Ranhill: Right Place, Right Time!

winsenlim68

Publish date: Thu, 12 Oct 2023, 03:47 PM

With the ever-evolving landscape of Malaysia's energy and infrastructure sectors, Ranhill has stood out as a uniquely positioned and dynamic player. With an extensive portfolio encompassing water operations in Johor, a robust presence as the largest independent power producer (IPP) in Sabah, Ranhill is uniquely positioned to harness the advantages arising from significant developments in these regions. These strategic developments not only bolster the company's current prospects but also pave the way for a sustainable and prosperous future in the heart of Southeast Asia.

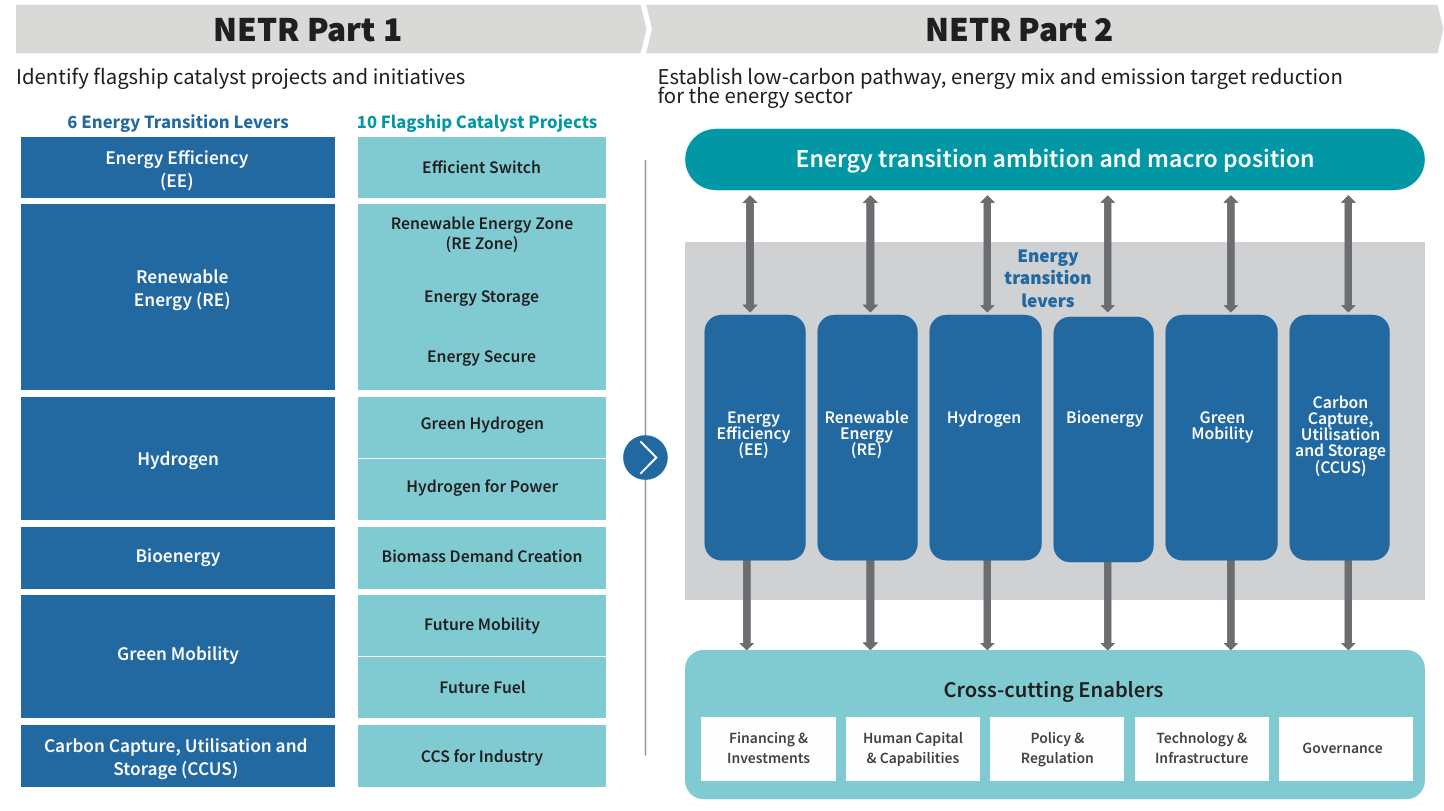

As the exclusive water operator in Johor, Ranhill is poised to capitalize on the potential demands within the Special Financial Zone (SFZ). The SFZ's revitalization, aimed at fostering Singapore-Malaysia business cooperation, presents unique opportunities for Ranhill to attract Singaporean firms seeking cost-effective solutions and forge invaluable partnerships with local Malaysian businesses. Moreover, as Malaysia advances into the second phase of the National Energy Transition Roadmap (NETR), Ranhill's participation in solar energy and carbon capture projects underscores its commitment to environmental sustainability. Concurrently, the forthcoming autonomy of the Sabah Energy Commission (ECoS) in 2024 with newly acquired regulatory powers in the oil and gas, and energy sectors open new doors and opportunities for Ranhill to broaden its footprint across Malaysia.

