Why Facebook Is Still Not Worth $174

Tan KW

Publish date: Wed, 02 May 2018, 11:18 AM

Facebook is back.

The charade lasted about a month and the media is still grasping at straws, but Facebook (NASDAQ:FB) retaliated and threw porridge in the face of doubters.

Here is some of what Facebook was cooking in its porridge, which you can find in the earnings release and more detailed 10-Q.

- Revenue was up 49% vs same year-ago period.

- Net income up 63% vs same year-ago period.

- Daily active users (DAUs) were 1.45 billion on average for March, a 13% increase year-over-year.

- Monthly active users (MAUs) were 2.20 billion as of March, a 13% increase year-over-year.

- Mobile ad revenue represented approximately 91% of advertising revenue for the first quarter of 2018, up from approximately 85% of advertising revenue in the first quarter of 2017.

A couple of facts jump out when reading these numbers.

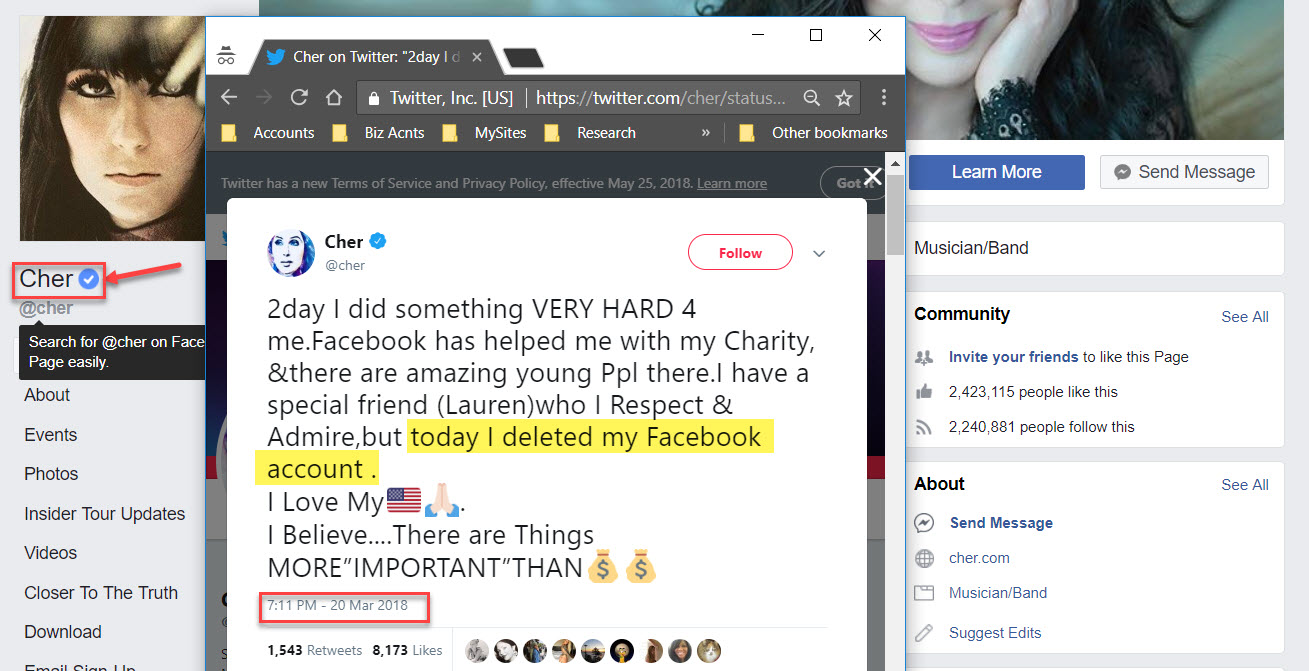

1. People didn’t delete their accounts. The network effect is too strong. I tend to throw out the word “moat” too often, which is wrong, because most companies don’t have a moat. But in Facebook’s case, its network effect moat is so strong that Cher backpedaled. She may have deleted her personal account, but she didn’t want to lose those 2.4 million people who like her page.

