COMEX Gold - Short Positions Still Good

rhboskres

Publish date: Tue, 12 Jun 2018, 09:42 AM

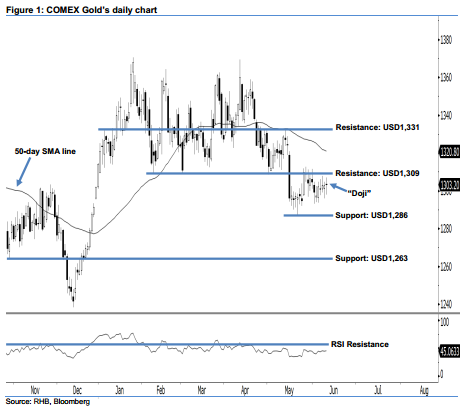

Short call stays intact, in line with the ongoing bearish bias. The COMEX Gold ended at USD1,303.20 last night to post a USD0.50 gain. However, this does not negate our bearish view, given that no strong upside movement has been sighted yet. The “Doji” candlestick pattern that formed implied yesterday’s session was an indecisive one. Overall, the bearish bias we detected in 15 May’s long black candle continues to exert itself. We also note that the 14-day RSI indicator continues to fluctuate below the 50-pt neutral level at 45.06 pts – an indication that market sentiment is weak. This enhances our downside view.

As long as the USD1,331 resistance is not taken out, we believe the opportunities are still leaning more towards the sellers. Hence, our short call remains intact, with a stop-loss set above the aforementioned resistance. This is in order to minimise the upside risk. Our short call was initially triggered on 16 May, following a firm downside movement below the USD1,309 level.

We set the immediate support at USD1,286, which is located at the low of 21 May. Should the COMEX Gold’s price slip below this level, the following support is seen at USD1,263, or the low of 27 Nov 2017. On the flip side, our immediate resistance is at USD1,309, ie the low of 8 Feb. This is followed by the USD1,331 resistance, which is situated at the high of 4 Jan.

Source: RHB Securities Research - 12 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024