1) Johor Special Financial Zone (SFZ) – Gateway for Expansion

The government recently announced its plans to create a SFZ in the Forest City area in Iskandar Puteri, providing a catalyst for boosting economic activity in Johor. The SFZ aims to revitalise the region by attracting substantial investments, promising industrial growth, thus fuelling economic development. Several incentives including a special income tax rate of 15% for skilled workers and the provision of multiple-entry visas haven been announced to further facilitate, simplify, and incentivise businesses to invest into the region. Hence, Ranhill’s strategic significance in Johor is unmistakable, beginning with its exclusive role as the sole water operator in the state.

Furthermore, the overarching aim of the SFZ to foster closer Singapore-Malaysia business cooperation holds immense promise for Johor and Ranhill as well. Malaysia and Singapore are set to hold the Leaders' Retreat in October to discuss and finalise operational details for a proposed Johor-Singapore Special Economic Zone (SEZ). The allure of lower labor and land costs makes the region an attractive proposition for these companies, enticing Singaporean firms in search of cost-effective solutions for their business which will also benefit Malaysia businesses through partnerships and knowledge sharing.

This strategic positioning places Ranhill at the forefront of meeting the escalating water demands resulting from the expected population surge within the SFZ. As the region experiences industrial expansion and increased urbanization, Ranhill is poised to capture a robust revenue stream through its offering of essential water services.

However, it's essential to recognize that the SFZ's ambitious goals may necessitate substantial infrastructure development, which could translate into significant investments. Nevertheless, Ranhill's extensive experience in water and power operations uniquely positions it as a prime candidate to lead these infrastructure projects, further solidifying its presence and influence in the region.

2) NETR Phase 2 – Clear Roadmap for National Renewable Energy Ambitions

With the unveiling of NETR Phase 2, the country has charted a clear path towards a more sustainable and environmentally conscious energy future. The roadmap lays out a series of strategic initiatives to not only reduce the country’s carbon footprint but also stimulate development and open new business opportunities in the Renewable Energy sector.

With an ambitious target to achieve carbon neutrality apart from increasing RE generation capacity to 70% by 2050, Carbon Capture, Storage (CCS) – a technology to capture CO2 emissions and safely storing them underground - has also been identified as one of the key development areas to reduce carbon emissions. The NETR has set a target of 3-6 CCUS clusters, with a combined storage capacity of 40-80 mtpa CO2 by 2050, which are instrumental in reducing greenhouse gas emissions and achieve climate goals.

It is important to highlight that Ranhill has made new strides in the CCS domain, having successfully won a contract from Petronas for the front-end engineering and design of its Kawasari CCS project. Once completed, it will rank as the largest offshore CCS project globally capturing up to 3.3 mtpa CO2 emissions.

These developments bode exceptionally well for Ranhill, as the company has been actively engaged in RE endeavors through projects like LSS4 and the Kawasari CCS project. Having established its experience and expertise, Ranhill is poised to leverage on these achievements to explore and capitalise on emerging opportunities.

3) Sabah Regains Energy Autonomy

In Sabah, Ranhill commands a dominant position as the largest Independent Power Producer (IPP) with an estimated 40% market share, a role that is set to gain further prominence. A significant development on the horizon in Sabah is the establishment and transfer of energy autonomy to the Sabah Energy Commission (ECS) in 2024. ECS's mission is clear: to provide secure, sustainable, affordable, and accessible energy for Sabah which could lead to the expedition and coordination of new energy projects.

Ranhill’s prominent IPP position in Sabah provides it a unique and strategic advantage in addressing Sabah’s energy requirements. Ranhill currently operates 2 CGPP plants with a combined capacity of 380MW at the Kota Kinabalu Industrial Park, as well as a successful bid for a 100MW CGPP plant in Kimanis in April 2023.

