WTI Crude Futures - Commodity Is Still On An Uptrend

rhboskres

Publish date: Mon, 09 Jul 2018, 10:21 AM

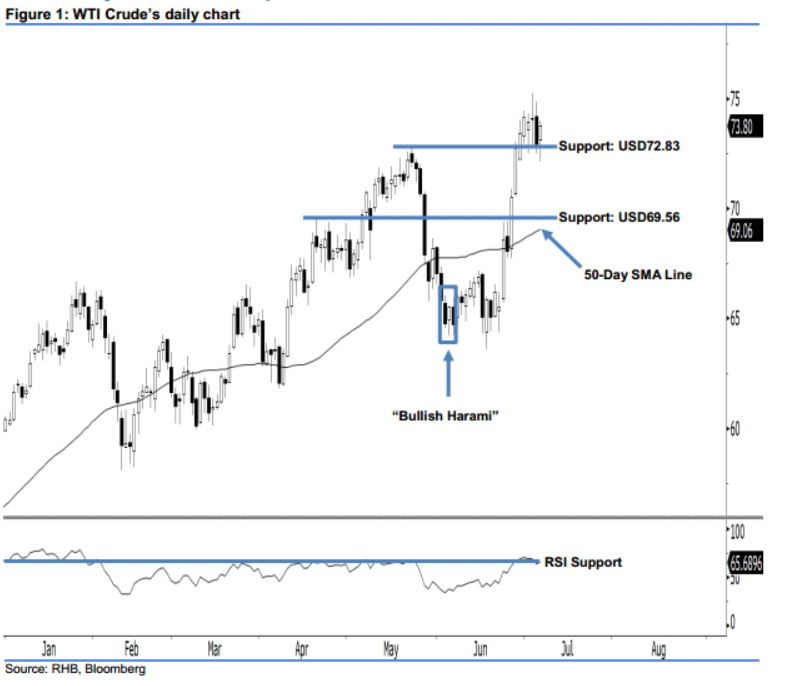

Traders are advised to stay in long positions as the bulls are still strong. Last Friday was a bullish session, as the WTI Crude posted a USD0.86 gain to close at USD73.80. It charted a white candle after oscillating between a low of USD72.14 and high of USD74.01. Although the 14-day RSI indicator shows an overbought situation above the 70-pt overbought level at 72 pts, we do not see any immediate strong selling activities. Instead, the commodity extended the upside movement to a new multi-high year high. Overall, our upside view remains in play.

In line with the ongoing upside movement, we maintain our long recommendation. For risk-minimisation purposes, traders are advised to keep their trailing-stop below the USD69.56 threshold. Recall that we made the long call on 25 Jun, following a firm upside development above USD67.16.

The USD72.83 mark, ie 22 May’s high, is maintained as our immediate support. If this level is taken out, the following support is found at the USD69.56 threshold, or 17 Apr’s high. On the flip side, we set the immediate resistance at USD75.84, which was the low of 4 Nov 2014. This is followed by the USD77.83 resistance level, located at the high of 21 Nov 2014.

Source: RHB Securities Research - 9 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024