My two cents on Supermax

mytwocents

Publish date: Fri, 12 Jun 2020, 03:37 PM

A maiden post to share my two cents on Supermax...

Background

Have been holding a little Supermax shares for the past 5 years with an entry price of RM1. Thesis back then was to hope for normalization of Supermax trading P/E multiple, as it had always been lagging behind the big two. Progressively sold off 60% holding when the share price hit 2.5,5,6 in the past 2 months or so, and decided to continue holding the the remaining 40% after there were more clarity on glovemakers barganing power to increase ASP during this covid-19 period.

My Two Cents on Q4 result and target prices

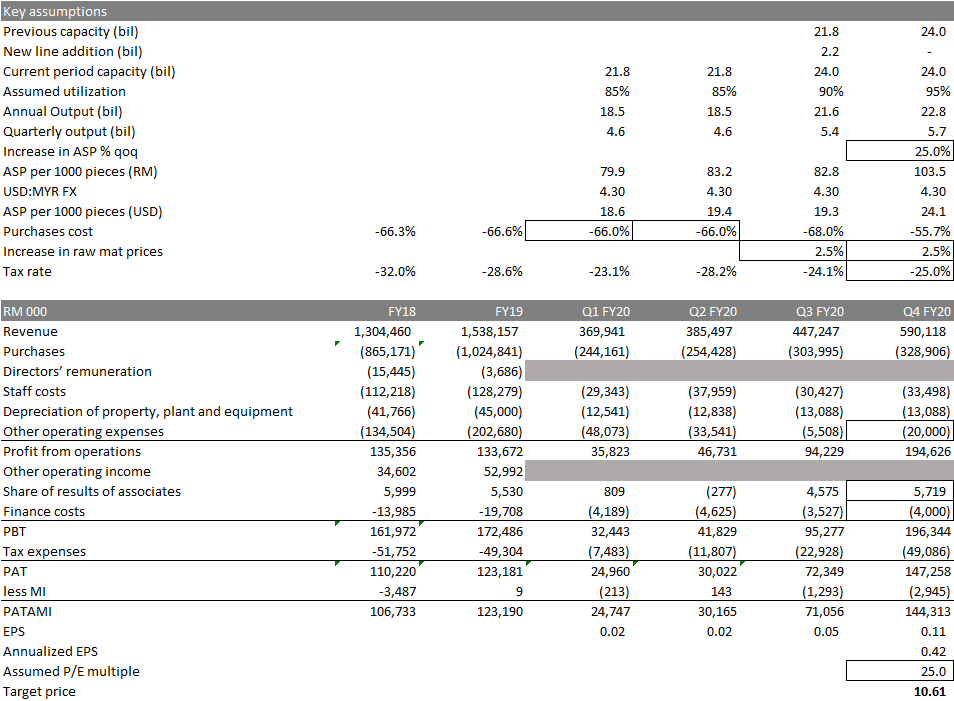

Key assumptions on my high level analysis/calculation are as follows:

- Q4 results are derived from Q3 results, assuming 90% utilization in Q3 FY2020.

- Assume 95% utilization in Q4 FY2020.

- A mdoest 25% increase in ASP in Q4 compared to Q3.

- Target price is based on 25x forward earnings, based on annualized Q4 FY2020 PAT. Big assumption is that the company will be able to maintain such high ASP and profitability in the coming 4 quarters or so.

- Other assumptions include simplied estimation on other expenses, interest expenses, share of results of associates, tax rate etc

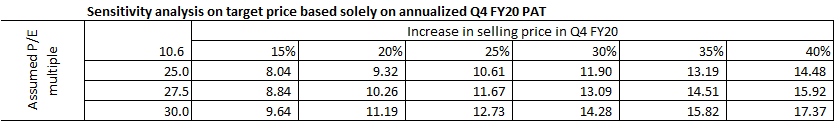

A little sensitivity on the increase in ASP and PE multiple to the target price. Top Glove management guided that at current tight supply environment, Top Glove expects to see "monthly double digit ASP" increase for the new few months. Given Supermax own distribution network in the developmed countries, it should be able to record a fairly high growth in ASP. As to what extend, no one could get it right i guess.

Short term target prices could go as high as RM17, should the company able to achieve 40% higher ASP consistently in the next year or so, whilst the market is valueing it at 30x forward PE. A more modest assumption would see the target price at RM11-12 per share in the near term.

Key risks

- Vaccine is successfully developed. One could argue that the demand for gloves would remain strong when vaccine is being rolled out. However the market sentiment towards glove stocks may not be as great as what we witness lately.

- Normalization of ASP when the super high demand tapers off. Should the demand tapers off, glove makers will not continue to see such strong margin business. However, revenue growth will still be supported by the glove makers aggresive expansion plans, assuming the medium and longer term demand will still come from high growth and highly populated developing countries, which have low per capital glove consumption.

Disclaimer

My two cents above do not form a view to buy or sell a share. It is solely used to faciliate discussions among forumers substantiated with basis and analysis. Happy to hear out from you guys any thoughts and guidance.

Discussions

Thanks bro. It may be conservative in terms of the ASP, but I couldn't be sure about the very optimistic ASP the analyst been reporting in recent reports with up to 3 times its previous selling price (75 dollar from 25 dollar or so). Sanity checks on various foreign market places indicate higher ASP, but not consistently as high as the 3 times cited by say CIMB CGS analyst report. Rightly or wrongly, I am thinking the 75 dollar per 1000 pieces ASP could apply to just selective sales channel but not across the board.

Therefore taking a conservative approach to keep updating the TP as we get more guidance/visibility from result announcement etc. )

2020-06-12 23:32

Goldberg

Many thanks for the impressive writeup allbeit a tad conservative. Your 2 cents certainly worth a million.

2020-06-12 22:47