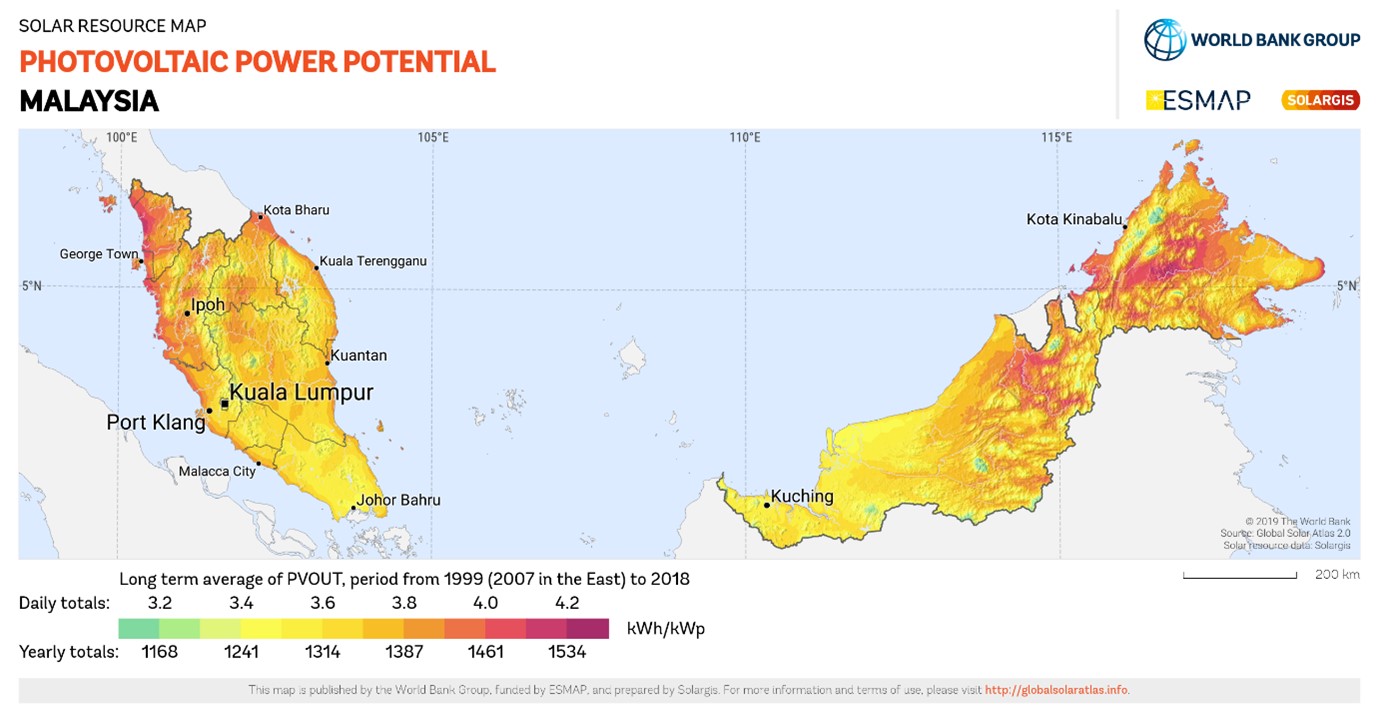

Furthermore, according to the World Bank, Sabah boasts one of the country’s highest solar generation capacities. Given Ranhill’s foray into solar through LSS4, the company possesses the knowledge and capacity to capitalise on this abundant solar potential.

As the region moves towards energy autonomy and the nation embraces renewable sources, Ranhill's expertise and capacity will continue to play a pivotal role in shaping Sabahs energy future.

