Rakuten Trade Research Reports

Technical View - CCK Consolidated Holdings Bhd

rakutentrade

Publish date: Tue, 17 Oct 2023, 09:08 AM

CCK Consolidated Holdings Bhd

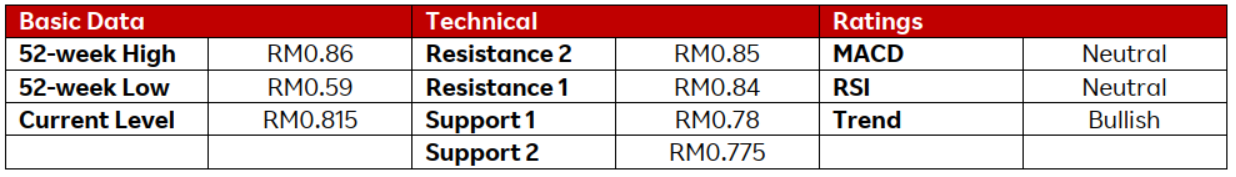

- Share price closed 1.24% higher at RM0.815 on Monday.

- CCK has been hovering between RM0.78 to RM0.85 after reaching its 52-week peak of RM0.86 inSep-23. Share price subsequently rebounded after touching its support at RM0.78 (S1) over the past week. It broke out from its resistance threshold of RM0.805 with a spike of buying momentum following the tabling of Budget 2024 regarding the removal of the ceiling price on chicken and eggs. Currently, it is trending above all of its EMA lines, suggesting that the upward momentum is gaining traction.

- A bullish bias may emerge above the RM0.815 level, and the bullish momentum should lift it towardsthe subsequent resistance level of RM0.84(R1), followed by RM0.85 (R2).

- Towards the downside, stop-loss is set at RM0.755, below the 7 Aug’s low.

Source: Rakuten Research - 17 Oct 2023

To sign up for an account: http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Rakuten Trade Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments