TEOSENG 7252

pixiu

Publish date: Wed, 20 Jul 2016, 11:34 PM

Abstract

Today, I would like to share how I forecast the share price of TEOSENG (core business: egg producer) and my personal view on this counter.

Background

"TEOSENG is a Johor-based poultry counter which produces 3.3million egg daily, for Q1 ended MAR 31, the revenue from RM112.59million drop to RM101.9million. The net profit dropped 74.5% from RM17.5million to RM3.6million. TEOSENG. Johor is located new Singapore. It is geographically strategic for TEOSENG to export the product to Singapore, which make 27% revenue last year."

Methods

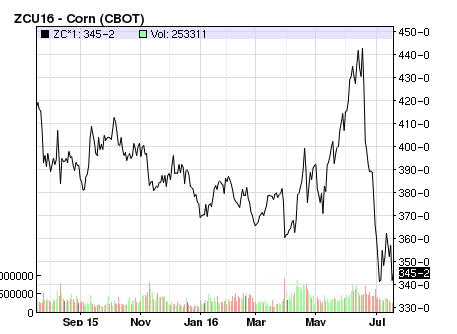

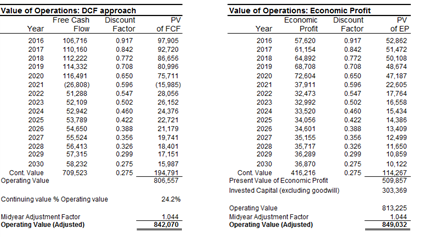

In my research, I used two approaches, i.e., discounted cash flow (DCF) and also economic profit (EP). I use DCF and EP approach to forecast the value per share. Technically I used EP approach as an approach to validate my DCF approach. If the different between two approaches are exceeded my tolerance limit then I will re-adjust my assumption as something might go wrong. Noted that the following assumptions are considered: (1) GDP in Malaysia for average 5.5% (2) Revenue growth of 1.6% (I used the population growth of Malaysia as my guide). (3) Population growth equal to TEOSENG revenue growth (4) Cost of Good Sold (CGS) is 55%. Recently I notice corn price has decreased significantly from 440 USD per unit to about 350 USD per unit which is about 20% as shown in Fig. 1. Therefore, I draw a conservative assumption that the percentage of CGS is 55% owing to the decreases in corn price. For poultry business, corn and soybean are the main raw materials which represent of roughly about 70% of CGS. Generally, 60% of corn and 40% of soybean are consumed. Additional, 90% of their materials are imported with bulk corn and soybean meal sources from Argentina, Brazil and US. For me, these are the assumptions are very conservative and reasonable for long-term trading.

Figure 1 Monthly Corn Price

When midyear adjustment factor is set to 1.044, I obtained operating values which are 842070 and 849032 for DCP and EP, respectively. These two figures are within the tolerance limit. I used the operating value from DCP approach to compute value of equity as shown in Fig.2 as it is the minimum of two figures.

Figure 2 DCP approach VS Economic Profit

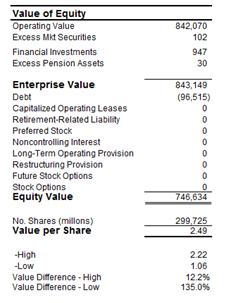

I obtained the value of equity is 746,634 as shown in Fig. 3. By dividing the figure with total number of share, I obtained my forecasted price is 2.49. For TEOSENG, CGS for 2014 and 2015 are 61% and 66% respectively. The surge in soybean and corn price is mainly due to stock-out. Besides, these two commodities are traded in USD, ringgit weakening cause even worst effect and it brings double sword effects to TEOSENG. This is a bad sign for egg producers. This issue leads many analysts to comment TEOSENG pessimistically and even downgrade its future earnings. I believe these maybe the reason that triggers the SELL call of this counter.

Figure 3 Targeted share price

Refer to historical results; the average highest and lowest prices for TEOSENG are 2.22 and 1.06, respectively. With this simple evaluation, I can evaluate and deduce that TEOSENG worth RM746 million or RM2.49 per share at market price. In short, I would say TEOSENG still have good chance.

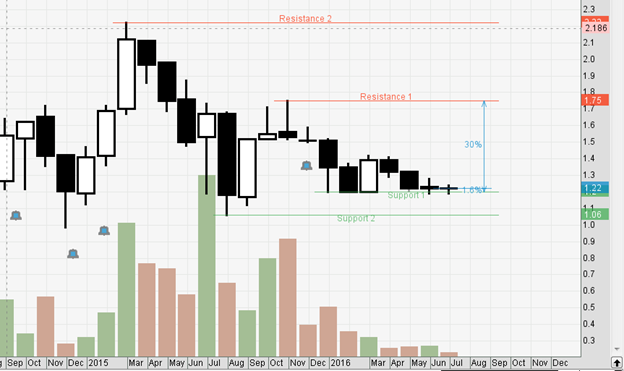

Figure 4: Monthly chart on TEOSENG

Summary

In my opinion, stock market is volatile. A good and bad news with makes stock price swing up and down. TEOSENG share price ever swing from RM0.5 per share to RM 2.2 per share within a year. This is due to all positive and optimistic perspective on this counter. However, due to a negative issue, now most traders seem anxious and try to cut lost. I would like to inspire you with a famous quote from Warren Buffett ““Be Fearful When Others Are Greedy and Greedy When Others Are Fearful””. In fact, we should start accumulate now before people are greedy. Please refer a monthly chart in Fig.4, I personally do not like to trade weekly or daily as I’m old (I don’t want heart attack). The chart shows that share price at RM 1.2 range is considered support which is quite safe to enter.

I’m not good in neither technical nor fundamental analysis…I believe good entry price, logical and reasonable strategic are important in trading.

Let us think logically.....

1. Malaysia population is increasing at average of 1.6% per year. Is it possible for TEOSENG to continue revenue drop?

2. Is it possible for MALAYSIAN to stop taking egg?

3. What is the future prospect of Egg Company?

Please DON’T….

1. Ask me how much I earn my profit in stock market? I’m here not to compete with anyone or argue with anyone. I’m here to share what I know. I don’t call anyone to BUY.

2. Ask me how confident on TEOSENG and target price this year. I don’t have the answer as I’m NOT GOD. I diversify on my stocks pick on few sectors, evaluate the stock price then buy in and hold.

3. Ask me to disclose my stocks. It is confidential.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Thanks the comments from a friend, I have tried to re-organize my content. TQVM :) Have a nice day

2016-07-21 09:18

Now enonomy not good, is it good to buy the shares? What is your opiniom on the current drop?

2016-07-21 12:55

And why do u recommend teoseng? why not QL, Ltkm or Huatlai? Are u holding teoseng and hope somebody buy ur shares?

2016-07-21 13:47

pixiu, your article is a good read and you even take EP into consideration.

I used to own Teo Seng share's. Here's a few things for you to ponder:

1. Teo Seng's revenue will most likely continue to rise, but profit wise is not a guarantee.

2. Profit is determined by USD dollar vs Ringgit, price of corn & soybean, and as well as selling price of egg which is controlled by Malaysian Government.

3. Future prospect of an egg company? Probably a mixed bag of M&A and growth in egg production farms.

2016-07-21 15:54

pixiu

Please read and comment. Thank you very much

2016-07-20 23:47