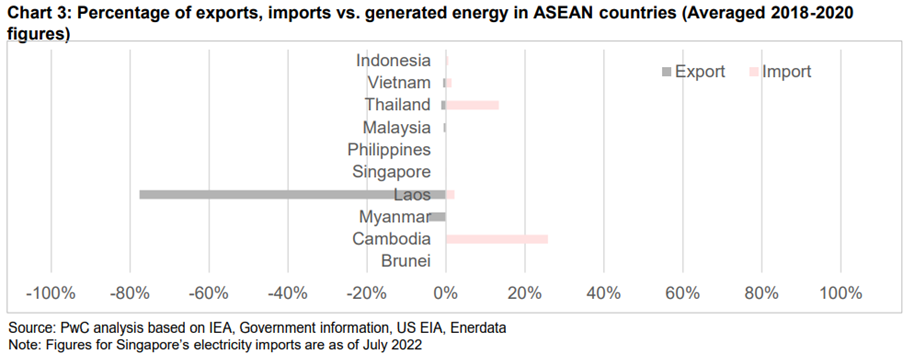

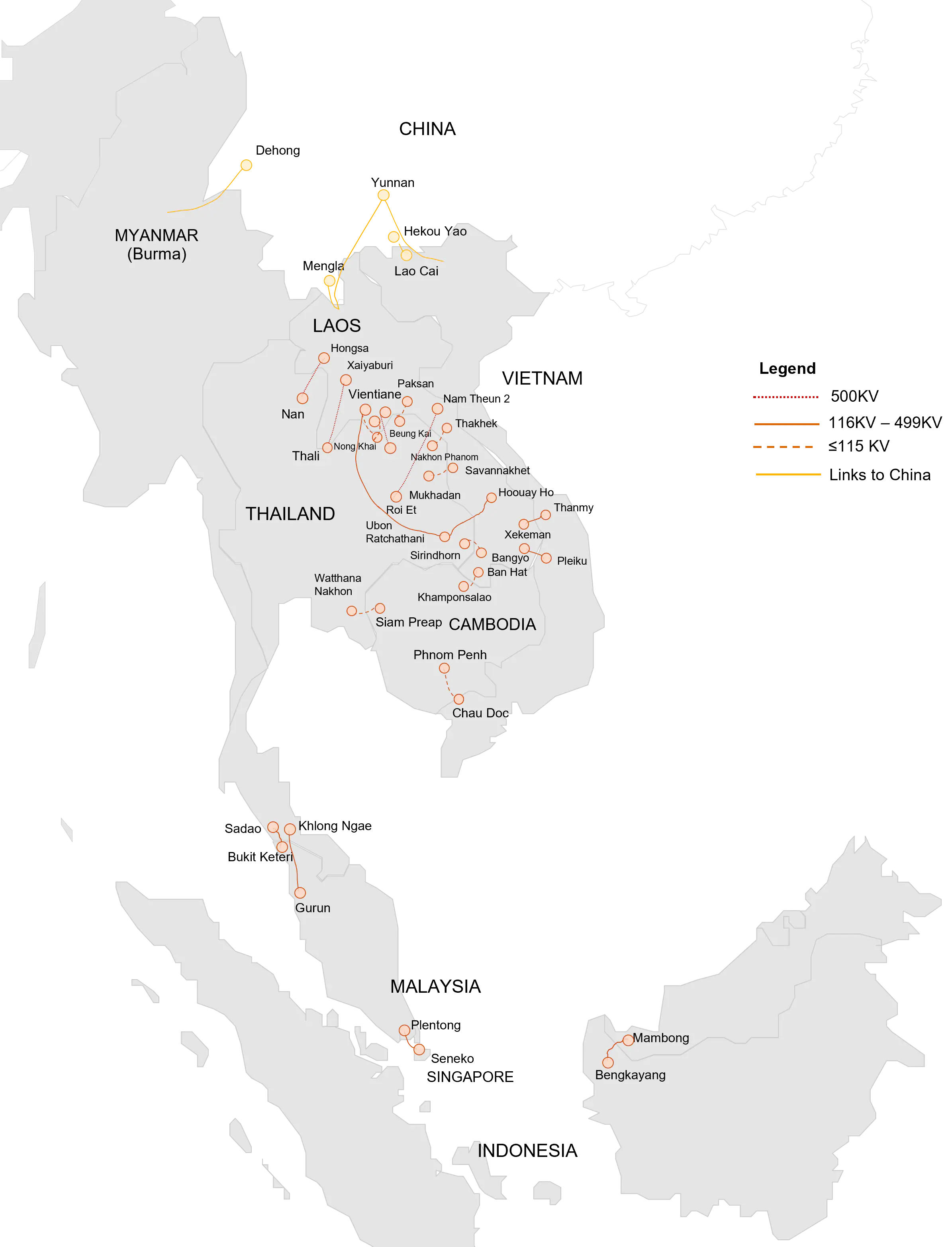

4) Establishment of RE Exchange

The government in conjunction with the NETR launch has also announced the establishment of a RE exchange by 2024 which aims to act as a market aggregator that will enable price discovery and monetise excess power, important steps in solidifying cross-border energy trading across the ASEAN region. As such companies like Ranhill can seize potential export opportunities, especially in neighbouring countries such as Singapore and Thailand and potentially across the wider developing ASEAN Power Grid in the future.

Singapore has already announced plans to import more clean energy, Singapore’s Energy Market Authority (EMA) has been working on paving the way for larger scale electricity imports of up to 4GW by 2035, creating a potential market for Malaysian renewable energy producers.

By integrating energy trading into the markets it can fully unlock the true potential of RE and realisation of price premiums that arise from trading which in turn further stimulate the renewable energy transition.

In conclusion, Ranhill with its strategic positioning across the region and sectors, is set to benefit from major macro and policy tailwinds which will propel the company further. These initiatives reflect the government’s proactive stance to drive sustainable growth via fostering the green energy transition, energy liberalisation policies as well as renewed focus in developing the Johor economy. This strategic alignment opens up new prospects and opportunities, enabling Ranhill to extend its influence and footprint further across the Malaysian landscape.