LCTITAN - Increasing product price - PP & PE

myinvesting

Publish date: Sun, 10 Sep 2017, 12:03 AM

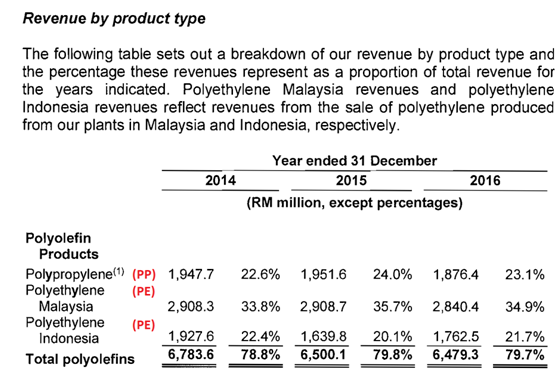

Source: IPO prospectus

Price Index in China – PP

Price Index in China – PE

Business News

Ethylene price hike boost for Malaysian and other petrochemical industries

PETALING JAYA: The petrochemicals industry is expected to benefit from the likely increase in the prices of ethylene-based products in the near future, according to Maybank IB Research.

The research house, which reiterated its “positive” recommendation on the sector, said the recent closure of 61% of ethylene plants in the United States has had an effect on the supply-demand balance and will likely increase product prices in the near future.

This was followed the aftermath of Hurricane Harvey in the Gulf of Mexico. The US has 22% global market share of ethylene production.

“Using PetroChemWire’s data that 61% of US ethylene plants are to close for two weeks, this equates to a total of 1.2 million tonnes (mmt) of ethylene production loss, or 0.5% of global annual consumption. This is the best case scenario as we expect supply line and other logistics damage to hinder the ramp-up process.

“Product prices are likely to rise in the near future. This episode boosts our positive stance on the sector as well as our buy calls on Petronas Chemicals Group Bhd (PChem) and Lotte Chemical Titan Bhd,” said Maybank IB Research in a note.

The research house added that the recent development will benefit PChem significantly and to a lesser extent, Lotte Chemical.

Ethylene prices in South-East Asia have risen by 3.1% in the past two weeks and is now trading at US$1,150 per tonne.

As for Gulf of Mexico, ethylene prices has surged even higher by 19.4% in the same period and is now trading at approximately US$644 per tonne. Both PChem and Lotte Chemical produce their own ethylene supply. However, Lotte Chemical procures Ethylene from third party for its Indonesian operations - which accounts to 44% of its total ethylene consumption.

[Comment: Indonesia's sale only contributing 22% of total sale, external supply of ethylene was only 27% instead as per IPO prospectus document. Impact should be managable. ]

“Therefore this business unit will suffer from higher raw material cost and incur margin contraction,” said the research unit.

The period of September to November is a peak season for petrochemicals as factories ramp-up production rates ahead of Christmas.

“The closure of US plants, however, means petrochemical producers can take the opportunity to push-up prices while exporters send their shipments into the US.

“The year 2017 is looking to be a record year for PChem in earnings delivery.

“While we initially expected the second half of 2017 to be subdued for PChem, Tropical Storm Harvey just pulled an extra gear to PChem’s fortunes. At the current share price, Lotte Chemical is still the cheapest Asian petrochemicals based on enterprise value to earnings before interest, taxes, depreciation and amortisation (EV/EBITDA) and price to book value (P/BV) measures. Based on this and coupled with respectable dividend yields, we advocate accumulating Lotte Chemical’s shares,” said Maybank IB Research.

Source: http://www.thestar.com.my/business/business-news/2017/09/08/ethylene-price-hike-boost/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on MyInvesting

Created by myinvesting | Sep 15, 2017

Discussions

many still not dare to jump in LCT even though the future valuation path is quite clear...

2017-09-10 11:48

true. may be this industry is very specialised and not common to any layman (not easy to understand), unless you are in that industry.

2017-09-10 21:05

Glove counters fall on selling as players hampered by rise in costs and ringgit | http://www.klsescreener.com/v2/news/view/278473

2017-09-11 19:51

Strong run up for past 2 days. Apart from better outlook, could that be all bankers really need to push up the share price by Sept quarter end to show a reduced loss from IPO? Otherwise, funds performance will fall below benchmark (KLCI, which is without LCTitan to go along).

2017-09-11 20:43

bursainvest12

Good info.

2017-09-10 08:56