IPO - Foundpac Group Berhad

omightycap

Publish date: Wed, 14 Dec 2016, 11:00 AM

See the original here

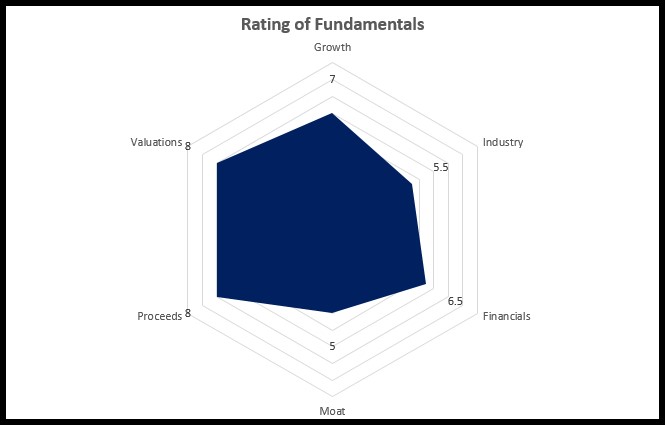

We think that the offering this round is above average and offered at a cheaper side of things with PE ratio estimated to be at 4.33 FY 2016. Although it is common that profit numbers are adjusted in preparation to beautify IPO image, giving it a 20% discount would still see around RM 13 million worth of profit that’s the reason for a 6.5 rating on Financials.

We rate growth, industry and moat a near average rating since the industry itself its filled with competitors and somewhat known as a matured industry. Growth was rated a little higher since the it operates in an ideal location which is Penang, the Silicon Valley of Malaysia.

We like how the company uses utilize their proceeds where a huge sum of it would go into expansionary plans by the company. From sales offices overseas to addition of new properties for production expansion, all these are key growth and this is what an initial public offering should look like seeking cash for growth rather than getting public money to help with debt payment.

We recommend you to subscribe for this offering as we believe that there’s value in this company and at the same time the valuations are selling this stock cheap.

See our report with extracts from the prospectus

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com