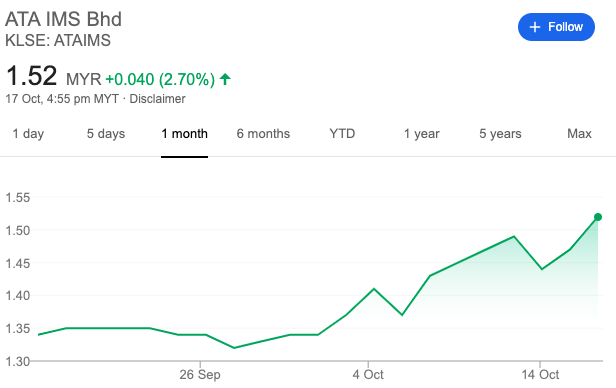

ATAIMS's Share Price Performance

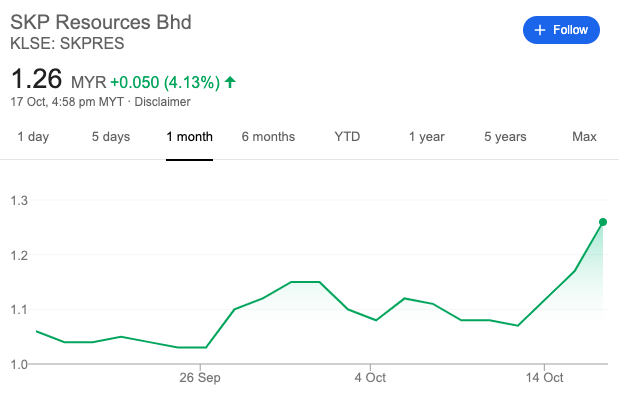

SKPRES's Share Price Performance

The share prices of MTAG's customers are on a strong uptrend, which hinting the business would be good. Hence, the business for MTAG is likely to be good. Should the share price goes on an up-trend just like its customers?

Pictures Speak Louder than Words

Last but not least, the current market cap of MTAG is about RM331 million. And the LIQUIDITY of this share is high, where you would not have any worry about liquidiity problem for both selling and buying. For example, today, the number of shares traded are more than 30 million shares, valued at more than RM15 million at current share price of RM0.485.

Disclaimer:

This is not a buy/sell call and you need to do your own homework to decide whether it is a good investment. For an undervalued stock with strong growth prospect, it shall go up with/without any presence of seasoned investors. Thank you.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

uncle koon will not buy new IPO stocks cos he don't know the history of the company

2019-10-17 22:48

Vs pe 15.8, skp pe 17 , aitms pe 17, fpgroup pe 20, greatech pe 25, istone pe24, mtag pe 7-10 only ? ? ?

2019-10-18 06:43

Birkin,

Don't you see it up 2.5c today?? I shout few days ago

I just take my profit as usual..

Go to Istone which is yet to touch 30c..

2019-10-18 17:23

Istone is doing the same business as Penta and Vitrox.

Automated test machine..

It is only 25.5c today..

I am scare to compare to Penta or vitrox because rm4. 8 for penta or rm8 for vitrox..

Do you know how scary of my earning if rm4. 8..

But be realistic...

37.5c to be our destination before hitting rm1. 00!

2019-10-18 17:33

Sometimes earning can be cook up for listing.Please becareful.Put value of 60 cents range.But 60 over cent range always bad luck if its do not follow by strong earning.For the cash,90 over millions build a factory with cutting edge tech need 1.5 years to 2.5 years.Can Its mantain strong earning is another question.

2019-10-18 19:13

MK,

This is the beauty of stock market.

I bought in Greatech, knm and mtag so I earn money...

I switch all to Istone. Let's see am I earn money..

You are scare too much of unnecessary scare.

2019-10-18 20:06

Greatech 70c... Everyone scold me of not understand industrial 4.0...it rally.

Knm... High debt.. It rally...

Mtag... Jump water during ipo.... Now rebound...

Today 3 stocks to one... Istone...

Let's see how good is its industrial 4.0 rally againt Greatech and uwc..

2019-10-18 20:08

win-win

From my understanding, PAT of MTAG should be like that.

PAT FY2016: RM15.9 million

PAT FY2017: RM22.6 million +42%

PAT FY2018: RM47.5 million +110%

PAT FY2019: RM32.9 million -31%

PG.26 — PAT 2016-2018

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=195933&name=EA_DS_ATTACHMENTS

PG.1 — PAT 2019 (unaudited)

https://www.malaysiastock.biz/GetReport.aspx?file=2019/9/20/0213%20-%200957239389569.pdf&name=MTAG%20-%20Quarterly%20Result%20(Q4-2019)%20-%2020.09.2019.pdf

And the current PE should be 10.

RM32.9 mil/681.62 mil shares = 4.8 sen (EPS)

2019-10-17 21:04