Ranhill on Track to a Better 2023

winsenlim68

Publish date: Wed, 05 Apr 2023, 03:55 PM

Update on 2023 Outlook

Following the latest quarterly results, Ranhill Utilities Berhad appears to be on a steady course for a potential rebound in FY23. The company's prospects look promising, and several developments are expected to uplift the company's outlook.

Here are some updates on the key factors that could drive Ranhill's growth in the upcoming year.

1) Tariff Hike Expected to Boost Earnings in FY23

Ranhill's subsidiary, Ranhill SAJ Sdn Bhd (RSAJ), has begun recognizing the backdated July 2022 gazetted tariff adjustments for Aug-Dec 2022 period. As per the adjustment, the rate for the first 35m3/month has been raised to RM3.10/m3 (from RM2.80/m3), and that of subsequent consumption is raised to MYR3.50/m3 (from RM3.30/m3). This adjustment is expected to lead to an increase in earnings of approximately RM10 million for FY23, according to a report by RHB.

2) Healthy Cash Flow from NRW Matching Grant Receipt

Ranhill has qualified for the Non-Revenue Water (NRW) reduction incentives for FY21, enabling it to recognize a reduction incentive of RM142 million in FY22. The disbursement of the RM142 million grant is expected in FY23 Q2, which will further boost Ranhill's cash flow and could lead to a potential boost in dividend payout for FY23. A simple back of the envelope calculation shows that RM142 million would yield 10 sen dividend per share, translating approximately 20% dividend yield from its current share price.

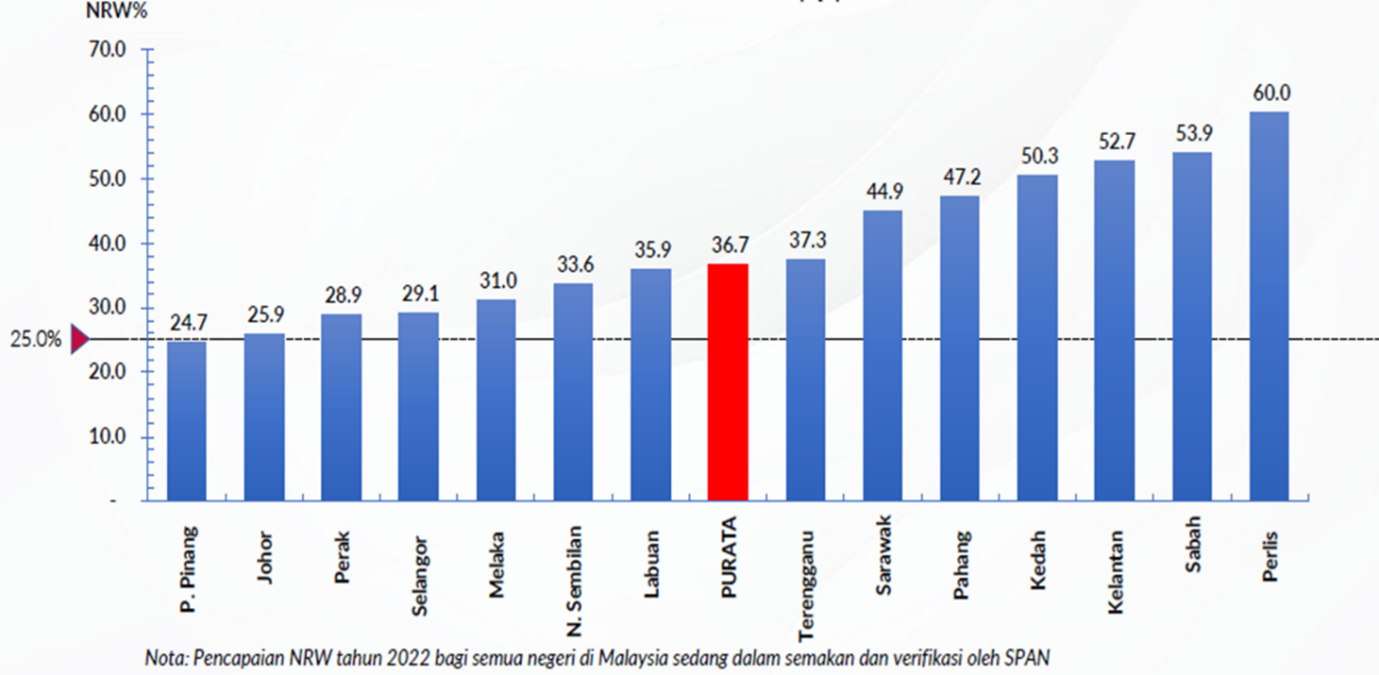

As per a report by RHB, Ranhill is the most efficient water operator in Malaysia as Johor has the lowest NRW per km of 17.2cu m/km/day. Therefore, it is highly likely that Ranhill will meet the NRW target for FY23 and qualify for the NRW incentive.

3) NRW Incentives Under the 12th Malaysia Plan

The 12th Malaysia Plan has allocated RM1.37 billion under Approach 2 for matching grants to assist water operators in states that has less than 40% NRW rate. Seven state water operators, including Ranhill in Johor are implementing Approach 2, thereby presenting an opportunity for Ranhill.

With the company’s impressive history of reducing NRW, it is anticipated that Ranhill will meet the criteria for the NRW incentive under Approach 2, thus further enhancing its cash flow position.

