Rakuten Trade Research Reports

Technical View - Kumpulan Perangsang Selangor Bhd

rakutentrade

Publish date: Fri, 16 Apr 2021, 09:51 AM

Kumpulan Perangsang Selangor Bhd (KPS, 5843)

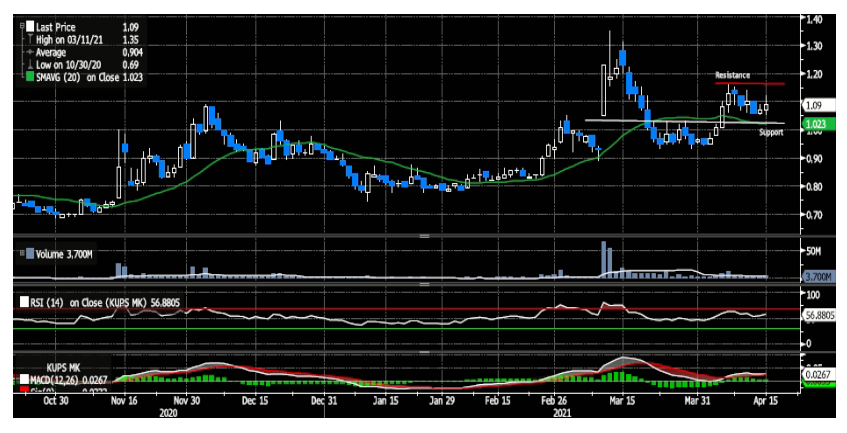

• KPS ended 1.9% or 2 sen higher to RM1.09 yesterday.

• Recent pull back from the high of RM1.16 could provide entry opportunity as key technical indicators are displaying signs of renewed buying interest. As share price is trading above key short-term moving average lines, the buying momentum is likely to be extended.

• As such, resistance levels are expected at RM1.16 (R1) and further to RM1.25 (R2).

• Conversely, support levels are projected at RM1.03 (S1) and RM0.95 (S2).

Source: Rakuten Research - 16 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

Supreme Consolidated Resources Bhd - Producers + Consumers = SUPREME

Created by rakutentrade | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments