FTSE Singapore Straits Times Index - Negative Outlook Extends

rhboskres

Publish date: Thu, 05 Jul 2018, 04:57 PM

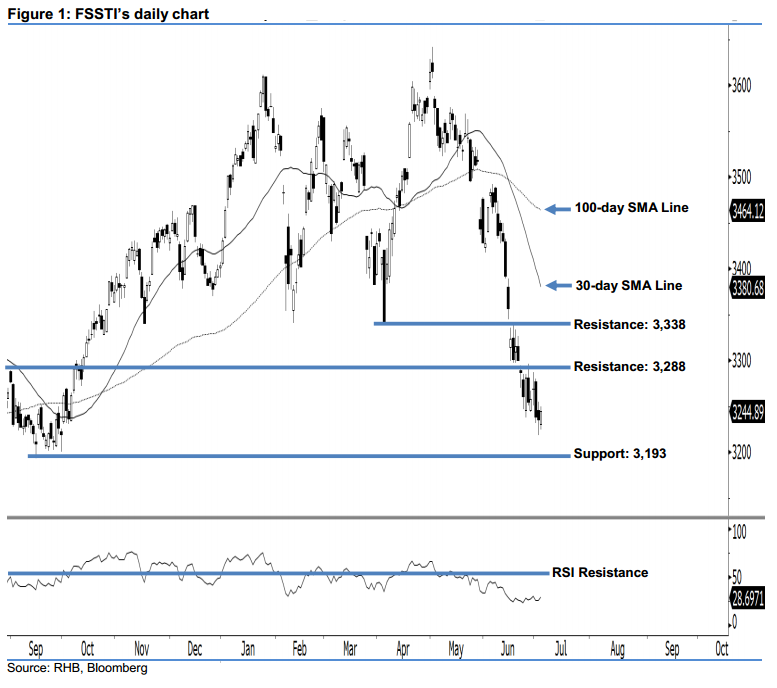

Index may still go down as the bears are still in control of market sentiment. After two weak sessions in a row, the FSSTI rebounded by 8.99 pts to close at 3,244.89 pts yesterday. It charted a white candle after hovering between a low of 3,224.62 pts and high of 3,249.52 pts. However, there is no change to our bearish view, as no strong upside movement has been detected yet. From our technical perspective, this minor increase is viewed as the index merely taking a normal breather after it dropped to its newest low since Oct 2017, on 3 Jul.

Based on the daily chart above, we believe that the bears are still in control of market sentiment. This is especially as no positive indicator has been detected at present. Our bearish view is also supported by the fact that the 30-day SMA line is situated below the 100-day SMA line, which implies a weak outlook.

We set the immediate support at 3,193 pts, which was the low of 15 Sep 2017. This is followed by the 1,133-pt support threshold, the low of 19 Apr 2017. On the flip side, our immediate resistance is maintained at 3,288 pts, located at the high of 31 Aug 2017. The next resistance is pegged at the 3,338-pt threshold, derived from the low of 4 Apr.

Source: RHB Securities Research - 5 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024