RHB Retail Research

Technical Analysis - British American Tobacco (Malaysia)

rhboskres

Publish date: Thu, 31 May 2018, 09:24 AM

British American Tobacco (Malaysia)

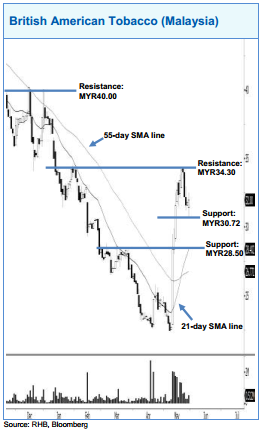

British American Tobacco’s near-term uptrend is considered intact as it still remains above the rising 21-day SMA line. Given that the 21-day SMA line has crossed above the 55-day SMA line recently, this indicates a positive sign. A bullish bias may emerge above the MYR30.72 level, with an exit set below the MYR28.50 threshold. Towards the upside, the immediate resistance is at MYR34.30. This is followed by the MYR40.00 level.

Source: RHB Securities Research - 31 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments