FBM Small Cap Index - the Bullish Bias Persists

rhboskres

Publish date: Thu, 12 Jul 2018, 05:15 PM

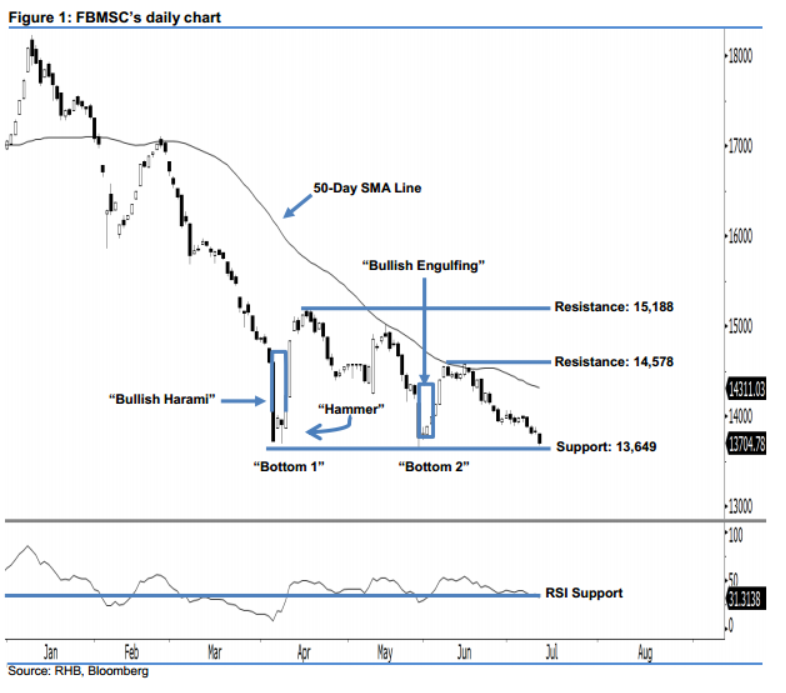

No change to our positive view until a further strong downside development is sighted. The FBMSC ended 130.09 pts lower to 13,704.78 pts yesterday, slipping below the previous 13,719-pt support. A black candle was formed after the index oscillated between a low of 13,671.56 pts and high of 13,807.07 pts. Nevertheless, this weak performance does not fully negate our positive view, as the FBMSC is situated near the aforementioned support. A further downside development is needed to justify that the bears are back. Overall, the bulls still dominate market sentiment.

At this juncture, we believe the momentum we highlighted in 5 Apr’s “Bullish Harami” and 6 Apr’s “Hammer” patterns has not been fully nullified yet. Meanwhile, we note that the reversal “Double Bottom” pattern remains in play – this supports our positive view.

Our immediate support is revised to 13,649 pts, which was the low of 30 May. If this level is taken out, the next support is set at the 13,116-pt threshold, or the low of 25 Aug 2015. Towards the upside, we keep the immediate resistance at 14,578 pts, which is located at the high of 14 Jun. For the next resistance, look to 15,188 pts, or 17 Apr’s high.

Source: RHB Securities Research - 12 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024