2. Facebook is a clear No. 2 in online advertising. Online business has become so competitive that without advertising, these online businesses have no way to acquire customers. People tend to think brick-and-mortar stores have too much overhead, but we are now at a point where advertising is essentially the new “rent” in the online space.

Amazon is continuing to expand its own ad platform, and I wouldn’t be surprised if it becomes No. 2 within five years. But for most advertisers, the only worthwhile place to advertise on is either Google or Facebook.

Driver to Facebook’s growth

I don’t consider Facebook so much a social media company anymore. It is now an advertising company.

Ad revenue is where it’s at, and it will continue to increase.

Some companies have pulled ads from Facebook after the Cambridge Analytica scandal, but nothing detrimental. In fact, while Tim Cook threw Facebook under the bus, Apple is more is than happy to use Facebook’s user data to sell its own products. The irony is that Apple knows even more about you than Facebook, and who knows how many third-party companies have access to that data.

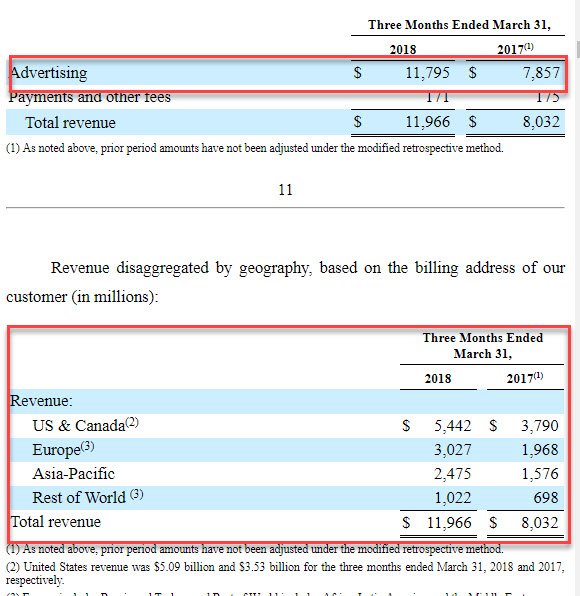

Check out the ad growth compared to the same quarter from a year ago.

In advertising revenue alone, this is a 50% increase.

The second table shows the breakdown of the revenue per region. There have been reports and opinions that U.S. revenue is slowing down, but if a 43% increase in U.S. revenue is considered a drag, I can’t wait to see what is considered growth.

The more interesting data to watch in the coming years will be the other regions as Europe and Asia revenues start to catch up to U.S. levels.

Fair value between $165 to $230?

I argued last time that Facebook isn’t worth $169.

It’s worth more. Before I get into my vauation, Professor Aswath Damodaran from New York University wrote a killer piece on his Facebook thoughts and valuation.

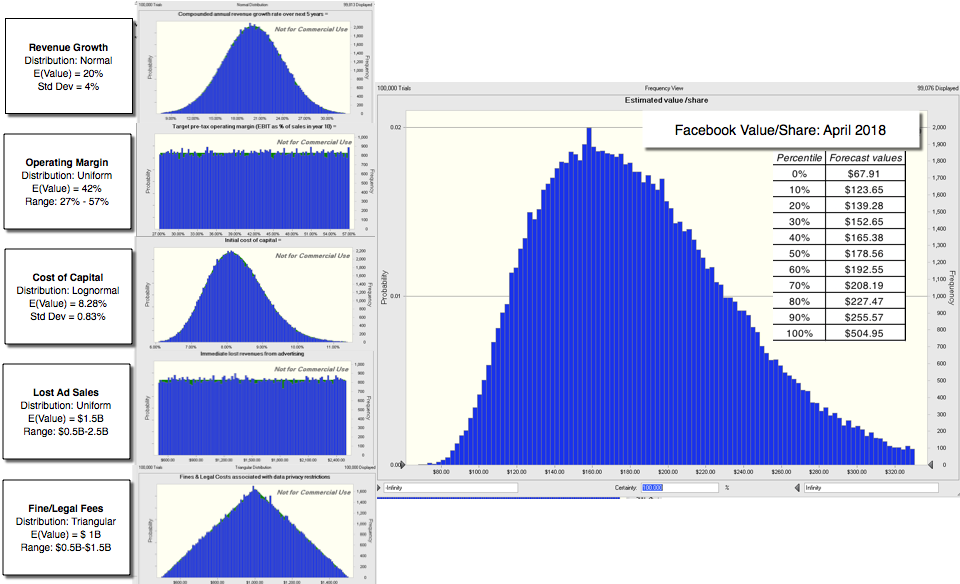

He came up with this valuation of $181 based on his various scenario assumptions. The chart below shows his range of possible values and the probability that it will happen. If I take the most likely probable percentile of 40-80%, the fair value range is $165 to $230. The median value in the chart is $179.

Source: Aswath Damadoran – Musings on Market User loss, in numbers and intensity, will be muted

- Advertisers will mostly stay on.

- Data restrictions are coming and will be costly.

- There will be fines.

These numbers and assumptions were before the earnings release and would certainly bump up the valuation higher.

Around the same time in mid-April, I also ran a quick valuation of Facebook using Vitaliy Katsenelson’s method to come up with a fair value of $182.

Katsenelson is the author of “Active Value Investing,” in which he describes the “Absolute PE” model to value stocks as opposed to using relative price-earnings ratio calculations.

The quick version of the Absolute price-earnings models is that you adjust the original price-earnings of the company based on three business aspects:

- Business risk.

- Financial risk.

- Earnings predictability.

A score is given for each section, and the adjusted price-earnings is calculated. If you wish to learn how to use this valuation method step by step, this is the link to the Absolute PE valuation tutorial.

3 Absolute PE valuation scenarios

Here are three fair values to have an intrinsic value range:

- The normal “base” case.

- Bear case story.

- Bull case story.

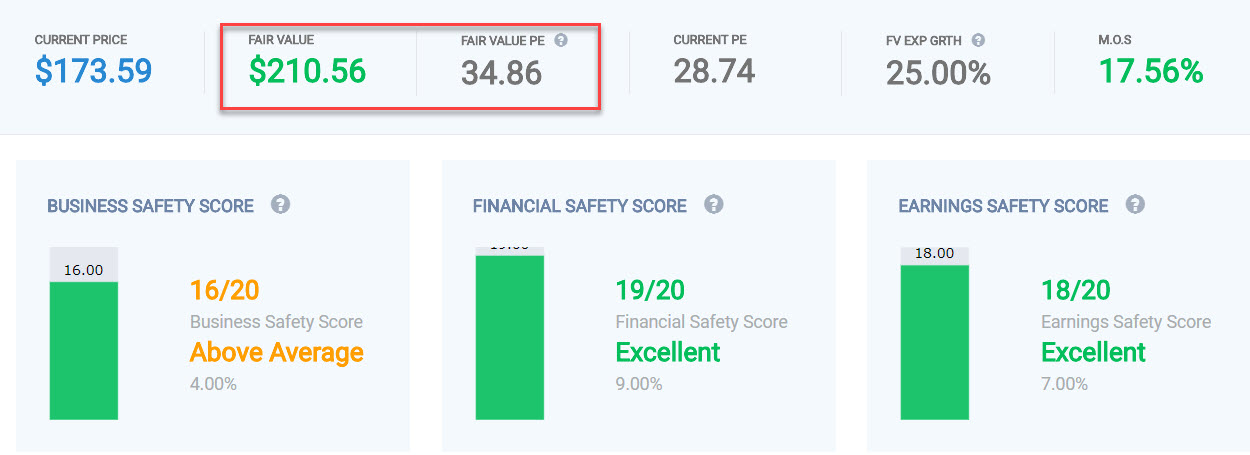

Base case valuation:

This is the company as it is now. No need to change anything

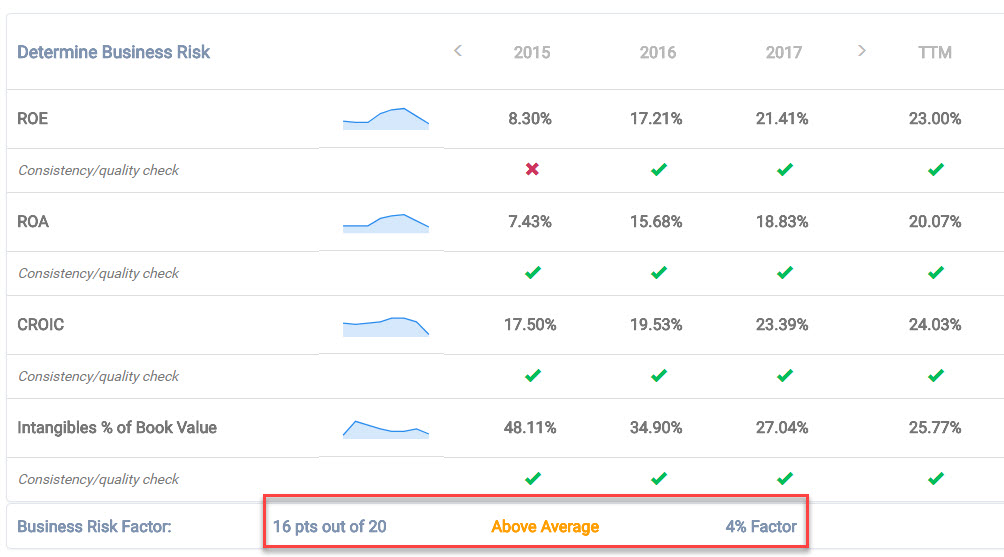

Business safety scores 16/20 based on our scoring system.

source: old school value

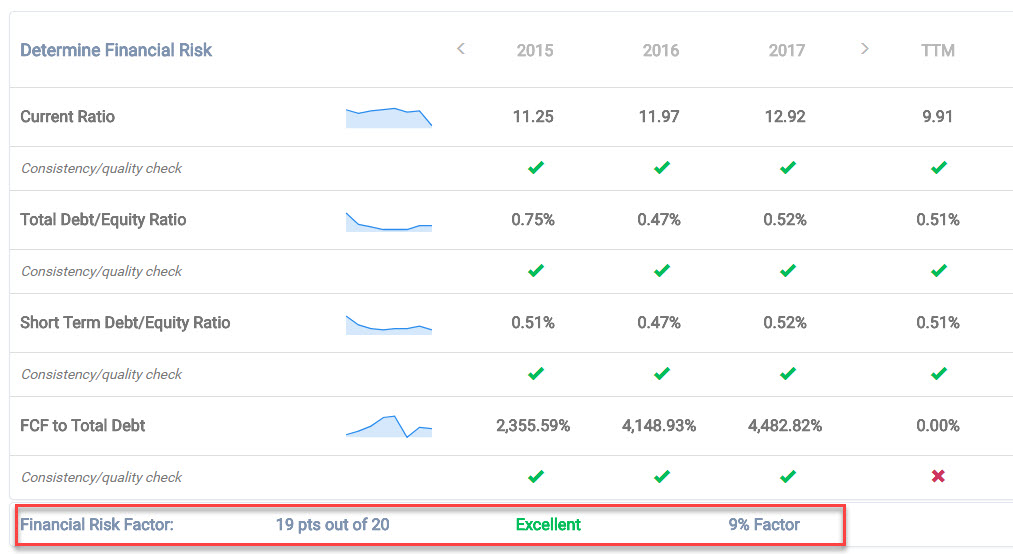

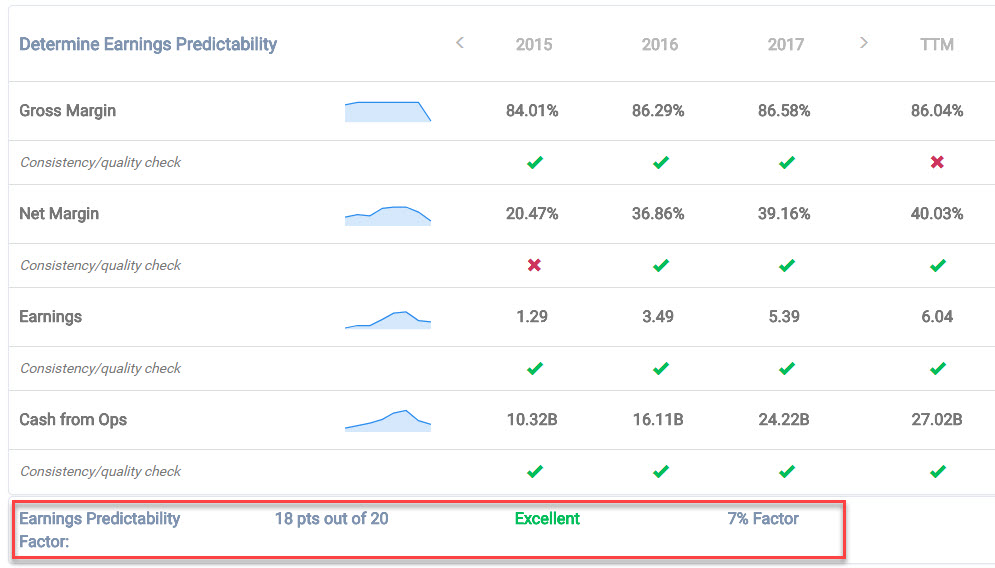

Financial safety gets a near perfect 19/20 with a healthy balance sheet.

Earnings predictability is also an excellent 18/20, with margin improvements and growing earnings year over year.

Using the math provided by the Absolute PE model, the new adjusted price-earnings ratio comes out to 34.86.

- Final adjusted PE is 34.86.

- Fair value for PE of 34.86 is $210.

With the latest earnings report, Facebook has increased its base valuation from $180 to $210.

source: old school value

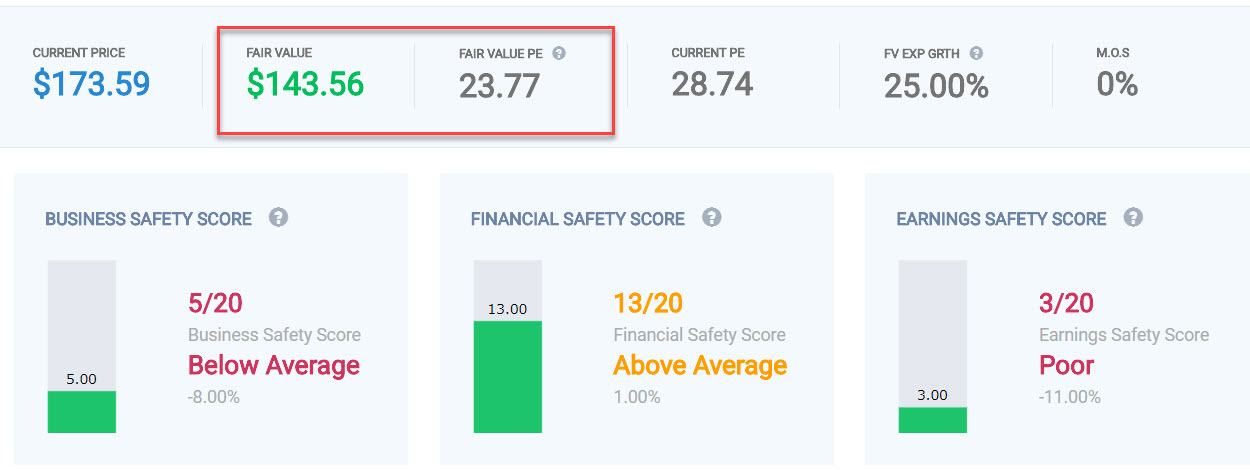

Bear case valuation

In this situation, we turn the story around and give it dire consequences to see where the low-ball fair value will lie.

Here are the assumptions:

- Business safety is in danger due to regulation, and a huge number of accounts are going to be deleted by another media blitz. Score is 5/20.

- Financial safety is compromised with lower margins and slowing growth. The cash still supports the business. Score is 13/20.

- Earnings predictability is shot as the business model slowly crumbles. Advertisers leave the platform in droves. Score is 3/20.

- Final adjusted price-earnings is 23.77.

- Fair value for price-earnings of 23.77 is $143.

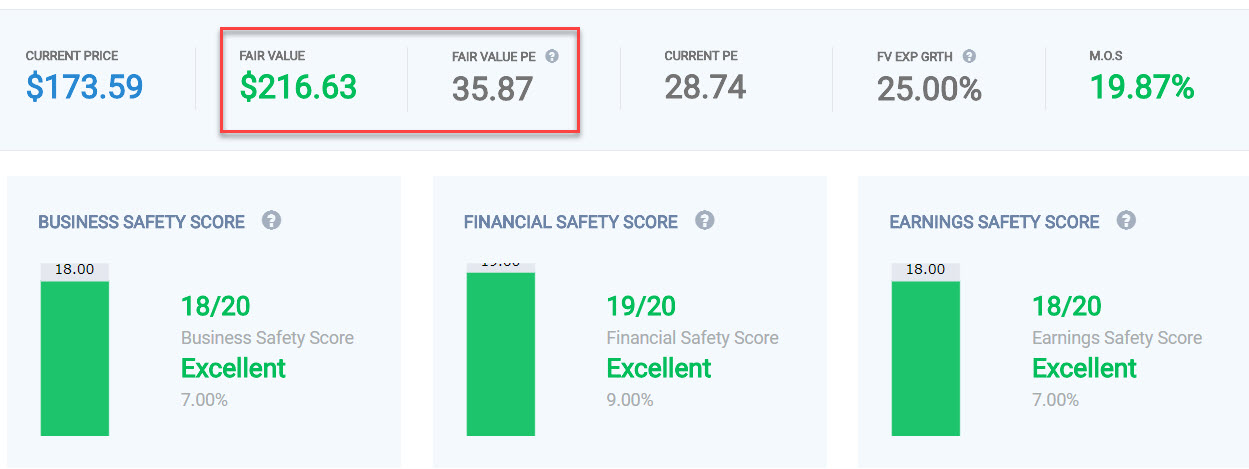

Bull case example:

- Business safety improves as people move on and the media moves onto the next thing. Accounts continue to grow. Score is 18/20.

- Financial safety remains healthy. There is so much free cash flow, Facebook can’t spend it fast enough. Score is 19/20.

- Earnings predictability stabilizes as advertisers continue to spend on the platform. Active users continue to increase. Score is 18/20.

- Final adjusted price-earnings is 35.87

- Fair value for price-earnings of 35.87 is $216

Updated Fair Value Range is $145 to $215

The probability of the bear case scenario playing out is too low but as a range, it looks like the intrinsic value lies within $145 and $215. This is pretty close to what Damodaran came up with despite using very different valuation techniques.

My bet is that it is in the upper range, as there is far too much growth ahead for Facebook.

Summary

- The latest 10-Q shows that Facebook has plenty of glory days ahead of it.

- The data scandal is overblown, and numbers prove that the majority of people don’t care about it.

- Advertising revenue continues to speed up and international revenue is gaining ground.

- Prof. Damodaran valued Facebook at $180 before earnings.

- A different valuation technique shows Facebook’s intrinsic value is between $145 and $215.

Disclosure: I am long Facebook.

https://www.oldschoolvalue.com/blog/stock-analysis/facebook-still-not-worth-174/

More articles on OldSchool.com - Jae Jun

Created by Tan KW | Oct 23, 2018

Created by Tan KW | Jun 14, 2018

Created by Tan KW | Apr 20, 2018