COMEX Gold - Market Sentiment Remains Bearish

rhboskres

Publish date: Wed, 04 Jul 2018, 05:22 PM

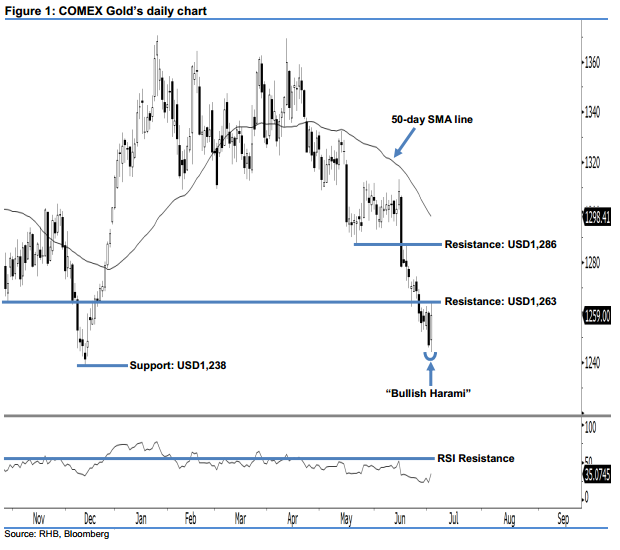

Until a strong upside movement is sighted, best that traders stay short. The COMEX Gold rebounded by USD11.90 to USD1,259.00 last night. It charted a white candle, which was situated within the body of the prior black candle. As a result, a reversal “Bullish Harami” candlestick pattern was formed, which suggests the current correction is nearing its limit. However, a further positive follow-through is needed before the upside momentum is confirmed. At this juncture, we think the commodity is merely taking a breather, as the overall downside movement remains intact. This is because the bears are still dominating market sentiment.

As the current technical landscape suggests the correction is still in play, we recommend traders to stay in short positions, with a trailing-stop pegged above the USD1,286 mark. This is to secure part of the trading profits. For the record, we made the short call on 16 May, following a strong downside development below the USD1,309 threshold.

Our immediate support is maintained at USD1,238, or the low of 12 Dec 2017. Should the COMEX Gold dip below this level, the following support is pegged at the USD1,217 threshold, which was the low of 9 May 2017. On the flip side, we set the immediate resistance at USD1,263, ie 27 Oct 2017’s low. For the next resistance, look to USD1,286, or 21 May’s low.

Source: RHB Securities Research - 4 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024