E-mini Dow Futures - Near-Term Sentiment Remains Positive

rhboskres

Publish date: Mon, 18 Jun 2018, 11:07 AM

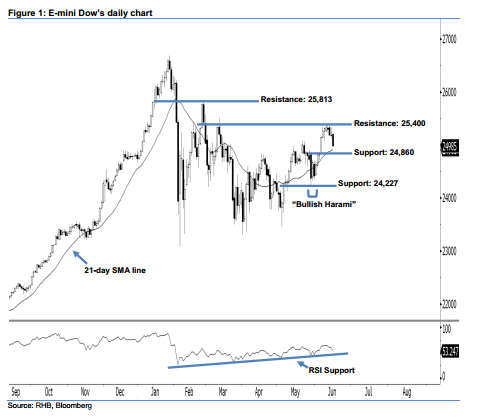

Stay long while setting a stop-loss below the 24,227-pt support. The E-mini Dow ended lower to form a black candle last Friday. It settled at 24,985 pts, off its high of 25,204 pts and low of 24,963 pts. The formation of last Friday’s black candle illustrate that the market may be taking a breather after recent gains. However, we maintain our near-term positive view, since the index did not negate the bullishness of 30 May’s “Bullish Harami” pattern. Technically, the index is still trading above the rising 21-day SMA line, which implies that the near-term upside move is not diminished yet.

Presently, the immediate support is seen at 24,860 pts, which was near the highs of 29 May and 4 Jun. The next support would likely be at 24,227 pts, ie the low of 30 May’s “Bullish Harami” pattern. On the other hand, we are now eyeing the immediate resistance at 25,400 pts, obtained from the high of 11 June. The next resistance is anticipated at 25,813 pts, ie the previous high of 27 Feb.

Thus, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 24,860-pt level on 7 Jun. A stop-loss can be set below the 24,227-pt threshold in order to minimise downside risk.

Source: RHB Securities Research - 18 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024