Rakuten Trade Research Reports

Technical View - Malakoff Corporation Bhd

rakutentrade

Publish date: Wed, 20 Sep 2023, 09:07 AM

Malakoff Corporation Bhd (MALAKOF, 5264)

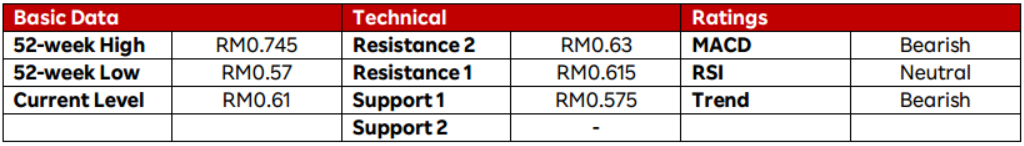

- Share price closed 1.67% higher at RM0.61 on Tuesday.

- MALAKOF experienced a gap down last month following its 2QFY23 earnings missing expectations,mainly due to higher weighted average fuel costs. As support has been found at RM0.575, it is poised to break out of its resistance threshold of RM0.615. High buying volume has been observed over the past week as the RSI indicates uptick momentum. A bullish MACD crossover was formed yesterday thus share price is expected to move higher.

- Resistance level are identified at RM0.615 (R1) and RM0.63 (R2).

- On the flipside, support level is pegged at RM0.575 (S1).

Source: Rakuten Research - 20 Sep 2023

To sign up for an account: http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

Supreme Consolidated Resources Bhd - Producers + Consumers = SUPREME

Created by rakutentrade | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments