Rakuten Trade Research Reports

Technical View - Jaya Tiasa Holdings Berhad

rakutentrade

Publish date: Wed, 05 Feb 2025, 10:20 AM

Jaya Tiasa Holdings Berhad (JTIASA, 4383)

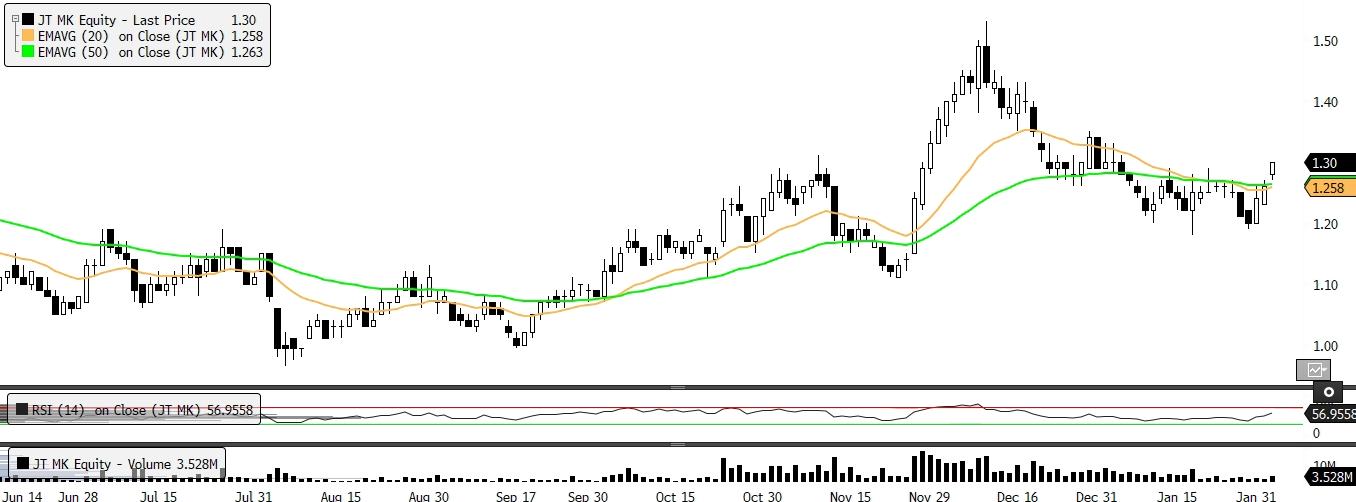

- JTIASA broke out of its 2-month bullish flag pattern with consecutive candlesticks, coinciding with a gap-up yesterday. As the stock bounced off from the converging EMAs, this hints to a potential golden cross, further supported by the uptick in RSI hence reinforcing a positive outlook.

- Thus, we expect the rising momentum to steer the stock higher and test the initial resistance at RM1.35 (R1) followed by RM1.43 (R2).

- On the downside, stop-loss is set at RM1.19.

| Basic Data | Technical | Ratings | |||

| 52-week High | RM1.53 | Entry Level | RM1.25 - RM1.30 | RSI | Neutral |

| 52-week High | RM0.965 | Resistance 1 | RM1.35 | Trend | Bullish |

| Current Level | RM1.30 | Resistance 2 | RM1.43 | ||

| Support 1 | RM1.27 | ||||

| Support 2 | RM1.19 | ||||

Source: Rakuten Research -

To sign up for an account : http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments