COMEX Gold - Bears Are In Firm Control

rhboskres

Publish date: Fri, 22 Jun 2018, 04:59 PM

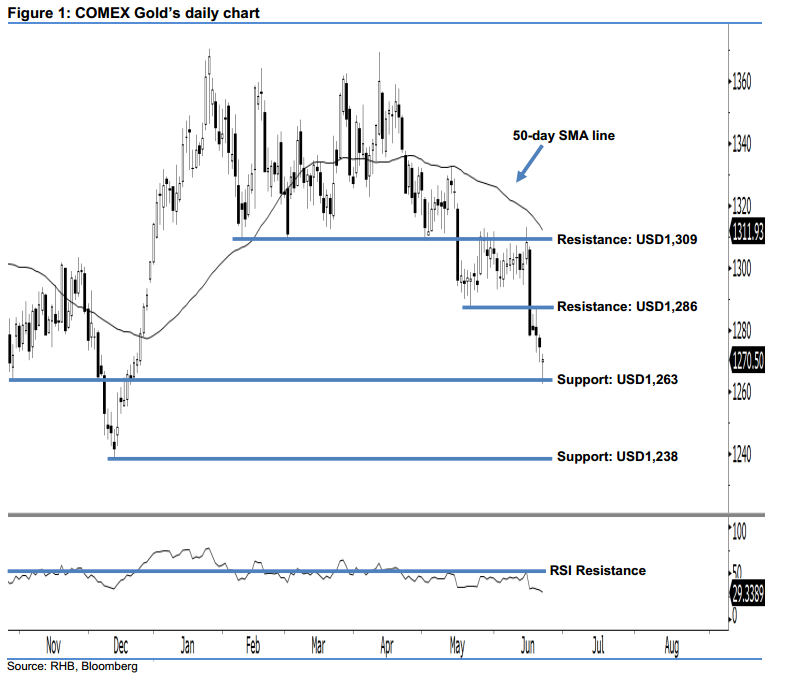

Bearish bias led to more than 5-month low; stay in short positions. Yesterday, the COMEX Gold ended at USD1,270.50 and posted a USD4 loss. The correction led the commodity to more than 5-month low. Technically speaking, the bears are currently in firm control of market sentiment. We highlight a small white candle with a longer lower shadow in the daily chart above, suggesting that momentum is accumulating. This is especially given that the 14-day RSI indicator is at 29.34 pts, which is within the oversold level below the 30-pt mark. However, as long as no firm upside follow-through is in sight, we believe the downside movement has not reached its limit yet.

The current technical landscape suggests that the bearish bias is still exerting itself. Hence, it is best that traders maintain short positions with a new trailing-stop set above the USD1,286 threshold. This is in order to secure part of the trading profit. For the record, we initially made the short recommendation on 16 May, after a strong downside development below the USD1,309 mark.

We keep the immediate support at USD1,263, which was the low of 27 Oct 2017. The following support is pegged at the USD1,238 mark, or 12 Dec 2017’s low. On the flip side, the immediate resistance is seen at USD1,286, ie the low of 21 May. This is followed by the USD1,309 resistance, which is located at 8 Feb’s low.

Source: RHB Securities Research - 22 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024