WTI Crude Futures - The Bears Are Still In Control

rhboskres

Publish date: Wed, 06 Jun 2018, 04:46 PM

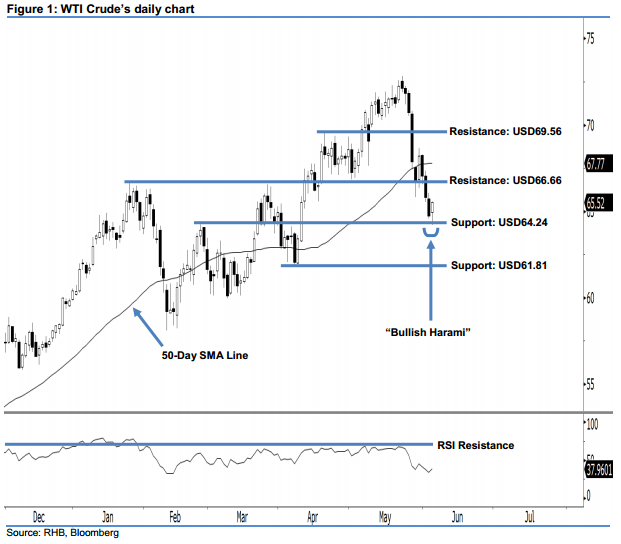

Opportunities still lean towards the sellers, keep short positions. Last night, the WTI Crude rebounded by USD.77 to USD65.52. A reversal “Bullish Harami” candlestick pattern was formed, which suggests that the current correction is ending. However, until we see strong upside follow through, there is no change to our bearish view. From our technical standpoint, the increase is viewed as the commodity merely taking a breather. This is a normal reaction after the WTI Crude dipped to its 7-week low on 5 May. Overall, the bears are still in dominance of market sentiment. The fact that the commodity is trading below the 50-day SMA line points towards a weak outlook. This supports our downside view.

Based on the daily chart above, we believe that the opportunities leans more towards the sellers. As such, it is best that traders maintain short positions. For risk-minimisation purposes, we advise setting a stop-loss above the USD69.56 mark. For the record, we made the short recommendation on 28 May, following a firm breached below the USD69.56 threshold.

Towards the downside, our immediate support stays at USD64.24, or the high of 27 Feb’s “Bearish Engulfing” pattern. This is followed by the USD61.81 support mark, which was the low of 6 Apr 2018. Conversely, our immediate resistance is seen at USD66.66, which was the high of 25 Jan’s high. The following resistance is pegged at USD69.56, located at the high of 17 Apr.

Source: RHB Securities Research - 6 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024