4) Progression of the Indonesian Djuanda Water Project

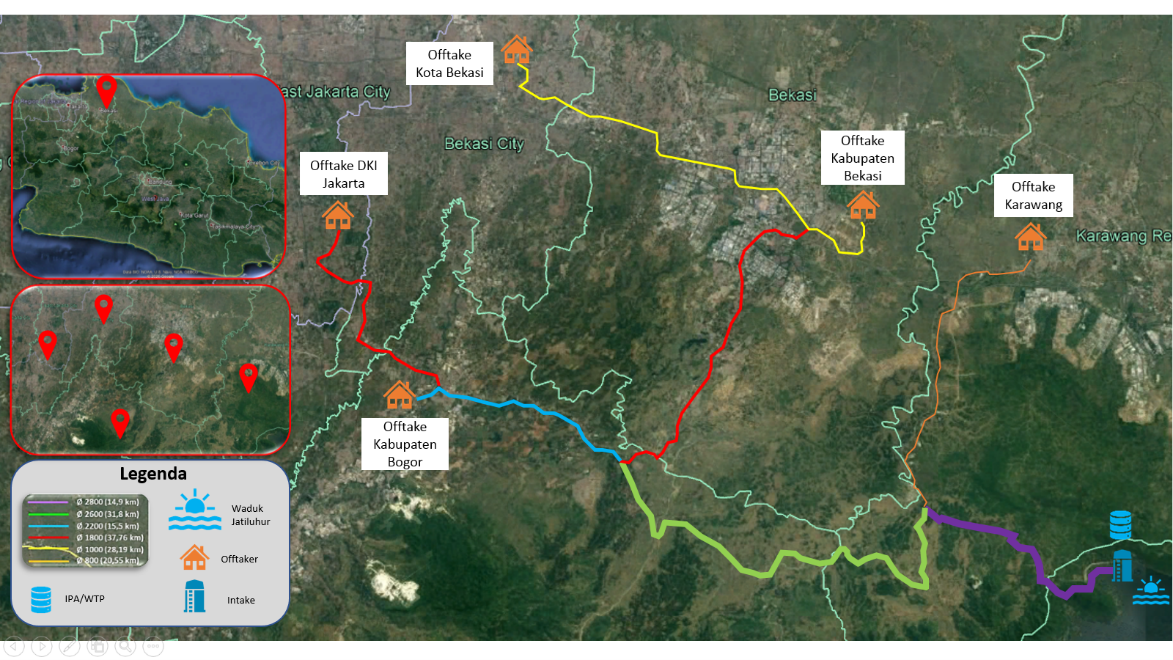

According to a report by RHB, the Indonesian Djuanda source-to-tap water project, with an estimated treatment capacity of 605m litres/day (MLD) and USD700-800m capex, is in its final feasibility study. Once accepted by the Indonesian Government, Ranhill will be accorded Initiator Status, which gives it the 'Right-to-Match' privilege as the project enters into the public tender process. Upon completion, the water project is expected to provide clean water access to 3.9 million residents around the Greater Jakarta area, including DKI Jakarta, Bekasi City, Bekasi Regency, and Bogor Regency.

The concession period awarded for this project is estimated to be 30 years, which is a significant boost for Ranhill's bottom line. The successful execution of this project could also open the door for Ranhill to new water project opportunities in Indonesia in the long term.

5) Successful bid for new 100MW CCGT plant in Sabah

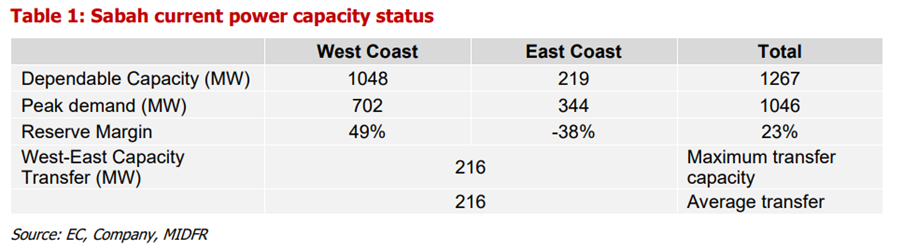

Ranhill Utilities and Sabah Energy Corporation's 60:40 consortium won the bid for a 100MW CCGT power facility on Sabah's west coast. The facility has a 21-year PPA with Sabah Electricity and set to begin commercial operation date on 1 March 2026. According to MIDF, it is estimated that the new plant could generate incremental equity value of 11sen/share based on Ranhill’s 60% stake. Ranhill's new plant will expand its power capacity in Sabah by 26%, making it the largest IPP with 30% market share.

According to the Sabah Electricity Supply Industry Outlook 2019, peak energy demand is expected to grow 14% to 1,080MW in 2029, resulting a reserve margin of mere 3%, far lower than the 23% currently. Therefore, Ranhill is proposing to extend the PPA of its existing RP1 power plant by eight years to 2037 to meet Sabah’s growing energy demands. Coupled with the expected completion of the Southern Link project this year, it will enable RAHH to distribute more electricity to the east coast through its existing power plants and hence increase its revenue.

In summary, the recent developments are a positive sign of Ranhill's growth potential. I anticipate the company to experience a re-rating, as these factors have not been fully priced in, along with a potential dividend bump from the government grant. In uncertain times like these, Ranhill's defensive nature is a good fit for investors.

The light at the end of the tunnel seems to be getting closer.