Hang Seng Index Futures - Persistent Upward Momentum

rhboskres

Publish date: Wed, 06 Jun 2018, 04:35 PM

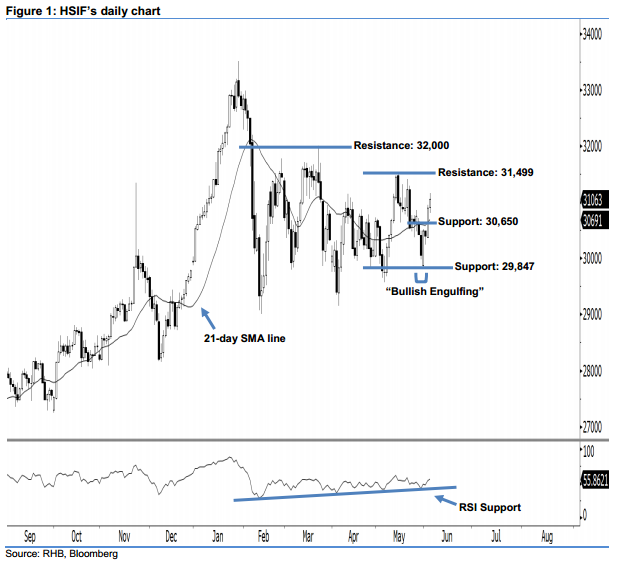

Maintain long positions, with a stop-loss set below the 29,847-pt level. The HSIF’s upside strength continued as expected after it ended higher and formed another white candle yesterday. It rose to a high of 31,163 pts during the intraday session, before ending at 31,063 pts for the day. As the index posted a white candle for the second consecutive session, this can be viewed as the bulls extending the buying momentum. Furthermore, the 14-day RSI indicator recovered to a more positive reading of 55.86 pts, the bullish sentiment has been enhanced. Overall, we stay bullish view on the index’s near-term outlook.

As shown in the chart, we anticipate the immediate support level at 30,650 pts, ie near the midpoint of 4 June’s long white candle. The next support is seen at 29,847 pts, which was the low of 31 May’s “Bullish Engulfing” pattern. To the upside, the immediate resistance level is situated at 31,499 pts, obtained from the high of 15 May. The next resistance would likely be at the 32,000-pt round figure, also set near the high of 21 Mar.

Therefore, we advise traders to stay long, given that we previously recommended initiating long above the 30,650-pt level on 5 June. A stop-loss can be set below the 29,847-pt threshold in order to limit downside risk.

Source: RHB Securities Research - 6 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024